Western Union 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

THE WESTERN UNION COMPANY 2007 Annual Report

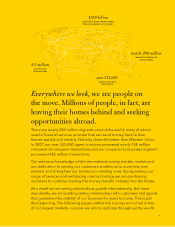

Number of Agent Locations Number of Agent Locations by Region

Europe, Middle East,

Africa, and South Asia

Asia Pacific Latin America ⁄ Mexico

and Caribbean

U.S. ⁄ C an ad a

02 03 04 05 06 07

151,000

182,000

219,000

270,000

300,000

335,000

2007

183,000

59,000

58,000

35,000

Building relationships for a consumer-

centric business

The push to go global is driven by customer

demand. Ours is a business built on relationships

with customers that we develop by enhancing their

experience with our brand. To that end, we reward

customer loyalty with a Gold Card program that, by

the end of 2007, had 9.5 million active cards in 65

countries, up from over 8 million cards in 2006. The

Gold Card is an important tool which improves cus-

tomer retention and increases transaction frequency.

In the United States, nearly half of all Western Union

branded consumer-to-consumer transactions occur

with a Gold Card. It speeds up the time at the point-

of-sale, and helps us to know our customers better.

We continually strive to bring value to our

customers. We have developed regionally focused

marketing promotions and grassroots events like

Africa Cash and Philippines Home for the Holidays.

We have offered continuity of income insurance as a

retention tool in Hong Kong, Malaysia and Austria.

These initiatives have had the effect of creating one

of the strongest customer/brand relationships in the

industry, as evidenced by the high brand awareness

that we continue to enjoy. In 2007, we were recog-

nized as a top 100 brand in the United States, given

Superbrand status in Nigeria and were singled out

as the Choice Brand of the year in Ukraine through

a nationwide customer survey. Our commitment to

serving our customers better is translating into

steady, sustainable growth for our business.

We take great measures to prevent fraud and

money laundering. In 2007, we spent over

$40 million and currently have approximately 300

employees dedicated to these efforts alone. As a

result we have earned a global reputation for having

comprehensive knowledge of how to comply with

the complicated regulations that govern internation-

al money transfer — a reputation that has earned the

trust not just of customers, but of businesses and

governments as well.

Driving innovation in technology and

service offerings

As time passes, migrant populations and their native

communities will prosper and their fi nancial needs

will evolve. The existing relationship they have with

our brand as a money transfer provider will ensure

that they turn to us for additional services. To

develop these services further we are investing in

innovative technology and establishing strategic

partnerships. The tremendous success of Pago Fácil,

our walk-in bill payment business in Argentina, has

encouraged us to focus in 2008 on expanding

our consumer-to-business segment internationally

through acquisitions and joint ventures.

Another area of focus for 2008 is to drive innova-

tion by developing new services and technologies.

We recently signed an agreement with Yodlee,

a leading provider of online banking and bill

payment solutions to fi nancial institutions. Google is

now using our network to send business-to-business

payments to partners in Malaysia, Romania and

elsewhere, bringing new customers into the Western

Union fold. We are also piloting a business-to-

business payment product with U.S.-based small

businesses. And there is ample opportunity for

more partnerships in the future, because businesses

understand the value of Western Union’s global

distribution network.

New opportunities are emerging for money

transfer providers as wireless technology becomes

readily available throughout the world. We are

excited about having offerings that will address an

adjacent market — those customers with a need to

conduct more frequent, lower principal transactions.

We recently announced an agreement with the

GSM Association, the global trade association whose

members include more than 700 mobile phone

operators. Through this relationship we entered into

agreements with Bharti Airtel, Globe Telecom and

Smart Communications to pilot mobile money trans-

fer in the booming Indian and Philippines markets.