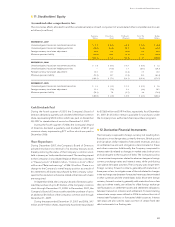

Western Union 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

WESTERN UNION 2007 Annual Report

||

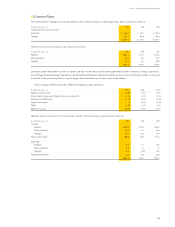

4. Related Party Transactions

Related Party Transactions with First Data

The Consolidated Statements of Income prior to the Spin-off

include expense allocations for certain corporate functions histori-

cally provided to Western Union by First Data. If possible, these

allocations were made on a specific identification basis.

Otherwise, the expenses related to services provided to Western

Union by First Data were allocated to Western Union based on

relative percentages, as compared to First Data’s other businesses,

of headcount or other appropriate methods depending on the

nature of each item or cost to be allocated.

Charges for functions historically provided to Western Union

by First Data are primarily attributable to First Data’s performance

of many shared services that the Company utilized prior to the

Spin-off. First Data continued to provide certain of these services

subsequent to the Spin-off through a transition services agree-

ment until September 29, 2007. In addition, prior to the Spin-off,

the Company participated in certain First Data insurance, benefi t

and incentive plans, and it received services directly related to

the operations of its businesses such as call center services,

credit card processing, printing and mailing. The Consolidated

Statements of Income refl ect charges incurred prior to the

spin-off from First Data and its affi liates for these services of

$152.4 million and $166.3 million for the years ended December

31, 2006 and 2005, respectively. Included in these charges are

amounts recognized for stock-based compensation expense,

as well as net periodic benefit income associated with the

Company’s pension plans.

Included in “Interest income from First Data, net” in the

Consolidated Statements of Income for the years ended Decem-

ber 31, 2006 and 2005 was interest income of $37.4 million and

$28.8 million, respectively, earned on notes receivable from First

Data subsidiaries and interest expense of $1.7 million and $4.5

million, respectively, incurred on notes payable to First Data which

were settled in connection with the Spin-off. Certain of the notes

receivable were euro denominated, and as such, the Company

had related foreign currency swap agreements to mitigate the

foreign exchange impact to the Company on such notes. Included

in “Foreign exchange effect on notes receivable from First Data,

net” in the Consolidated Statements of Income during the years

ended December 31, 2006 and 2005 are foreign exchange gains/

(losses) of $10.1 million and $(5.9) million, respectively, from the

revaluation of these euro denominated notes receivable and

related foreign currency swap agreements.

During the period from January 1, 2006 through September

29, 2006 and the year ended December 31, 2005, the Company

recognized commission revenues from a First Data subsidiary in

connection with its money order business of $23.6 million and

$29.6 million, respectively. Subsequent to the Spin-off, the

Company continues to recognize commission revenue from this

First Data subsidiary.

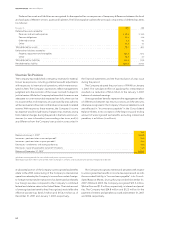

Other Related Party Transactions

The Company has ownership interests in certain of its agents, all

of which are accounted for under the equity method of account-

ing. The Company pays these agents, as it does its other agents,

commissions for money transfer and other services provided on

the Company’s behalf. Commissions paid to these agents for the

years ended December 31, 2007, 2006 and 2005 totaled $256.6

million, $212.2 million and $177.7 million, respectively. For those

agents where an ownership interest was acquired during the

year, only amounts paid subsequent to the investment date have

been refl ected as a related party transaction.

||

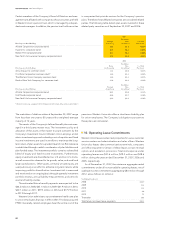

5. Commitments and Contingencies

In the normal course of business, Western Union is subject to

claims and litigation. Management of Western Union believes

such matters involving a reasonably possible chance of loss will

not, individually or in the aggregate, result in a material adverse

effect on Western Union’s fi nancial position, results of operations

or cash fl ows. Western Union accrues for loss contingencies as

they become probable and estimable.

On August 21, 2006, the Interregional Inspectorate No. 50 of

the Federal Tax Service of the Russian Federation for the City of

Moscow (“Tax Inspectorate”) issued a tax audit report to OOO

Western Union MT East (“Western Union MT East”), an indirect

wholly-owned subsidiary of the Company, asserting claims for

the underpayment of Russian Value Added Taxes (“VAT”) related

to the money transfer activities of Western Union MT East in Russia

during 2003 and 2004. On October 24, 2006, the Tax Inspectorate

issued its fi nal decision for tax assessment and tax demand

notices to Western Union MT East for approximately $20 million,

including a 20% penalty and applicable interest to date. The

assessment was challenged at successive levels within the Russian

courts, and all such courts have ruled in favor of Western Union

MT East, holding that the services provided in Russia by Western

Union MT East qualify as banking services which are not subject

to VAT. The Tax Inspectorate requested a hearing by the Presidium

of the Supreme Arbitrazh Court of the Russian Federation, the

highest court in Russia, which request was denied on December

26, 2007, and, accordingly no further appeals are available to the

Tax Inspectorate with respect to this matter. However, the Tax

Inspectorate has the ability to assert the same position in subse-

quent tax years since decisions of Russian courts are not viewed

as binding precedents by the Russian tax authorities. As of

December 31, 2007, the Company has not accrued any potential

loss or associated penalties and interest for this matter.

Western Union is subject to unclaimed or abandoned property

(escheat) laws in the United States and abroad. These laws

require the Company to remit to certain government authorities

the property of others held by the Company that has been

unclaimed for a specifi ed period of time, such as unpaid money

transfers. The Company holds property subject to escheat laws

and the Company has an ongoing program to comply with such

laws. The Company is subject to audits with regard to its escheat-

ment practices.