Western Union 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Notes to Consolidated Financial Statements

In November 2006, the Company terminated these swaps in

conjunction with the issuance of the 2011 and 2036 Notes

described in Note 13, by paying cash of approximately $18.6

million to the counterparties. The difference in the actual issuance

date and the probable issuance date as stated in the Company’s

hedge designation documentation resulted in ineffectiveness of

$0.6 million, which was immediately recognized in “Derivative

gains/(losses), net” in the Consolidated Statements of Income.

No amounts were excluded from the measure of effectiveness.

The remaining $18.0 million loss on the hedges was included in

“Accumulated other comprehensive loss” and will be reclassifi ed

to “Interest expense” over the life of the related notes.

In June 2007, the Company entered into an interest rate swap

with a notional amount of $75.0 million to effectively change the

interest rate payments on a portion of its notes due 2011 from

fi xed-rate payments to short-term LIBOR-based variable rate

payments in order to manage the mix of fi xed and fl oating rates

in the Company’s debt portfolio. The interest rate swap has a

termination date of November 17, 2011, matching the maturity

date of the hedged instrument. Additionally, the payment dates

and coupon of the fi xed portion of the swap match the contractual

terms specifi ed in the notes being hedged, and the rate on the

fl oating portion of the swap resets every three months. Accordingly,

the Company designated this derivative as a fair value hedge

utilizing the short-cut method in SFAS No. 133, which permits an

assumption of no ineffectiveness if these and other criteria are

met. The fair value of the hedge was a net asset of $3.6 million

as of December 31, 2007. The offset to the change in fair value

of the interest rate swap is refl ected in the balance of the hedged

instrument within the Company’s “Borrowings” in the Consolidated

Balance Sheets and interest expense has been adjusted to include

the effects of payments made and received under the swap.

Summary Impact of Derivatives

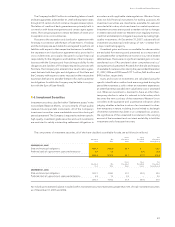

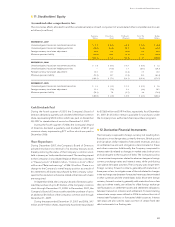

The following table summarizes activity in “Accumulated other comprehensive loss” related to all derivatives designated as cash

fl ow hedges (in millions):

2007 2006 2005

Balance included in “Accumulated other comprehensive loss” at January 1, $(29.3) $ — $ —

Total reclassifi cation into earnings from “Accumulated other comprehensive loss” 26.9 (1.5) —

Changes in fair value of derivatives, net of tax (41.3) (27.8) —

Balance included in “Accumulated other comprehensive loss” at December 31, $(43.7) $(29.3) $ —

“Accumulated other comprehensive loss” of $29.3 million related to the foreign currency forward contracts is expected to be reclas-

sifi ed into revenue within the next 12 months as of December 31, 2007. Approximately $1.7 million of losses on the forecasted debt

issuance hedges are expected to be recognized in interest expense during the next 12 months as of December 31, 2007. No amounts

have been reclassifi ed into earnings as a result of the underlying transaction being considered probable of not occurring within the

specifi ed time period.

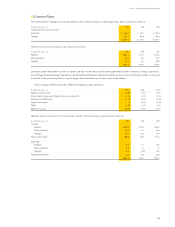

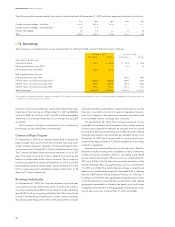

The following table summarizes changes in the fair value of derivatives held during the respective years (in millions):

2007 2006 2005

Interest rate fair value hedges — effective portion(a) $ 3.6 $ — $ —

Interest rate cash fl ow hedges — effective portion(b) — (18.0) —

Foreign currency cash fl ow hedges — effective portion(c) (55.9) (11.4) —

Portion excluded from effectiveness assessment and ineffectiveness(d) 8.3 0.9 —

Foreign currency undesignated(e) (21.1) (41.9) 71.2

Total increase/(decrease) in fair value $(65.1) (70.4) $71.2

(a) Changes in the fair value of interest rate swaps designated as fair value hedges are offset by recognized changes in the fair value of the hedged borrowings.

(b) The effective portion of changes in fair value of interest rate swaps designated as cash fl ow hedges are recorded in other comprehensive income or loss. This amount recognized

in other comprehensive income or loss is subsequently amortized to interest expense over the life of the debt being hedged.

(c) The change in spot value of foreign currency forward contracts designated as cash fl ow hedges is recognized in other comprehensive income or loss. Amounts classifi ed within

“Accumulated other comprehensive loss” are reclassifi ed to revenue in the period that the hedged item effects earnings.

(d) The portion of change in fair value of a derivative excluded from effectiveness assessment for foreign currency forward contracts designated as cash fl ow hedges represents the

difference between changes in forward rates and spot rates, along with all changes in fair value during periods in which the instrument was not designated as a hedge. The inef-

fectiveness recognized in forecasted debt hedges is attributable to the timing of the debt issuance changing from original expectation. These changes were recognized in “Derivative

gains/ (losses), net.”

(e) Changes in the fair value of undesignated foreign currency forward contracts are recognized in “Cost of services.” Prior to September 29, 2006, the Company did not have derivatives

that qualifi ed for hedge accounting in accordance with SFAS No. 133. As such, the effect of the changes in the fair value of these derivatives prior to September 29, 2006 is included

in “Derivative gains/(losses), net.”