Western Union 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

21

|| We continue to face robust competition in both our consumer-

to-consumer and consumer-to-business segments from a

variety of money transfer and consumer payment providers.

We believe the most signifi cant competitive factors in the

consumer-to-consumer segment relate to brand recognition,

distribution network, consumer experience and price and in

the consumer-to-business segment relate to brand recognition,

convenience, speed, variety of payment methods and price.

|| Regulation of the money transfer industry is increasing. The

number and complexity of regulations around the world and

the pace at which regulation is changing are factors that pose

signifi cant challenges to our business. We continue to imple-

ment policies and programs and adapt our business practices

and strategies to help us comply with current legal require-

ments, as well as with new and changing legal requirements

affecting particular services, or the conduct of our business

in general. Our activities include dedicated compliance

personnel, training and monitoring programs, government

relations and regulatory outreach efforts and support and

guidance to the agent network on compliance programs.

These efforts increase our costs of doing business.

||

Our consumer-to-business segment continues to experience

a shift in demand in the United States from cash-based walk-in

payment services to lower margin, higher volume growth

electronic payment services.

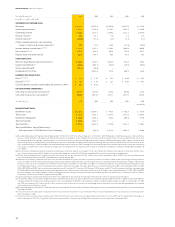

Signifi cant Financial and Other Highlights

Signifi cant fi nancial and other highlights for the year ended

December 31, 2007 include:

|| We generated $4,900.2 million in total consolidated revenues

and $1,322.0 million in consolidated operating income,

resulting in year-over-year growth of 10% and 1% in total

consolidated revenues and operating income, respectively.

Our operating income margin was 27% during the year ended

December 31, 2007 compared to 29% during the year ended

December 31, 2006. Operating income and operating income

margin were impacted by the shift in business mix refl ecting

stronger growth in the international business, which carries

a lower margin than the United States originated businesses,

the $22.3 million accelerated non-cash stock compensation

charge taken in connection with the change in control of First

Data as further described in “Results of Operations,” and $59.1

million of incremental independent public company expenses

compared to $25.1 million in 2006.

|| Consolidated net income during 2007 was $857.3 million,

representing a decrease of 6% from 2006. Basic and diluted

earnings per share during 2007 were $1.13 and $1.11, respec-

tively, compared to basic and diluted earnings per share in

2006 of $1.20 and $1.19, respectively. In addition to the factors

described above which have negatively impacted operating

income during 2007, net income also decreased in 2007 due

to higher interest expense in connection with higher outstand-

ing borrowings payable to third parties.

|| We completed 167.7 million consumer-to-consumer transac-

tions worldwide, representing an increase of 14% over 2006,

due primarily to transactions generated outside of the

United States.

|| We completed 404.5 million consumer-to-business transac-

tions, an increase of 62% over 2006. Excluding transactions

attributable to Pago Fácil, which was acquired in December

2006, consumer-to-business transactions increased 1% in

2007 compared to 2006.

||

Consolidated cash fl ow provided by operating activities was

$1,103.5 million. Cash provided by operating activities

remained consistent during the year ended December 31,

2007 compared to the year ended December 31, 2006,

despite decreased net income, as some of the decrease to

net income was from increased non-cash charges which have

not impacted cash fl ows.

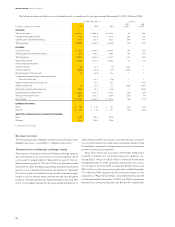

The Separation of Western Union from First Data

On January 26, 2006, First Data Board of Directors announced

its intention to pursue the distribution of 100% of its money

transfer and consumer payments businesses related assets,

through a tax-free distribution to First Data shareholders. Effec-

tive on September 29, 2006, First Data completed the separation

and the distribution of these businesses (the “Distribution”).

Prior to the Distribution, our company had been a segment of

First Data.

In connection with the spin-off, we reported a $4.1 billion

dividend to First Data in our consolidated statements of stock-

holders’ equity/(defi ciency)/net investment in The Western

Union Company, consisting of a promissory note from our

subsidiary, First Financial Management Corporation, or “FFMC,”

in an aggregate principal amount of $2.4 billion, the issuance

of $1.0 billion in Western Union notes and a cash payment to

First Data of $100.0 million. The remaining dividend was com-

prised of cash, consideration for an ownership interest held by

a First Data subsidiary in one of our agents which had already

been refl ected as part of our company, settlement of net inter-

company receivables (exclusive of certain intercompany notes

as described in the following paragraph), and transfers of certain

liabilities, net of assets.

We also settled as part of the spin-off, certain intercompany

notes receivable and payable with First Data along with related

interest and currency swap agreements associated with these

notes. The net settlement of the principal and related swaps

resulted in a net cash infl ow to our cash fl ows from fi nancing

activities of $724.0 million. The net settlement of interest on these

notes receivable and payable of $40.7 million was refl ected in

cash fl ows from operating activities in our consolidated statement

of cash fl ows.