Western Union 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

WESTERN UNION 2007 Annual Report

||

Management’s Discussion and

Analysis of Financial Condition and

Results of Operations

You should read the following discussion in conjunction with

the consolidated fi nancial statements and the notes to those

statements included elsewhere in this Annual Report. This Annual

Report contains certain statements that are forward-looking

within the meaning of the Private Securities Litigation Reform

Act of 1995. Certain statements contained in the Management’s

Dis cussion and Analysis of Financial Condition and Results of

Operations are forward-looking statements that involve risks

and uncertainties. The forward-looking statements are not

historical facts, but rather are based on current expectations,

estimates, assumptions and projections about our industry,

business and future fi nancial results. Our actual results could

differ materially from the results contemplated by these forward-

looking statements due to a number of factors, including those

discussed in other sections of this Annual Report. See “Forward-

looking Statements.”

||

Overview

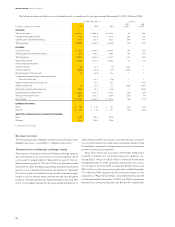

We are a leading provider of money transfer services, operating

in two business segments:

||

Consumer-to-consumer money transfer services, provided

primarily through a global network of third-party agents using

our multi-currency, real-time money transfer processing sys-

tems. This service is available for both international transactions —

that is, the transfer of funds from one country to another — and

intra-country transfers — that is, money transfers from one

location to another in the same country.

||

Consumer-to-business payment services, which allow consum-

ers to send funds to businesses and other organizations that

receive consumer payments, including utilities, auto fi nance

companies, mortgage servicers, fi nancial service providers

and government agencies (all sometimes referred to as “bill-

ers”) through our network of third-party agents and various

electronic channels. While we continue to pursue international

expansion of our offerings in selected markets, as demonstrated

by our December 2006 acquisition of Servicio Electronico de

Pago S.A. and related entities (“SEPSA” or “Pago Fácil”) in

Argentina, the segment’s revenue was primarily generated in

the United States during all periods presented.

Businesses not considered part of the segments described above

are categorized as “Other” and represented 3% or less of con-

solidated revenue during the three years ended December 31,

2007, 2006 and 2005, and include Western Union branded money

orders available through a network of third-party agents primarily

in the United States and Canada, and prepaid services. Prepaid

services include a Western Union branded prepaid MasterCard®

card sold through select agents in the United States and the

internet, a Western Union branded prepaid Visa® card sold on

the internet, and top-up services for third parties that allow con-

sumers to pay in advance for mobile phone and other services.

Also included in “other” are recruiting and relocation expenses

associated with hiring senior management positions new to our

company, and consulting costs used to develop ongoing pro-

cesses in connection with completing the spin-off; and expenses

incurred in connection with the development of certain new

service offerings, including costs to develop mobile money

transfer and micro-lending services.

The consumer-to-consumer money transfer service is available

through an extensive network of agent locations that offer West-

ern Union services around the world. Some of our agent locations

only pay out and do not send money. In addition to our agent

locations, we are expanding the ability of consumers to send

money through other channels, such as our internet site, west-

ernunion.com, and the telephone. Consumer-to-consumer money

transfer service is available through the Western Union®, Orlandi

Valuta® and VigoSM brands. The consumer-to-business service

allows consumers to transfer money to a biller. This service is

available at many of our Western Union agent locations, primarily

in the United States, and through the internet or by telephone.

Factors that we believe are important to our long-term

success include international growth by expanding and diver-

sifying our global distribution network, building our brands

and enhancing the consumer experience, expanding the chan-

nels by which consumers can send or receive money, and

diversifying our consumer-to-consumer and consumer-to-

business service offerings through new technologies and new

services. Signifi cant factors affecting our fi nancial position and

results of operations include:

||

Transaction volume is the primary generator of revenue in

our businesses. Transaction volume in our consumer-to-

consumer segment is affected by, among other things, the

size of the international migrant population and individual

needs to transfer funds in emergency situations. We believe

that the demand for money transfer services will be strong as

people continue to migrate to other countries for economic

and other reasons. As noted elsewhere in this Annual Report,

a reduction in the size of the migrant population, interruptions

in migration patterns or reduced employment opportunities

including those resulting from any changes in immigration

laws, economic development patterns or political events,

could adversely affect our transaction volume. For discussion

on how these factors have impacted us in recent periods, refer

to the consumer-to-consumer segment discussion below.

|| Revenue is also impacted by changes in the fees we charge

consumers, the amount of money sent, and by the foreign

exchange spreads we set. We intend to continue to implement

strategic pricing reductions, including actions to reduce

foreign exchange spreads, where appropriate, taking into

account growth opportunities and competitive factors.

Decreases in our fees or foreign exchange spreads generally

reduce margins, but are done in anticipation that they will

result in increased transaction volumes and increased rev-

enues over time.