Western Union 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

WESTERN UNION 2007 Annual Report

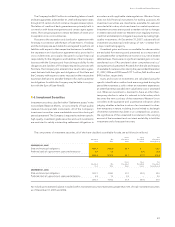

||

FAIR VALUE HEDGES —

Changes in the fair value of derivatives

that are designated as fair value hedges of fi xed rate debt

in accordance with SFAS No. 133 are recorded in interest

expense. The offsetting change in value attributable to changes

in the benchmark interest rate of the related debt instrument

is also recorded in interest expense consistent with the related

derivative’s change.

||

UNDESIGNATED —

Derivative contracts entered into to reduce

the variability related to (a) settlement assets and obligations,

generally with terms of a few days up to three weeks, and (b)

certain foreign currency denominated cash positions, generally

with maturities of less than one year, are not designated as

hedges for accounting purposes and, as such, changes in

their fair value are included in operating expenses consistent

with foreign exchange rate fl uctuations on the related settle-

ment assets and obligations or cash positions.

The Company also had certain other foreign currency swap

arrangements with First Data, prior to September 29, 2006, to

mitigate the foreign exchange impact on certain euro denominated

notes receivable with First Data. These foreign currency swaps

did not qualify for hedge accounting and, accordingly, the fair

value changes of these agreements were reported in the accom-

panying Consolidated Statements of Income as “Foreign exchange

effect on notes receivable from First Data, net.” The fair value of

these swaps were settled in cash along with the related notes

receivable in connection with the Spin-off.

The fair value of the Company’s derivative fi nancial instruments

is derived from standardized models that use market based inputs

(e.g., forward prices for foreign currency).

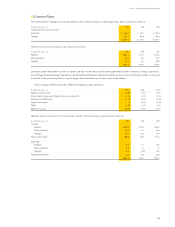

Stock-Based Compensation

The Company currently has a stock-based compensation plan

that grants Western Union stock options, restricted stock awards

and restricted stock units to employees and other key individuals

who perform services for the Company. In addition, the Company

has a stock-based compensation plan that provides for grants

of Western Union stock options and stock unit awards to non-

employee directors of the Company. Prior to the Spin-off,

employees of Western Union participated in First Data’s stock-

based compensation plans.

Effective January 1, 2006, the Company adopted SFAS No.

123R, “Share-Based Payment” (“SFAS No. 123R”), using the

modifi ed prospective method. SFAS No. 123R requires all stock-

based compensation to employees be measured at fair value

and expensed over the requisite service period and also requires

an estimate of forfeitures when calculating compensation expense.

The Company recognizes compensation expense on awards on

a straight-line basis over the requisite service period for the

entire award. In accordance with the Company’s chosen method

of adoption, results for prior periods have not been adjusted.

Prior to the adoption of SFAS No. 123R, the Company followed

Accounting Principles Board (“APB”) Opinion No. 25 which

accounts for share-based payments to employees using the

intrinsic value method and, as such, generally recognized no

compensation expense for employee stock options. Refer to

Note 14 for additional discussion regarding details of the

Company’s stock-based compensation plans and the adoption

of SFAS No. 123R.

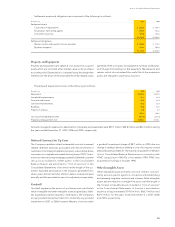

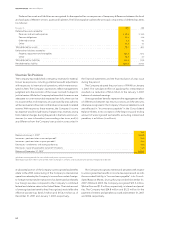

Reclassifi cations

Certain prior year amounts have been reclassifi ed to conform to

the current year presentation. These reclassifi cations had no

impact on the Company’s consolidated fi nancial position, results

of operations or cash fl ows as previously reported.

New Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, “Fair Value

Measurements” (“SFAS No. 157”), which defines fair value,

establishes a framework for measuring fair value under GAAP

and expands disclosures about fair value measurements. SFAS

No. 157 applies to other accounting pronouncements that

require or permit fair value measurements. The new guidance

is effective for fi nancial statements issued for fi scal years begin-

ning after November 15, 2007, and for interim periods within

those fi scal years. The Company adopted the provisions of SFAS

No. 157 on January 1, 2008. The Company believes the impact

of adoption will not be signifi cant to the Company’s consolidated

fi nancial position, results of operations and cash fl ows as it has,

in most cases, historically reported assets and liabilities required

to be reported at fair value using the methods prescribed by

SFAS No. 157.

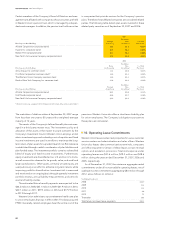

On September 29, 2006, the FASB issued SFAS No. 158,

“Employers Accounting for Defi ned Benefi t Pension and Other

Postretirement Plans — An Amendment of SFAS No. 87, 88, 106

and 132(R)” (“SFAS No. 158”). The remaining provisions that the

Company will adopt under SFAS No. 158 require a plan’s funded

status to be measured at the employer’s fi scal year end. The

Company will change its measurement date from September 30

to December 31 during 2008.

In February 2007, the FASB issued SFAS No. 159, “The Fair

Value Option for Financial Assets and Liabilities” (“SFAS No.

159”), which provides companies with an option to report selected

fi nancial assets and liabilities at fair value, and establishes pre-

sentation and disclosure requirements designed to facilitate

comparisons between companies that choose different measure-

ment attributes for similar types of assets and liabilities. The new

guidance is effective for fi scal years beginning after November

15, 2007. The Company adopted the provisions of SFAS No. 159

on January 1, 2008. The Company believes the impact of adoption

will not be signifi cant as the Company will not elect to measure

any fi nancial instruments or other items at fair value that are not

currently required to be measured at fair value.

In December 2007, the FASB issued SFAS No. 141R, “Business

Combinations” (“SFAS No. 141R”). This statement establishes a

framework to disclose and account for business combinations.

The adoption of the requirements of SFAS No. 141R applies

prospectively to business combinations for which the acquisition

date is on or after fi scal years beginning after December 15, 2008

and may not be early adopted. The Company is currently evaluat-

ing the potential impact of the adoption of SFAS No. 141R.