Western Union 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

Notes to Consolidated Financial Statements

||

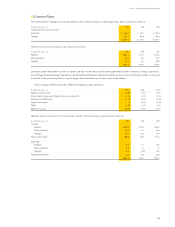

8. Income Taxes

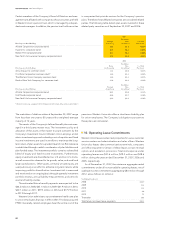

The components of pretax income, generally based on the jurisdiction of the legal entity, are as follows (in millions):

Year Ended December 31, 2007 2006 2005

Components of pretax income:

Domestic $ 529.3 $ 707.1 $ 801.9

Foreign 693.1 628.0 542.2

$1,222.4 $1,335.1 $1,344.1

The provision for income taxes is as follows (in millions):

Year Ended December 31, 2007 2006 2005

Federal $287.7 $331.1 $338.0

State and local 26.3 34.5 29.1

Foreign 51.1 55.5 49.6

$365.1 $421.1 $416.7

Domestic taxes have been incurred on certain pre-tax income amounts that were generated by the Company’s foreign operations.

Accordingly, the percentage obtained by dividing the total federal, state and local tax provision by the domestic pretax income, all

as shown in the preceding tables, may be higher than the statutory tax rates in the United States.

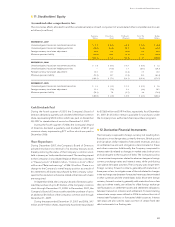

The Company’s effective tax rates differ from statutory rates as follows:

Year Ended December 31, 2007 2006 2005

Federal statutory rate 35.0% 35.0% 35.0%

State income taxes, net of federal income tax benefi ts 1.7% 2.0% 2.0%

Foreign rate differential

(7.7)% (6.3)% (5.8)%

Federal tax credits

—% (0.3)% (0.4)%

Other 0.9% 1.1% 0.2%

Effective tax rate 29.9% 31.5% 31.0%

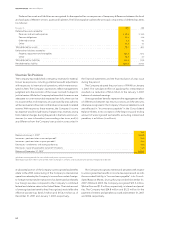

Western Union’s provision for income taxes consists of the following components (in millions):

Year Ended December 31, 2007 2006 2005

Current:

Federal $284.9 $314.0 $326.4

State and local 25.5 33.1 26.0

Foreign 50.5 61.1 39.4

Total current taxes 360.9 408.2 391.8

Deferred:

Federal 2.8 17.1 11.6

State and local 0.8 1.4 3.1

Foreign 0.6 (5.6) 10.2

Total deferred taxes 4.2 12.9 24.9

$365.1 $421.1 $416.7