Western Union 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

WESTERN UNION 2007 Annual Report

||

Our Segments

We manage our business around the consumers we serve and

the type of services we offer. Each segment addresses a dif-

ferent combination of consumer needs, distribution networks

and services.

|| CONSUMER-TO-CONSUMER — money transfer services between

consumers, primarily through a global network of third-party

agents using our multi-currency, real-time money transfer

processing systems.

|| CONSUMER-TO-BUSINESS — the processing of payments from

consumers to billers through our networks of third-party

agents and various electronic channels. The segment’s rev-

enue was primarily generated in the United States for all

periods presented.

Our other businesses not included in these segments include

Western Union branded money orders available through a network

of third-party agents primarily in the United States and Canada,

and prepaid services. Prepaid services include a Western Union

branded prepaid MasterCard® card sold through select agents

in the United States and the internet, a Western Union branded

prepaid Visa® card sold on the internet, and top-up services for

third parties that allow consumers to pay in advance for mobile

phone and other services.

Also included in “other” are recruiting and relocation expenses

associated with hiring senior management positions new to our

company, and consulting costs used to develop ongoing pro-

cesses in connection with completing the spin-off; and expenses

incurred in connection with the development of certain new

service offerings, including costs to develop mobile money

transfer and micro-lending services.

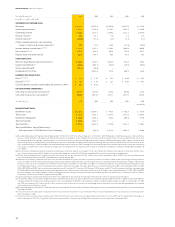

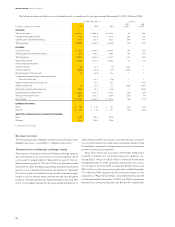

The table below presents the components of our consolidated revenue:

Year Ended December 31, 2007 2006 2005

International(a) 65% 62% 59%

Domestic(b) 11% 14% 16%

Mexico(c) 7% 8% 7%

Total consumer-to-consumer 83% 84% 82%

Consumer-to-business 15% 14% 15%

Other 2% 2% 3%

100% 100% 100%

(a) Represents transactions between and within foreign countries (excluding Canada and Mexico), transactions originated in the United States or Canada and paid elsewhere, and

transactions originated outside the Untied States or Canada and paid in the United States or Canada. Excludes all transactions between or within the United States and Canada and

all transactions to and from Mexico as refl ected in (b) and (c) below.

(b) Represents all transactions between and within the United States and Canada.

(c) Represents all transactions to and from Mexico.

Consumer-to-Consumer Segment

Individual money transfers from one consumer to another are

the core of our business, representing 83% of our total consoli-

dated revenues for 2007. We offer consumers a variety of ways

to send money. Although most remittances are sent in cash at

one of our more than 335,000 agent locations worldwide, in

some countries we offer the ability to send money over the internet

or the telephone, using a credit or debit card. Some agent loca-

tions accept debit cards to initiate a transaction. We also offer

consumers several options to receive a money transfer. While

the vast majority of transfers are paid in cash at agent locations,

in some places we offer payments directly to the receiver’s bank

account or on a stored-value card.

Operations

Our revenue is derived primarily from transaction fees charged

to consumers to transfer money, and in certain money transfer

transactions involving different send and receive currencies, we

generate revenue based on the difference between the exchange

rate set by Western Union to the consumer and the rate at which

we or our agents are able to acquire currency.

In a typical money transfer transaction, a consumer goes to

one of our agent locations, completes a form specifying, among

other things, the name and address of the recipient, and delivers

it, along with the principal amount of the money transfer and the

fee, to the agent. This sending agent enters the transaction infor-

mation into our data processing system and the funds are

made available for payment, usually within minutes. The recipient

enters any agent location in the designated receiving area or

country, presents identifi cation and is paid the transferred amount.

Recipients do not pay a fee (although in limited circumstances,

a tax may be imposed on the payment of the remittance). We

determine the fee paid by the sender, which generally is based

on the principal amount of the transaction and the locations to

and from which the funds are sent and are to be transferred.