Western Union 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

Notes to Consolidated Financial Statements

||

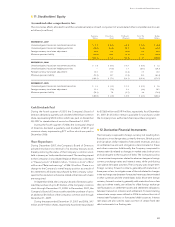

11. Stockholders’ Equity

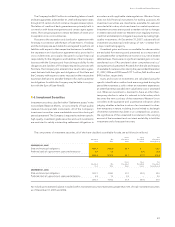

Accumulated other comprehensive loss

The income tax effects allocated to and the cumulative balance of each component of accumulated other comprehensive loss are

as follows (in millions):

Beginning Pretax Gain Tax Benefit Net of Tax Ending

Balance (Loss) (Expense) Amount Balance

DECEMBER 31, 2007

Unrealized gains (losses) on investment securities $ 1.2 $ (2.3) $ 0.8 $ (1.5) $ (0.3)

Unrealized gains (losses) on hedging activities (29.3) (24.6) 10.2 (14.4) (43.7)

Foreign currency translation adjustment 18.0 8.1 (2.8) 5.3 23.3

Minimum pension liability (63.4) 24.5 (9.2) 15.3 (48.1)

$(73.5) $ 5.7 $(1.0) $ 4.7 $(68.8)

DECEMBER 31, 2006

Unrealized gains (losses) on investment securities $ 1.6 $ (0.7) $ 0.3 $ (0.4) $ 1.2

Unrealized gains (losses) on hedging activities — (31.0) 1.7 (29.3) (29.3)

Foreign currency translation adjustment 10.5 11.7 (4.2) 7.5 18.0

Minimum pension liability (74.2) 12.7 (1.9) 10.8 (63.4)

$ (62.1) $ (7.3) $ (4.1) $(11.4) $(73.5)

DECEMBER 31, 2005

Unrealized gains (losses) on investment securities $ 3.8 $ (3.4) $ 1.2 $ (2.2) $ 1.6

Foreign currency translation adjustment 15.3 (7.2) 2.4 (4.8) 10.5

Minimum pension liability (79.1) 7.6 (2.7) 4.9 (74.2)

$ (60.0) $ (3.0) $ 0.9 $ (2.1) $(62.1)

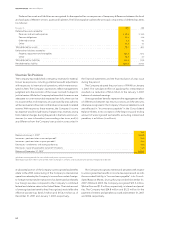

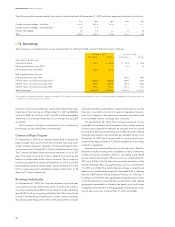

Cash Dividends Paid

During the fourth quarter of 2007, the Company’s Board of

Directors declared a quarterly cash dividend of $0.04 per common

share, representing $30.0 million which was paid on December

28, 2007 to shareholders of record on December 14, 2007.

During the fourth quarter of 2006, the Company’s Board

of Directors declared a quarterly cash dividend of $0.01 per

common share, representing $7.7 million which was paid in

Decem ber 2006.

Share Repurchases

During December 2007, the Company’s Board of Directors

adopted resolutions to retire all of its existing treasury stock,

thereby restoring the status of the Company’s common stock

held in treasury as “authorized but unissued”. The resulting impact

to the Company’s Consolidated Balance Sheet was a decrease

in “Treasury stock” of $462.0 million, “Common stock” of $0.2

million and “Retained earnings” of $461.8 million. There is no

change to the Company’s overall equity position as a result of

this retirement. All shares repurchased by the Company subse-

quent to this resolution will also be retired at the time such shares

are reacquired.

In September 2006, the Company’s Board of Directors autho-

rized the purchase of up to $1.0 billion of the Company’s common

stock through December 31, 2008. In December, 2007, the

Company’s Board of Directors authorized the purchase of up to

an additional $1.0 billion of the Company’s common stock through

December 31, 2009.

During the years ended December 31, 2007 and 2006, 34.7

million and 0.9 million shares, respectively, have been repurchased

for $726.8 million and $19.9 million, respectively. As of December

31, 2007, $1.25 billion remains available for purchases under

the Company’s two authorized share repurchase programs.

||

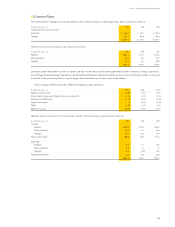

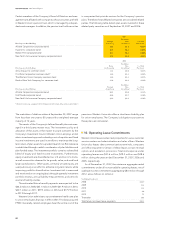

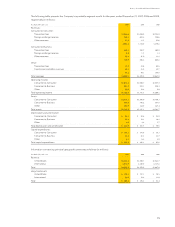

12. Derivative Financial Instruments

The Company is exposed to foreign currency risk resulting from

fl uctuations in exchange rates, primarily the euro, British pound

and Canadian dollar related to forecasted revenues and also

on settlement assets and obligations denominated in these

and other currencies. Additionally, the Company is exposed to

interest rate risk related to changes in market rates both prior to

and subsequent to the issuance of debt. The Company’s policy

is to minimize its exposures related to adverse changes in foreign

currency exchange rates and interest rates, while prohibiting

speculative derivative activities. The Company uses longer-term

foreign currency forward contracts, generally with maturities of

three years or less, to mitigate some of the risk related to changes

in the exchange rate between forecasted revenues denominated

in other currencies and the United States dollar. Short-term foreign

currency forward contracts, generally with maturities from a few

days up to three weeks, are utilized to offset foreign exchange

rate fl uctuations on settlement assets and settlement obligations

between transaction initiation and settlement. Forward starting

interest rate swaps were utilized in 2006 to reduce the risk of

interest rate fl uctuations on forecasted debt issuances. Interest

rate swaps are also used to swap a portion of certain fi xed rate

debt instruments to a fl oating rate.