Western Union 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

WESTERN UNION 2007 Annual Report

Prior to September 29, 2006, we did not have any derivative

instruments that were designated as hedges under the provisions

of SFAS No. 133. As a result, changes in the fair market value of

our outstanding derivative instruments, which are impacted

primarily by fl uctuations in the euro, have been recognized in

“derivative gains/(losses), net” in the consolidated statement of

income for all derivatives entered into prior to September 29,

2006. Since these instruments were not designated to qualify

for hedge accounting treatment, there was resulting volatility in

our net income for the periods presented prior to September

29, 2006. For example, during the years ended December 31,

2006 and 2005, we had pre-tax derivative (losses)/gains of $(21.2)

million and $45.8 million, respectively.

A hypothetical uniform 10% strengthening or weakening in

the value of the United States dollar relative to all other curren-

cies in which our profi ts are generated would result in a decrease/

increase to pretax annual income of approximately $28 million

based on the Company’s forecast of unhedged 2008 exposure

to foreign currency at December 31, 2007. There are inherent

limitations in this sensitivity analysis, primarily due to the assump-

tion that foreign exchange rate movements are linear and

instantaneous, the unhedged exposure is static, and that the

Company would not hedge any additional exposure. As a result,

the analysis is unable to refl ect the potential effects of more

complex market changes that could arise, which may positively

or negatively affect income.

Interest Rates

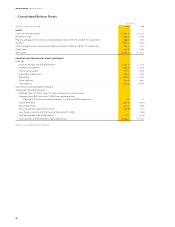

We invest in several types of interest bearing assets, with a total

value at December 31, 2007 of $1.7 billion. Most of this amount

is sensitive to changes in interest rates, and is included in our

consolidated balance sheets within “cash and cash equivalents”

and “settlement assets.” Such assets classifi ed as “cash and cash

equivalents” are highly liquid investments with maturities of

three months or less at the date of purchase and are readily

convertible to cash. To the extent these assets are held in con-

nection with money transfers and other related payment services

awaiting redemption, they are classifi ed as “settlement assets.”

Earnings on these investments will increase and decrease with

changes in the underlying short-term interest rates.

Substantially all of the remainder of our portfolio consists of

highly rated, fi xed rate municipal bonds, which may include

investments made from cash received from our money transfer

business and other related payment services awaiting redemp-

tion classifi ed within “settlement assets” in the consolidated

balance sheets. As interest rates rise, the fair market value of

these fi xed rate interest-bearing securities will decrease; con-

versely, a decrease to interest rates would result in an increase

to the fair market values of the securities. We have classifi ed

these investments as available-for-sale within settlement assets

in the consolidated balance sheets, and accordingly, recorded

these instruments at their fair market value with the net unrealized

gains and losses, net of the applicable deferred income tax

effect, being added to or deducted from our total stockholders’

equity on our consolidated balance sheets.

As of December 31, 2007, $838.2 million of our total $3,338.0

million in debt carries a fl oating interest rate or matures in such

a short period that the fi nancing is effectively a fl oating rate

position. Of this fl oating rate debt, $500.0 million bears interest

based on the three month LIBOR plus 15 basis points and is

reset quarterly, and $338.2 million represents commercial paper

with a weighted-average interest rate of approximately 5.5%

and a weighted-average initial term of 36 days.

The Company reviews its overall exposure to fl oating and

fi xed rates by evaluating our net asset position in each, also

considering duration of the individual positions. The Company

actively manages this mix of fi xed versus fl oating exposure in

an attempt to minimize risk, reduce costs, and optimize returns.

Portfolio exposure to interest rates can be modifi ed by changing

the mix of our interest bearing assets, as well as adjusting the

mix of fi xed versus fl oating rate debt. The latter is accomplished

primarily through the use of interest rate swaps and the decision

regarding terms of any new debt issuances (i.e., fi xed versus

fl oating). We revised certain guidelines in February 2007 and

have begun, through the use of interest rate swaps designated

as hedges, to increase the percent of fl oating rate debt, subject

to market conditions. For example, during June 2007, we entered

into an interest rate swap with a notional amount of $75.0 million

to manage the mix of fi xed and fl oating rates in our debt port-

folio. Our weighted-average interest rate on our borrowings,

including our hedges, outstanding at December 31, 2007 was

approximately 5.63%.