Western Union 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

WESTERN UNION 2007 Annual Report

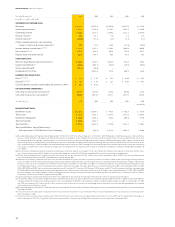

The following table sets forth our consolidated results of operations for the years ended December 31, 2007, 2006 and 2005.

Year Ended December 31, % Change

2007 2006

(in millions, except per share amounts) 2007 2006 2005 vs. 2006 vs. 2005

REVENUES:

Transaction fees $3,989.8 $3,696.6 $3,354.8 8% 10%

Foreign exchange revenue 771.3 653.9 531.0 18% 23%

Commission and other revenues 139.1 119.7 102.1 16% 17%

Total revenues 4,900.2 4,470.2 3,987.9 10% 12%

EXPENSES:

Cost of services 2,808.4 2,430.5 2,118.9 16% 15%

Selling, general and administrative 769.8 728.3 599.8 6% 21%

Total expenses 3,578.2 3,158.8 2,718.7 13% 16%

Operating income 1,322.0 1,311.4 1,269.2 1% 3%

Other (expense)/income:

Interest income 79.4 40.1 7.6 98% *

Interest expense (189.0) (53.4) (1.7) 254% *

Derivative gains/(losses), net 8.3 (21.2) 45.8 * *

Foreign exchange effect on notes receivable

from First Data, net — 10.1 (5.9) * *

Interest income from First Data, net — 35.7 24.3 * 47%

Other income, net 1.7 12.4 4.8 (86)% 158%

Total other (expense)/income, net

(99.6) 23.7 74.9 * (68)%

Income before income taxes 1,222.4 1,335.1 1,344.1 (8)% (1)%

Provision for income taxes 365.1 421.1 416.7 (13)% 1%

Net income $ 857.3 $ 914.0 $ 927.4 (6)% (1)%

EARNINGS PER SHARE:

Basic $ 1.13 $ 1.20 $ 1.21 (6)% (1)%

Diluted $ 1.11 $ 1.19 $ 1.21 (7)% (2)%

WEIGHTED-AVERAGE DILUTED SHARES OUTSTANDING:

Basic 760.2 764.5 763.9

Diluted 772.9 768.6 763.9

* Calculation not meaningful

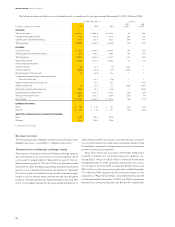

Revenues overview

The following provides highlights of revenue growth while a more

detailed discussion is included in “— Segment Discussion”:

Transaction fees and foreign exchange revenue

The majority of transaction fees and foreign exchange revenue

are contributed by our consumer-to-consumer segment, which

is discussed in greater detail in “Segment Discussion.” Consoli-

dated revenue growth of 10% and 12% during the years ended

December 31, 2007 and 2006, respectively, was driven by revenue

growth in our international business (as defi ned in “Segment

Discussion”) due to increased money transfers at existing agent

locations, and to a lesser extent, money transfers at new agent

locations. International revenue represented 65%, 62% and 59%

of our consolidated revenue for the years ended December 31,

2007, 2006 and 2005, respectively. Our international consumer-

to-consumer transactions that were originated outside of the

United States continued to display strong transaction and revenue

growth for all periods presented.

Pago Fácil, which was acquired in December 2006 and is

primarily included in our consumer-to-business segment, con-

tributed $67.7 million and $3.6 million of revenue for the years

ended December 31, 2007 and 2006, respectively. Our acquisi-

tion of Vigo in October 2005 contributed $140.5 million and

$24.2 million in total revenue during the years ended December

31, 2006 and 2005, respectively. Excluding the impact of the

acquisitions of Pago Fácil and Vigo, consolidated revenue growth

for the years ended December 31, 2007 and 2006 compared to

the previous corresponding years was 8% and 9%, respectively.