Western Union 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

WESTERN UNION 2007 Annual Report

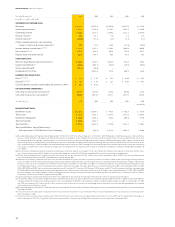

Year ended December 31, 2007 2006 2005 2004 2003

(in millions, except per share data)

STATEMENTS OF INCOME DATA:

Revenues $4,900.2 $4,470.2 $3,987.9 $3,547.6 $3,151.6

Operating expenses(a) 3,578.2 3,158.8 2,718.7 2,435.5 2,148.6

Operating income 1,322.0 1,311.4 1,269.2 1,112.1 1,003.0

Interest income(b) 79.4 40.1 7.6 1.8 0.7

Interest expense(c) (189.0) (53.4) (1.7) (1.7) (1.3)

Other income/(expense), net, excluding

interest income and interest expense(d) 10.0 37.0 69.0 (13.6) (39.8)

Income before income taxes(a) (b) (c) (d) 1,222.4 1,335.1 1,344.1 1,098.6 962.6

Net income(a) (b) (c) (d) 857.3 914.0 927.4 751.6 633.7

Depreciation and amortization 123.9 103.5 79.5 79.2 78.4

CASH FLOW DATA:

Net cash provided by operating activities 1,103.5 1,108.9 1,002.8 930.2 792.8

Capital expenditures(e) (192.1) (202.3) (65.0) (49.5) (99.8)

Shares repurchased(f) (726.8) (19.9) — — —

Dividends to First Data — 2,953.9 417.2 659.8 324.2

EARNINGS PER SHARE DATA:

Basic(a) (b) (c) (d) (g) $ 1.13 $ 1.20 $ 1.21 $ 0.98 $ 0.83

Diluted(a) (b) (c) (d) (g) $ 1.11 $ 1.19 $ 1.21 $ 0.98 $ 0.83

Cash dividends to public stockholders per common share $ 0.04 $ 0.01 — — —

KEY INDICATORS (UNAUDITED):

Consumer-to-consumer transactions(h) 167.73 147.08 118.52 96.66 81.04

Consumer-to-business transactions(i) 404.55 249.38 215.11 192.57 179.39

As of December 31, 2007 2006 2005 2004 2003

(unaudited)

BALANCE SHEET DATA:

Settlement assets $1,319.2 $1,284.2 $ 914.4 $ 702.5 $ 583.9

Total assets 5,784.2 5,321.1 4,591.7 3,315.8 3,027.4

Settlement obligations 1,319.2 1,282.5 912.0 696.6 573.6

Total borrowings 3,338.0 3,323.5 — — —

Total liabilities 5,733.5 5,635.9 1,779.9 1,381.3 1,198.5

Total stockholders’ equity/(defi ciency)/

Net Investment in The Western Union Company 50.7 (314.8) 2,811.8 1,934.5 1,828.9

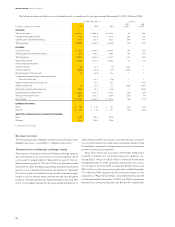

(a) We adopted Statement of Financial Accounting Standards (“SFAS”) No. 123R, “Share-Based Payment,” or “SFAS No. 123R,” following the modifi ed prospective method effective

January 1, 2006. SFAS No. 123R requires all stock-based payments to employees to be recognized in the income statement based on their respective grant date fair values over

the corresponding service periods and also requires an estimation of forfeitures when calculating compensation expense. Stock-based compensation expense, including stock

compensation expense allocated by First Data prior to the spin-off on September 29, 2006 and the impact of adopting SFAS No. 123R, was $50.2 million and $30.1 million for the

years ended December 31, 2007 and 2006. Our stock-based compensation expense in 2007 included a non-recurring charge of $22.3 million related to the vesting of the remaining

converted unvested Western Union stock-based awards upon the completion of the acquisition of First Data on September 24, 2007 by an affi liate of Kohlberg Kravis Roberts &

Co.’s (“KKR”).

(b) Interest income is attributed primarily to international cash balances and loans made to several agents. On the spin-off date, the Company received cash in connection with the settle-

ment of intercompany notes with First Data (net of certain other payments made to First Data) which signifi cantly increased our international cash balances.

(c) Interest expense primarily relates to debt incurred in connection with the spin-off from First Data. Interest expense was signifi cantly higher in 2007 since the related borrowings

were outstanding for the full year 2007 compared to three months during 2006.

(d) Amounts were primarily recognized prior to the spin-off and include derivative gains and losses, net interest income due from First Data, and the net foreign exchange effect on

notes receivable from First Data and related foreign currency swaps with First Data. Prior to the spin-off, we did not have any forward contracts that qualifi ed as hedges, and therefore,

the gains and losses on these contracts were refl ected in income prior to that date. On September 29, 2006, we entered into foreign currency forward positions to qualify for cash

fl ow hedge accounting. As a result, we anticipate future amounts refl ected in the caption “Derivative gains/(losses), net” will be minimal. During the years ended December 31, 2007,

2006, 2005, 2004 and 2003, the pre-tax derivative gain/(loss) was $8.3 million, $(21.2) million, $45.8 million, $(30.2) million and $(37.9) million, respectively. Notes receivable from

First Data affi liates and related foreign currency swap agreements were settled in cash in connection with the spin-off. During the years ended December 31, 2006, 2005 and 2004,

the interest income, net recognized from First Data, including the impact of foreign exchange translation of the underlying notes, was $45.8 million, $18.4 million and $16.6 million,

respectively. There were no amounts recognized during 2003.

(e) Capital expenditures include capitalization of contract costs, capitalization of purchased and developed software and purchases of property and equipment.

(f) In September 2006, the Company’s Board of Directors authorized the purchase of up to $1.0 billion of our common stock through December 31, 2008. In December 2007, the

Company’s Board of Directors authorized the purchase of up to an additional $1.0 billion of the Company’s common stock through December 31, 2009. As of December 31, 2007

and 2006, we reacquired 35.6 million and 0.9 million shares pursuant to these plans, respectively, and through shares withheld to cover tax withholding obligations on restricted

stock awards and units that have vested.

(g) For all periods prior to September 29, 2006 (the date of our spin-off from First Data), basic and diluted earnings per share were computed utilizing the basic shares outstanding at

September 29, 2006.

(h) Consumer-to-consumer transactions include consumer-to-consumer money transfer services worldwide. Amounts include Vigo Remittance Corp. transactions since the acquisition

date of October 21, 2005.

(i) Consumer-to-business transactions include Quick Collect, Western Union Convenience Pay, Speedpay, Equity Accelerator, Just in Time EFT and Servicio Electrónico de Pago S.A.

and its subsidiaries (“SEPSA” or “Pago Fácil”) transactions processed by us. Amounts include Pago Fácil transactions since its acquisition in December 2006.