Western Union 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

35

Notes

On September 29, 2006, we issued $1.0 billion aggregate prin-

cipal amount of unsecured notes maturing on October 1, 2016

(the “2016 Notes”). Interest on the 2016 Notes is payable semian-

nually on April 1 and October 1 each year. We may redeem the

2016 Notes at any time prior to maturity at the applicable treasury

rate plus 20 basis points.

On November 17, 2006, we issued $2 billion aggregate

principal amount of unsecured fi xed and fl oating rate notes,

comprised of $500 million aggregate principal amount of our

Floating Rate Notes due 2008 (the “Floating Rate Notes”), $1

billion aggregate principal amount notes due 2011 (the “2011

Notes”) and $500 million aggregate principal amount of notes

due 2036 (the “2036 Notes”).

In June 2007, we entered into an interest rate swap with a

notional amount of $75.0 million to effectively change the

characteristic of our interest rate payments on a portion of our

2011 Notes from fi xed-rate payments to short-term LIBOR-based

variable rate payments in order to manage the mix of fi xed and

fl oating rates in our debt portfolio. The rate on the fl oating

portion of the swap resets every three months based on the

three month LIBOR.

Interest with respect to the 2011 Notes and 2036 Notes is

payable semiannually in arrears on May 17 and November 17

each year. Interest with respect to the Floating Rate Notes is

payable quarterly in arrears on February 17, May 17, August 17,

and November 17 each year at a per annum rate equal to the three

month LIBOR plus 15 basis points, reset quarterly (5.06% and 5.52%

at December 31, 2007 and 2006, respectively). We may redeem

the 2011 Notes and the 2036 Notes at any time prior to maturity

at the applicable treasury rate plus 15 basis points and 25 basis

points, respectively. We may redeem the Floating Rate Notes at

any time on or after May 17, 2007, at a redemption price equal

to 100% of the principal amount of the Floating Rate Notes to be

redeemed plus accrued interest on the date of redemption.

Debt Service Requirements

Our 2008 debt service requirements will include payments on

existing borrowings and any future borrowings under our com-

mercial paper program, the payment due on the maturity of our

$500 million Floating Rate Notes in 2008 and interest payments.

We have the ability to use existing fi nancing sources, such as our

Revolving Credit Facility and commercial paper program, to meet

debt obligations as they arise. Currently we intend to refi nance

our Floating Rate Notes in 2008 with new fi nancing sources,

depending on market conditions. Additionally, we may convert

a portion of our commercial paper program into longer term

borrowings in 2008. Based on market conditions at the time such

re-fi nancings occur, we may not be able to obtain new fi nancings

under similar conditions as historically reported.

As discussed in “Cash and Investment Securities” above, a

signifi cant portion of our cash and cash equivalents on hand at

December 31, 2007 is held by foreign entities, some of which

has been taxed at relatively low foreign tax rates compared to

our combined federal and state tax rate in the United States. We

currently plan to invest such funds through these foreign entities.

However, if we change our plans or are required to change our

plans in order to use these cash and cash equivalents for debt

service, we would incur signifi cant tax obligations.

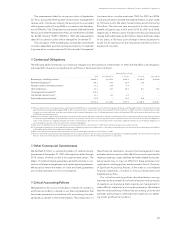

Credit Ratings and Debt Covenants

The credit ratings on our debt are an important consideration in

managing our fi nancing costs and facilitating access to additional

capital on favorable terms. Factors that we believe are important

in assessing our credit ratings include earnings, cash fl ow genera-

tion, leverage, available liquidity and overall business risks.

Our Revolving Credit Facility contains a facility fee and a

utilization fee, determined based on our credit rating assigned

by S&P and/or Moody’s, as further described above. We do not

have any other terms within our debt agreements or other con-

tracts that are tied to changes in our credit ratings. The table

below summarizes our credit ratings as of December 31, 2007:

December 31, 2007 S&P Moody’s Fitch

Short-term rating A-2 P-2 F2

Senior unsecured A- A3 A-

Ratings outlook Stable Stable Stable

These ratings are not a recommendation to buy, sell or hold any

of our securities. Our credit ratings may be subject to revision or

withdrawal at any time by the assigning rating organization, and

each rating should be evaluated independently of any other

rating. We cannot ensure that a rating will remain in effect for any

given period of time or that a rating will not be lowered or with-

drawn entirely by a rating agency if, in its judgment, circumstances

so warrant. A signifi cant downgrade or an indication that a sig-

nifi cant downgrade may occur could result in the following:

|| Our access to the commercial paper market may be limited,

and if we were downgraded below investment grade, our

access to the commercial paper market would likely be

eliminated;

||

Our borrowing costs on certain existing borrowings would

increase;

||

We may be required to pay a higher interest rate in future

fi nancings;

|| Our potential pool of investors and funding sources may

decrease;

|| Regulators may impose additional capital and other require-

ments on us, including imposing restrictions on the ability of

our regulated subsidiaries to pay dividends; and

|| Our agent relationships may be adversely impacted, particularly

those agents that are fi nancial institutions or post offi ces.

The indenture governing our notes and the Revolving Credit

Facility all contain covenants which, among other things, limit

or restrict our ability to grant certain types of security interests,

enter into sale and leaseback transactions or incur certain sub-

sidiary level indebtedness. In addition, the Revolving Credit

Facility requires us to maintain a consolidated interest coverage

ratio of greater than 2:1 (ratio of consolidated EBITDA, as defi ned

in the agreement, to interest expense) for each period compris-

ing the four most recent consecutive fi scal quarters. Our con-

solidated interest coverage ratio was 8:1 as of December 31,

2007. As of December 31, 2007, we are in compliance with our