Western Union 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

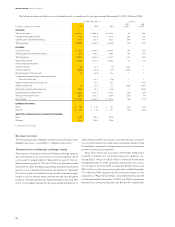

Management’s Discussion and Analysis of Financial Condition and Results of Operations

25

In addition, fl uctuations in the exchange rate between the

euro and the United States dollar have resulted in the following

benefi t or reduction to consumer-to-consumer transaction fee

and foreign exchange revenue (which represents over 80% of

our consolidated revenue) over the previous year, net of foreign

currency hedges, that would not have occurred had there been

a constant exchange rate:

Year ended December 31, (in millions) Benefi t/(Reduction)

2007 $78.8

2006 $11.5

2005 $ (1.4)

Overall, consolidated revenue increased due to the strong trans-

action growth in our international business, and due to the impact

of the acquisitions and the euro noted above. The revenue growth

experienced by our international business was offset by revenue

declines in our domestic business (transactions between and

within the United States and Canada), and to a lesser extent, the

Mexico business during the years ended December 31, 2007

and 2006 compared to the corresponding previous periods.

Revenue for the years ended December 31, 2007 and 2006 for

our United States to Mexico, United States outbound and domestic

businesses were adversely impacted by various factors which

began in the second quarter of 2006 in the United States, includ-

ing the immigration debate and subsequent general market

softness, in part due to the slow down in the construction industry.

Domestic and United States outbound transactions and revenues

for money transfers were also impacted by a decline in transac-

tions initiated on our website and on the telephone in the United

States during the year ended December 31, 2007. These declines

resulted primarily from additional controls implemented begin-

ning in early 2007 by Western Union, card associations and issuing

banks in response to credit and debit card fraud.

Foreign exchange revenue increased for the years ended

December 31, 2007 and 2006 over the corresponding previous

periods, due to an increase in cross-currency transactions primarily

as a result of strong growth in international consumer-to-consumer

transactions. The overall increase in foreign exchange revenue

during these periods relating to the increase in cross-currency

transactions was partially offset by reduced foreign exchange

spreads in selected markets. The acquisition of Vigo also con-

tributed to foreign exchange revenue growth in 2006.

We have and intend to continue to implement strategic pricing

reductions to reduce fees and foreign exchange spreads, where

appropriate, taking into account growth opportunities and com-

petitive factors. Pricing decreases and foreign exchange actions

generally reduce margins, but are done in anticipation that they

will result in increased transaction volumes and increased revenues

over time. The costs of such pricing decreases and foreign

exchange actions have averaged approximately 3% of our annual

consolidated revenue over the last three years.

Commission and other revenues

During the year ended December 31, 2007, commission and

other revenues increased over the previous corresponding period

primarily as a result of interest income from higher money transfer

and payment services settlement asset balances and higher

enrollment fees from increased participation in our recurring

mortgage payment service program. Commission and other

revenue increased during the year ended December 31, 2006

compared to the year ended December 31, 2005 as a result of

higher investment income on money orders pending settlement

and higher enrollment fees from increased participation in our

recurring mortgage payment service program.

Operating expenses overview

Incremental independent public company expenses of $59.1

million and $25.1 million in 2007 and 2006, respectively, are

classifi ed within operating expenses under the captions “cost

of services” and “selling, general and administrative” in the

consolidated statements of income. Incremental public company

expenses relate to staffi ng additions and related costs to replace

First Data support, corporate governance, information technol-

ogy, corporate branding and global affairs, benefi ts and payroll

administration, procurement, workforce reorganization, stock

compensation, and other expenses related to being a stand-alone

public company as well as recruiting and relocation expenses

associated with hiring key management positions new to our

company, other employee compensation expenses and temporary

labor used to develop ongoing processes. These expenses are

those in excess of amounts allocated to us by First Data prior to

September 29, 2006 or beyond amounts we presume First Data

would have allocated subsequently thereto. We expect most of

these expenses will continue to be incurred in future periods.

At the time of the spin-off, First Data converted stock options,

restricted stock awards and restricted stock units (collectively,

“stock-based awards”) of First Data stock held by Western Union

and First Data employees. Both Western Union and First Data

employees received converted Western Union stock-based

awards. All converted stock-based awards, which had not vested

prior to September 24, 2007, are subject to the terms and condi-

tions applicable to the original First Data stock-based awards,

including change of control provisions which require full vesting

upon a change of control of First Data. Accordingly, upon the

completion of the acquisition of First Data on September 24,

2007 by an affi liate of Kohlberg Kravis Roberts & Co (“KKR”), all

of these remaining converted unvested Western Union stock-

based awards vested. In connection with this accelerated vesting,

we incurred a non-cash pre-tax charge of $22.3 million during

the third quarter of 2007. Approximately one-third of this charge

was recorded within “cost of services” and two-thirds was recorded

within “selling, general and administrative expenses” in the

consolidated statements of income.