Western Union 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

WESTERN UNION 2007 Annual Report

The Company capitalizes initial payments for new and

renewed agent contracts to the extent recoverable through

future operations, contractual minimums and/or penalties in

the case of early termination. The Company’s accounting policy

is to limit the amount of capitalized costs for a given contract

to the lesser of the estimated future cash fl ows from the contract

or the termination fees the Company would receive in the event

of early termination of the contract.

The Company develops software that is used in providing

services. Software development costs are capitalized once

technological feasibility of the software has been established.

Costs incurred prior to establishing technological feasibility are

expensed as incurred. Technological feasibility is established

when the Company has completed all planning, designing,

coding and testing activities that are necessary to determine that

a product can be produced to meet its design specifi cations,

including functions, features and technical performance require-

ments. Capitalization of costs ceases when the product is available

for general use. Software development costs and purchased

software are amortized over a term of three to fi ve years.

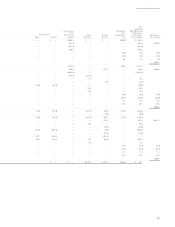

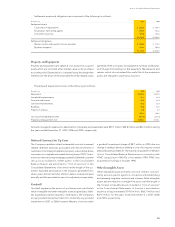

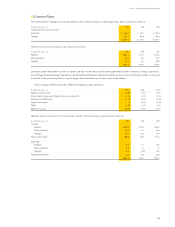

The following table provides the components of other intangible assets (in millions):

December 31, 2007 December 31, 2006

Weighted-

Average

Amortization Net of Net of

Period Initial Accumulated Initial Accumulated

(in years) Cost Amortization Cost Amortization

Capitalized contract costs 6.6 $274.0 $193.1 $242.3 $155.6

Acquired contracts 9.2 74.1 42.8 74.1 49.7

Acquired trademarks 24.7 44.7 41.0 40.7 38.8

Developed software 3.3 74.6 15.2 66.0 12.6

Purchased or acquired software 3.2 74.9 32.5 50.4 18.8

Other intangibles 6.8 28.6 9.5 25.6 12.2

Total other intangibles 7.5 $570.9 $334.1 $499.1 $287.7

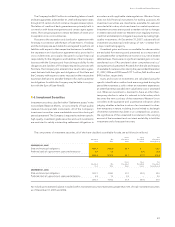

The estimated future aggregate amortization expense for existing

other intangible assets as of December 31, 2007 is expected to

be $84.5 million in 2008, $57.7 million in 2009, $50.9 million in

2010, $39.7 million in 2011, $25.2 million in 2012 and $76.1

million thereafter.

Other intangible assets are reviewed for impairment on an

annual basis and whenever events indicate that their carrying

amount may not be recoverable. In such reviews, estimated

undiscounted cash fl ows associated with these assets or opera-

tions are compared with their carrying values to determine if a

write-down to fair value (normally measured by the present value

technique) is required. Western Union did not record any impair-

ment related to other intangible assets during the years ended

December 31, 2007, 2006 and 2005.

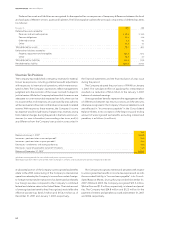

Revenue Recognition

The majority of the Company’s revenues are comprised of con-

sumer money transfer transaction fees that are based on the

principal amount of the money transfer and the locations from

and to which funds are transferred. Consumer money transfer

transaction fees are set by the Company and recorded as revenue

at the time of sale. In certain consumer money transfer transac-

tions involving different send and receive currencies, the Company

generates revenue based on the difference between the

exchange rate set by Western Union to the consumer and the

rate at which Western Union or its agents are able to acquire

currency. This foreign exchange revenue is recorded at the time

the related transaction fee revenue is recognized.

The Company also offers several consumer-to-business pay-

ment services, including payments from consumers to billers.

Revenues for these services are primarily derived from transaction

fees, which are recorded as revenue when payments are sent to

the intended recipients.

The Company’s Equity Accelerator service requires a consumer

to pay an upfront enrollment fee to participate in this mortgage

payment service. These enrollment fees are deferred and rec-

ognized into income over the length of the customer’s expected

participation in the program, generally fi ve to seven years. Actual

customer attrition data is assessed at least annually and the

period over which revenue is recognized is adjusted prospec-

tively. Many factors impact the duration of the expected customer

relationship, including interest rates, refi nance activity and trends

in consumer behavior.

The Company sells money orders issued by IPS under the

Western Union brand and manages the agent network through

which such money orders are sold. Western Union recognizes

monthly commissions from IPS based on a fi xed investment yield

on the average investable balance resulting from the sale of

money orders. Western Union also recognizes transaction fees

collected from the Company’s agents at the time a money order

is issued to the consumer.

Loyalty Program

Western Union operates a loyalty program which consists of

points that are awarded to program participants. Such points

may be redeemed for either a discount on future money transfers

or merchandise. The Company estimates the distribution

between awards of merchandise and discounts based on recent