Western Union 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

Notes to Consolidated Financial Statements

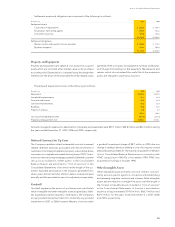

As part of the Spin-off, the Company also executed several

non-cash transactions, including the issuance of $1.0 billion in

notes to First Data in partial consideration for the contribution

by First Data to the Company of its money transfer and consumer

payments businesses (Note 13). The Company did not receive

any proceeds from the subsequent private offering of the notes.

In addition, First Data transferred to the Company its headquarters

in Englewood, Colorado and certain other fi xed assets with a

net book value of $66.5 million, the Company transferred to

First Data certain investments with a net book value of $20.9

million, and reclassifi ed certain tax and employee-related obliga-

tions from intercompany liabilities totaling $193.8 million. First

Data also distributed 765.3 million shares of Western Union’s

common stock to holders of First Data common stock.

Basis of Presentation

The fi nancial statements in this Annual Report for periods ending

on or after the Distribution are presented on a consolidated

basis and include the accounts of the Company and its majority-

owned subsidiaries. The fi nancial statements for the periods

presented prior to the Distribution are presented on a combined

basis and represent those entities that were ultimately transferred

to the Company as part of the Spin-off. The assets and liabilities

presented have been refl ected on a historical basis, as prior to

the Distribution such assets and liabilities presented were 100%

owned by First Data. The historical Consolidated Statements of

Income include expense allocations for certain corporate func-

tions historically provided to Western Union by First Data, includ-

ing treasury, tax, accounting and reporting, mergers and

acquisitions, risk management, legal, internal audit, procurement,

human resources, investor relations and information technology.

If possible, these allocations were made on a specifi c identifi ca-

tion basis. Otherwise, the expenses related to services provided

to Western Union by First Data were allocated to Western Union

based on the relative percentages, as compared to First Data’s

other businesses, of headcount or other appropriate methods

depending on the nature of each item of cost to be allocated.

However, the fi nancial statements for the periods presented

prior to the Distribution do not include all of the actual expenses

that would have been incurred had Western Union been a stand-

alone entity during the periods presented and do not refl ect

Western Union’s combined results of operations, fi nancial posi-

tion and cash fl ows had Western Union been a stand-alone

company during the periods presented.

All signifi cant intercompany transactions and accounts have

been eliminated.

The accompanying Consolidated Balance Sheets are unclas-

sifi ed consistent with industry practice and due to the short-term

nature of Western Union’s settlement obligations, contrasted

with its ability to invest cash awaiting settlement in long-term

investment securities.

||

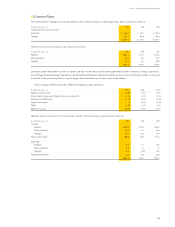

2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States

of America (“GAAP”) requires management to make estimates

and assumptions that affect the amounts reported in the fi nancial

state ments and accompanying notes. Actual results could differ

from these estimates.

Principles of Consolidation

Western Union consolidates fi nancial results when it will absorb

a majority of an entity’s expected losses or residual returns or

when it has the ability to exert control over the entity. Control

is normally established when ownership interests exceed 50%

in an entity. However, when Western Union does not have the

ability to exercise control over a majority-owned entity as a

result of other investors having contractual rights over the

management and operations of the entity, it accounts for the

entity under the equity method. As of December 31, 2007 and

2006, there were no greater-than-50%-owned affi liates whose

fi nancial statements were not consolidated. Western Union

utilizes the equity method of accounting when it is able to

exercise signifi cant infl uence over the entity’s operations, which

generally occurs when Western Union has an ownership interest

of between 20% and 50% in an entity.

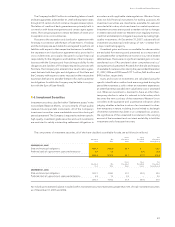

Earnings Per Share

The calculation of basic earnings per share is computed by

dividing net income available to common stockholders by the

weighted-average number of shares of common stock outstanding

for the period. Prior to September 29, 2006, all outstanding shares

of Western Union were owned by First Data. Accordingly, for all

periods prior to the completion of the Distribution on September

29, 2006, basic and diluted earnings per share are computed

using Western Union’s shares outstanding as of that date.

Unvested shares of restricted stock are excluded from basic

shares outstanding. Diluted earnings per share subsequent to

September 29, 2006 refl ects the potential dilution that could

occur if outstanding stock options at the presented date are

exercised and shares of restricted stock have vested and shares

have been transferred in settlement of stock unit awards.

As of December 31, 2007 and 2006, there were 10.4 million

and 4.9 million, respectively, outstanding options to purchase

shares of Western Union stock excluded from the diluted earnings

per share calculation under the treasury stock method as their

effect is anti-dilutive. Prior to the September 29, 2006 spin-off

date, there were no potentially dilutive instruments outstanding.

The treasury stock method assumes proceeds from the exercise

price of stock options, the unamortized compensation expense

and assumed tax benefi ts are available to reduce the dilutive

effect upon exercise. Of the 59.4 million outstanding options to

purchase shares of common stock of the Company, approximately

58% are held by employees of First Data.