Western Union 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

WESTERN UNION 2007 Annual Report

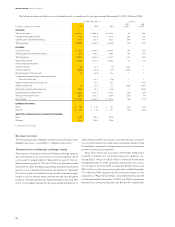

Cost of services

Cost of services is primarily comprised of agent commissions

and also includes expenses for personnel, software, equipment,

telecommunications, bank fees, depreciation and amortization

and other expenses incurred in connection with providing money

transfer and other payment services. Cost of services was 57%,

54%, and 53% of consolidated revenue for the years ended

December 31, 2007, 2006 and 2005, respectively. Overall, agent

renewals in 2007 resulted in commission rates materially consistent

with previous agreements.

The majority of the increase in cost of services as a percentage

of revenue in 2007 compared to the corresponding period in

2006 was attributable to the shift in our business mix refl ecting

stronger growth from our international business, which carries

higher cost of services compared to our United States originated

businesses. The Pago Fácil business, which carries a lower margin

than our existing consumer-to-business services, also contributed

to the increase in cost of services. The stock compensation charge

resulting from the acquisition of First Data by an affi liate of KKR

and incremental public company expenses were additional factors

leading to the increase in cost of services in 2007, and caused

cost of services to increase at a higher rate between 2007 and

2006 compared to the increase in 2006 compared to 2005.

The majority of the increase in cost of services for the year

ended December 31, 2006 compared to 2005 was attributable

to the shift in our business mix refl ecting stronger growth from

our international business, as described above. Another factor

impacting cost of services as a percent of revenue was the

October 2005 acquisition of Vigo, which has higher cost of

services compared to Western Union branded money transfers.

Higher stock compensation costs in connection with the adoption

of SFAS No. 123R, and higher employee incentive compensation

expense also contributed to the increase in cost of services as a

percent of revenue.

Selling, general and administrative

Selling, general and administrative expenses increased for the

year ended December 31, 2007 compared to the corresponding

period in the prior year primarily due to incremental public

company expenses and the stock compensation charge related

to KKR’s acquisition of First Data, as described above. In addition,

costs associated with the inclusion of the Pago Fácil business

contributed to the increase in 2007 from 2006.

Selling, general and administrative expenses increased for

the year ended December 31, 2006 compared to the correspond-

ing period in the prior year due primarily to Vigo, incremental

public company expenses, as discussed above, higher stock

compensation expense from the adoption of SFAS No. 123R and

higher employee incentive compensation expenses in 2006

compared to 2005.

Marketing related expenditures, principally classifi ed within

“selling, general and administrative” expenses, increased during

the years ended December 31, 2007 and 2006 compared to the

corresponding periods in the prior years. However, marketing

related expenditures as a percent of consolidated revenue were

approximately 6.0%, 6.5% and 6.9% during the years ended

December 31, 2007, 2006 and 2005, respectively. Marketing

related expenditures include advertising, events, loyalty programs

and the cost of employees dedicated to marketing activities.

When making decisions with respect to marketing investments,

we review opportunities for advertising and other marketing

related expenditures together with opportunities for pricing

adjustments and other initiatives in order to best maximize the

return on these investments. For further discussion regarding the

impact of pricing decreases refer to the “Transaction fees and

foreign exchange revenue” discussion within the consumer-to-

consumer segment section.

Interest income

Interest income increased during the years ended December 31,

2007 and 2006 compared to corresponding periods in the prior

years due to higher international cash balances resulting from

the net cash received in connection with the settlement of inter-

company notes with First Data (net of certain other payments

made to First Data) on the spin-off date, and from cash generated

through our international operations. Also contributing to higher

interest income in 2007 and 2006 was interest income recorded

in connection with a $140.0 million loan made to one of our

agents in the fi rst quarter of 2006.

Interest expense

Interest expense increased to $189.0 million for the year ended

December 31, 2007 compared to $53.4 million during 2006, due

to interest expense on our outstanding borrowings that arose in

connection with the spin-off on September 29, 2006. Interest

expense was signifi cantly higher in 2007 since the related bor-

rowings were outstanding for the full year 2007 compared to

three months during 2006.

Derivative gains/(losses), net

Our foreign currency forward contracts that did not qualify as

hedges under applicable derivative accounting rules were held

primarily in the euro and British pound and had maturities of one

year or less. Prior to September 29, 2006, we did not have any

forward contracts that qualifi ed as hedges, and therefore the

unrealized gains and losses on these contracts were refl ected

within this line item in the consolidated statements of income

prior to that date. Since these instruments did not qualify for

hedge accounting treatment, there was resulting volatility in our

net income for the periods presented prior to September 29,

2006. For example, during the years ended December 31, 2006

and 2005, we had pre-tax derivative (losses)/gains of $(21.2)

million and $45.8 million, respectively.

On September 29, 2006, we established our foreign currency

forward positions to qualify for cash fl ow hedge accounting. We

anticipate the amounts refl ected in this income statement caption

going forward will be minimal, as such amounts will relate primarily

to the portion of the change in fair value that is considered inef-

fective or is excluded from the measure of effectiveness related

to contracts designated as accounting hedges.