Western Union 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

WESTERN UNION 2007 Annual Report

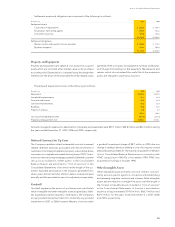

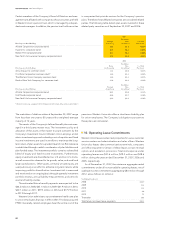

The following summarizes contractual maturities of state and municipal obligations as of December 31, 2007 (in millions):

Amortized Fair

Cost Value

Due within 1 year $ 32.8 $ 33.0

Due after 1 year through 5 years 35.1 35.6

Due after 5 years through 10 years — —

Due after 10 years 119.4 119.4

$187.3 $188.0

Preferred stock with a fair value of $5.8 million as of December

31, 2007 is not included above because the securities do not

have fi xed maturities. Actual maturities may differ from contractual

maturities because issuers may have the right to call or prepay

the obligations or the Company may have the right to put the

obligation back to the issuer prior to its contractual maturity.

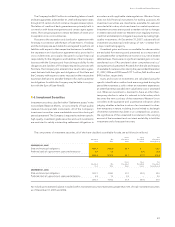

Aggregate unrealized losses on the Company’s investment

securities as of December 31, 2007 and 2006 were $1.1 million

and $0.1 million, respectively. The unrealized losses on such

investments as of December 31, 2007 were deemed to be

temporary as the duration of the loss has been short, and the

Company has the intent and ability to hold these securities

until a recovery.

||

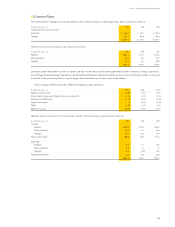

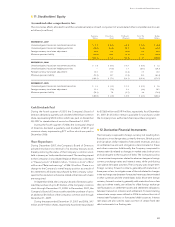

7. Other Assets and Other Liabilities

The following table summarizes the components of other assets and other liabilities (in millions):

December 31, 2007 2006

Other assets:

Equity method investments $211.3 $165.1

Amounts advanced to agents, net of discounts 93.1 112.4

Deferred customer set up costs 41.9 45.5

Prepaid commissions 22.5 37.8

Accounts receivable, net 22.5 24.3

Prepaid expenses 19.8 16.6

Debt issue costs 13.5 14.6

Derivative fi nancial instruments 8.1 0.6

Other 65.3 86.5

Total other assets $498.0 $503.4

Other liabilities:

Deferred revenue $ 74.2 $ 83.3

Derivative fi nancial instruments 37.2 12.8

Pension obligations 27.6 52.9

Other 43.9 51.3

Total other liabilities $182.9 $200.3

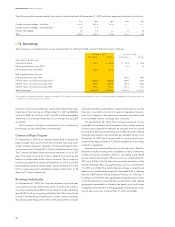

Amounts advanced to agents

From time to time, the Company makes advances and loans to

agents. In 2006, the Company signed a six year agreement with

one of its existing agents which included a four year loan of

$140.0 million to the agent. The terms of the loan agreement

require that a percentage of commissions earned by the agent

(61% in 2008 and 64% in 2009) be withheld by us as repayment

of the loan and the agent remains obligated to repay the loan if

commissions earned are not suffi cient. The Company imputes

interest on this below-market rate note receivable, and has

recorded the note net of a discount of $22.5 million and $37.8

million as of December 31, 2007 and 2006, respectively. The

remaining loan receivable balance relating to this agent as of

December 31, 2007 and 2006, net of discount, was $67.5 million

and $82.2 million, respectively. Other advances and loans out-

standing as of December 31, 2007 and 2006 were $25.6 million

and $30.2 million, respectively.