Western Union 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

31

outside of Arizona, which efforts Western Union has resisted in

court. We believe that these events and the publicity they created

led some consumers to avoid Western Union’s services in late

2006 and early 2007. Western Union remains in litigation with

the Arizona Attorney General on these matters. We believe that

our legal position is sound, and the publicity surrounding these

matters has largely abated.

Domestic transaction growth rates in the year ended Decem-

ber 31, 2006 over the same period in 2005 declined compared

to increases observed for the year 2005 due in part to the uncer-

tainty created by the immigration debate described above, and

broader market softness experienced within the United States

domestic business in 2006.

Growth in Mexico money transfer transactions for the year

ended December 31, 2006 compared to the same period in 2005

was driven by the acquisition of Vigo and growth in Western

Union branded transactions. The decline in revenue growth

rates was primarily due to the uncertainty created by the immigra-

tion debate in the United States as described above.

Foreign exchange revenue increased for the year ended

December 31, 2006 due to the acquisition of Vigo and an increase

in the higher growth international business resulting in increased

cross-currency transactions.

Operating income

The consumer-to-consumer segment’s operating income increased

by 1% for the year ended December 31, 2007 compared to the

corresponding period in 2006. This increase was primarily driven

by increased revenue in our international business. Operating

income during the year ended December 31, 2007 was impacted

by the ongoing shift in our business mix refl ecting stronger

growth in our international business, which carries lower profi t

margins than in our United States originated businesses. However,

we have been experiencing a convergence between international

operating profi t margins and profi t margins of our United States

originated businesses. Operating income during the year ended

December 31, 2007 was adversely impacted by incremental

public company expenses which are incremental to both costs

allocated by First Data prior to the spin-off and presumed over-

head allocations from First Data had we remained part of First

Data. Such incremental public company expenses include salaries,

benefi ts, equipment, supplies and other costs incurred in con-

nection with operating as a separate public company. In addition,

we recognized an accelerated non-cash stock compensation

charge of $22.3 million taken in connection with the change in

control of First Data, of which 85% was allocated to the consumer-

to-consumer segment.

The consumer-to-consumer segment’s operating income

increased for the year ended December 31, 2006 compared to the

same period in 2005 due to an increase in revenue and by lower

escheatment accruals resulting from charges incurred in 2005

that did not recur in 2006. These benefi ts to operating income

during the year ended December 31, 2006 were partially offset by

the ongoing shift in our business mix refl ecting stronger growth

in our international business, and incremental public company

expenses as discussed above. In addition, we incurred higher

employee incentive compensation expenses, including those

incurred in connection with the adoption of SFAS No. 123R.

Consumer-to-Business Segment

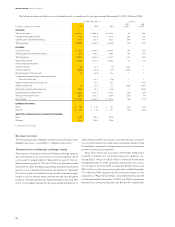

The following table sets forth our consumer-to-business segment results of operations for the years ended December 31, 2007,

2006 and 2005.

Year Ended December 31, % Change

2007 2006

(in millions) 2007 2006 2005 vs. 2006 vs. 2005

REVENUES:

Transaction fees $665.5 $593.7 $565.0 12% 5%

Other revenues 54.4 42.5 35.2 28% 21%

Total revenues $719.9 $636.2 $600.2 13% 6%

Operating income $223.7 $223.3 $220.4 — 1%

Operating margin 31% 35% 37%

KEY INDICATORS:

Consumer-to-business transactions 404.5 249.4 215.1 62% 16%

Revenues

2007 COMPARED TO 2006

Transaction growth of 62% and revenue growth of 13% in the year

ended December 31, 2007 compared to the same period in 2006

primarily resulted from the acquisition of Pago Fácil and growth

in electronic bill payments, partially offset by slight de clines in

United States cash-based bill payments due to the continued

shift in the United States to electronic-based bill payments.

In December 2006, we acquired the remaining 75% interest

in Pago Fácil. Prior to the acquisition, we held a 25% interest in

Pago Fácil. This acquisition contributed $67.7 million and $3.6

million in revenue for the years ended December 31, 2007 and

2006, respectively, of which $64.4 million and $3.6 million related

to our consumer-to-business segment in the years ended