Western Union 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

WESTERN UNION 2007 Annual Report

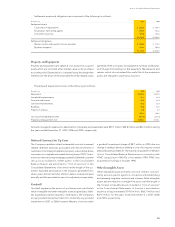

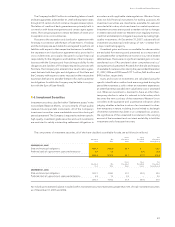

||

Notes to Consolidated Financial Statements

||

1. Formation of the Entity and

Basis of Presentation

The Western Union Company (“Western Union” or the “Company”)

is a leader in global money transfer, providing people with fast,

reliable and convenient ways to send money around the world

and to pay bills. The Western Union® brand is globally recognized.

The Company’s services are available through a network of agent

locations in more than 200 countries and territories. Each location

in the Company’s agent network is capable of providing one or

more of the Company’s services.

The Western Union business consists of the following

segments:

|| CONSUMER-TO-CONSUMER — money transfer services between

consumers, primarily through a global network of third-party

agents using the Company’s multi-currency, real-time money

transfer processing systems. This service is available for both

international transfers — that is, the transfer of funds from one

country to another and intra-country transfers — that is, money

transfers from one location to another in the same country.

||

CONSUMER-TO-BUSINESS —

the processing of payments from

consumers to businesses and other organizations that receive

consumer payments, including utilities, auto fi nance compa-

nies, mortgage servicers, fi nancial service providers and

government agencies, referred to as “billers,” through Western

Union’s network of third-party agents and various electronic

channels. The segment’s revenue was primarily generated

in the United States during all periods presented.

All businesses that have not been classifi ed into the consumer-

to-consumer or consumer-to-business segments are reported

as “Other” and include the Company’s money order and prepaid

services businesses. The Company’s money order business

markets Western Union branded money orders issued by

Integrated Payment Systems Inc. (“IPS”), a subsidiary of First Data

Corporation (“First Data”), to consumers at non-bank retail loca-

tions primarily in the United States and Canada. Western Union

also markets a Western Union branded prepaid MasterCard®

card, a Western Union branded prepaid Visa® card, and provides

top-up services for third parties that allow consumers to pay in

advance for mobile phone and other services. Also included in

“Other” are certain expenses incurred by Western Union to effect

its spin-off from First Data, as described below, and expenses

incurred in connection with the development of certain new

service offerings, including costs to develop mobile money

transfer and micro-lending services.

The primary entities providing the services described above

are Western Union Financial Services, Inc. and its subsidiaries

(“WUFSI”), Vigo Remittance Corp. (“Vigo”), Orlandi Valuta,

E Commerce Group, Paymap, Inc. and Servicio Electrónico de

Pago S.A. and its subsidiaries (“SEPSA” or “Pago Fácil”). There

are additional legal entities included in the consolidated fi nancial

statements of The Western Union Company, including First

Financial Management Corporation (“FFMC”), WUFSI’s imme-

diate parent company.

Various aspects of the Company’s services and businesses

are subject to United States federal, state and local regulation,

as well as regulation by foreign jurisdictions, including certain

banking and other fi nancial services regulations. In addition,

there are legal or regulatory limitations on transferring certain

assets of the Company outside of the countries where these

assets are located, or which constitute undistributed earnings

of affi liates of the Company accounted for under the equity

method of accounting. However, there are generally no limita-

tions on the use of these assets within those countries. As of

December 31, 2007, the amount of net assets subject to these

limitations totaled approximately $200 million.

As of December 31, 2007, Western Union has two four-year

labor contracts (both expiring August 6, 2008) with the Communi-

cations Workers of America, AFL-CIO representing approximately

845 employees located primarily in Texas and Missouri. The

Company’s United States-based employees are not otherwise

represented by any labor organization.

Spin-off from First Data

On January 26, 2006, the First Data Board of Directors announced

its intention to pursue the distribution of 100% of its money

transfer and consumer payments businesses and its interest in

a Western Union money transfer agent, as well as related assets,

including real estate, through a tax-free distribution to First Data

shareholders (the “Separation” or “Spin-off”). Effective on

September 29, 2006, First Data completed the separation and

the distribution of these businesses by distributing The Western

Union Company common stock to First Data shareholders (the

“Distribution”). Prior to the Distribution, the Company had been

a segment of First Data.

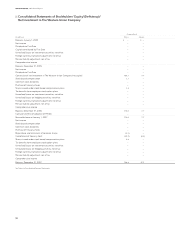

In connection with the Spin-off, the Company reported a $4.1

billion dividend to First Data in the accompanying consolidated

statements of stockholders’ equity/(defi ciency)/net investment

in The Western Union Company, consisting of a promissory note

from FFMC in an aggregate principal amount of $2.4 billion, the

issuance of $1.0 billion in Western Union notes, and a cash

payment to First Data of $100.0 million. The remaining dividend

was comprised of cash, consideration for an ownership interest

held by a First Data subsidiary in a Western Union agent which

had already been refl ected as part of the Company, settlement

of net intercompany receivables (exclusive of certain intercompany

notes as described in the following paragraph), and transfers of

certain liabilities, net of assets. Since the amount of the dividend

exceeded the historical cost of the Company’s net assets at the

time of the Spin-off, a capital defi ciency resulted.

The Company also settled certain intercompany notes receiv-

able and payable with First Data along with related interest and

currency swap agreements associated with such notes as part

of the Spin-off. The net settlement of the principal and related

swaps resulted in a net cash infl ow of $724.0 million to the

Company’s cash fl ows from fi nancing activities. The net settlement

of interest on such notes receivable and payable of $40.7 million

was reflected in cash flows from operating activities in the

Company’s Consolidated Statement of Cash Flows.