Western Union 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

39

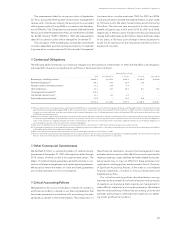

DESCRIPTION

Tax Allocation agreement with First Data

Pursuant to a tax allocation agreement signed

in connection with our spin-off from First Data,

we and First Data each are liable for taxes

imposed on our respective businesses both

prior to and after the spin-off.

We are in the process of resolving certain

tax matters with First Data relating to periods

prior to the spin-off.

Derivative Financial Instruments

We utilize derivative instruments to mitigate

foreign currency and interest rate risk. We

recognize all derivative instruments in other

assets and other liabilities in our consolidated

balance sheets at their fair value. Cer tain of

our derivative arrangements are designated

as either cash fl ow hedges or fair value hedges

at the time of inception, and others are not

designated as hedges in accordance with SFAS

No. 133.

Cash Flow hedges — Cash flow hedges

consist of foreign currency hedging of fore-

casted sales and hedges of anticipated fi xed

rate debt issuances. Derivative value changes

that are captured in accumulated other com-

prehensive loss are reclassifi ed to earnings in

the same period or periods the hedged item

affects earnings, to the extent the change in the

fair value of the instrument is effective in offset-

ting the change in fair value of the hedged item.

The portion of the change in fair value that is

either considered ineffec tive or is excluded

from the measure of effectiveness is recognized

immediately in the income statement.

Fair Value hedges — Fair value hedges con-

sist of hedges of fi xed rate debt, through inter-

est rate swaps. The changes in fair value of

these hedges, along with offsetting changes

in fair value of the related debt instrument are

recorded in interest expense.

JUDGMENTS AND UNCERTAINTIES

Under the tax allocation agreement, with

respect to taxes and other liabilities that could

be imposed as a result of a fi nal determination

that is inconsistent with the anticipated tax

consequences of the spin-off (as set forth in

the private letter ruling and relevant tax opin-

ion), we may be liable to First Data for all or a

portion of any such taxes or liabilities.

The accounting guidance related to derivative

accounting is complex and contains strict docu-

mentation requirements.

The details of each designated hedging

relationship must be formally documented at

the inception of the arrangement, including

the risk management objective, hedging strat-

egy, hedged item, specifi c risks being hedged,

the derivative instrument, how effectiveness is

being assessed and how ineffectiveness, if any,

will be measured. The derivative must be highly

effective in offsetting the changes in cash fl ows

or fair value of the hedged item, and effective-

ness is evaluated quarterly on a retrospective

and prospective basis.

If the hedge is no longer deemed effective,

we discontinue applying hedge accounting to

that relationship prospectively.

EFFECT IF ACTUAL RESULTS

DIFFER FROM ASSUMPTIONS

Although we believe that we have appropriately

apportioned such taxes between First Data

and us through 2007, subsequent adjustments

may occur.

If we are required to indemnify First Data

for taxes incurred as a result of the spin-off

being taxable to First Data, it likely would have

a material adverse effect on our business,

fi nancial position, results of operations and

cash fl ows.

While we expect that our derivative instruments

that currently qualify for hedge accounting will

continue to meet the conditions for hedge

accounting, if hedges do not qualify for hedge

accounting, the changes in the fair value of the

derivatives used as hedges would be refl ected

in earnings which could have a significant

impact on our reported earnings.

As of December 31, 2007, the cumulative

amount of unrealized losses classifi ed within

accumulated other comprehensive loss that

would be refl ected in earnings if our hedges

were disqualifi ed from hedge accounting, net

of income taxes, was $43.7 million.