Vodafone 2001 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL REVIEW

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

7

The Group’s preservation of its credit ratings has enabled it to access a

wide range of debt finance including commercial paper, bonds and

committed bank facilities. The Group has dollar and Euro commercial

paper programmes for US$15 billion and £2 billion, respectively, which it

uses to meet its short term liquidity requirements. The commercial paper

facilities are backed by a US$14.55 billion (£10.2 billion) committed

bank facility, which expires in September 2001, with a one year term-out

option. The Group also has £13.5 billion (sterling equivalent) of capital

market debt in issue, with maturities from June 2001 to February 2030.

In addition, certain of the Group’s subsidiary undertakings have

committed facilities that may only be used to fund their operations.

Misrfone in Egypt has a facility of EGP2.4 billion (£438m) that expires

in 2005, Mannesmann AG in Germany has bilateral facilities totalling

K562m which expire in 2004 and 2006 and VRAM Telecommunications

Company Limited in Hungary has a facility of K350m that fully expires

in 2008. Of these aggregate committed facilities of approximately

£1,005m, the undrawn amount at 31 March 2001 was £322m.

Foreign exchan ge m an agem en t

Foreign currency exposures on known future transactions are hedged,

including those resulting from the repatriation of international

dividends and loans. Forward foreign exchange contracts are the

derivative instrument most used for this purpose.

The Group’s policy is not to hedge its international net assets with

respect to foreign currency balance sheet translation exposure, since

net tangible assets represent a small proportion of the market value

of the Group and international operations provide risk diversity.

However, at 31 March 2001, 86% of gross borrowings were

denominated in currencies other than sterling in anticipation of cash

flows from profitable international operations and this provides a

partial hedge against profit and loss account translation exposure.

In terest rate man agem en t

Under the Group’s interest rate management policy, interest rates are

fixed when net interest is forecast to have a significant impact on

profits. Therefore, the term structure of interest rates is managed

within limits approved by the Board, using derivative financial

instruments such as interest rate swaps, futures and forward rate

agreements.

At the end of the year, 72% of the Group’s gross borrowings were

fixed for a period of at least one year. Based on the Group’s net debt

at 31 March 2001, a one percent rise in market interest rates would

increase profit before taxation by approximately £40m.

Counterp arty risk m an agemen t

Liquid investments, cash deposits and other financial instrument

transactions give rise to credit risk on the amounts due from

counterparties. The Group frequently monitors these risks and the

credit rating of its counterparties and, by policy, limits the aggregate

credit and settlement risk it may have with any one counterparty.

Whilst the Group may be exposed to credit losses in the event of non-

performance by these counterparties, the possibility of material loss is

considered to be minimal because of these control procedures.

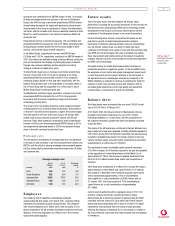

Shareholder returns

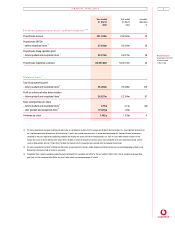

Basic earnin gs per share

Basic earnings per share, before goodwill and exceptional items,

decreased by 20% from 4.71p to 3.75p, primarily reflecting the dilution

arising from the issue of new shares in connection with the

Mannesmann acquisition.

Basic earnings per share, after goodwill and exceptional items, fell

from 1.80p last year to a loss per share of 15.89p in the year to

31 March 2001. The loss per share of 15.89p includes a charge of

19.34p per share (2000: 6.32p per share) in relation to the

amortisation of goodwill.

Divid en ds

The proposed final dividend of 0.714p produces a total for the year of

1.402p, an increase of 5% over last year, and reflects the continuing

strong trading performance and operating cash flow generation of the

Group’s operations. The dividend was covered 2.4 times by Group

earnings, before goodwill amortisation, compared with 3.5 times in

the year ended 31 March 2000.

Sh are price

The share price at 31 March 2001 was 193.0p (2000 – 348.5p) and

has increased significantly since the Company floated in 1988 at an

issue price of 170p, which is now equivalent to 11.33p following the

capitalisation issues in July 1994 and September 1999. However,

during the year, in common with all other telecommunications

companies, Vodafone’s share price suffered as market sentiment

moved away from technology and telecommunications stocks.

Nevertheless, investor support is demonstrated by the strong demand

for the recent placing of the Company’s shares, which raised over

£3.5 billion.

Introduction of the single

European currency

Working groups have been established by local management, where

the impact on business operations of trading in the Euro is significant,

to manage the implementation of appropriate change programmes.

In EU markets not yet committed to the introduction of the Euro,

preliminary assessments have been carried out. The financial cost of

preparing for the adoption of the Euro is not material to the Group.

Basis of preparation of fi nancial

statements

During the year the Group has adopted Financial Reporting Standard

18, “Accounting Policies”, implementation of which has not had any

effect on the financial results for the year or required changes to prior

year comparatives.

Two other Financial Reporting Standards (“FRS”) were issued by the

Accounting Standards Board during the year as follows:

FRS 17 – Retirement Benefits; and

FRS 19 – Deferred Tax.

FRS 17 replaces SSAP 24 “Accounting for Pension Costs” and

changes existing accounting and disclosure requirements for defined

benefit pension schemes. Although transitional rules apply, when fully

implemented the principal changes will be the inclusion of pension

scheme surpluses or deficits on the balance sheet, analysis of the

pension charge between operating profit and net interest, and the

reporting of actuarial gains and losses in the statement of total

recognised gains and losses. It is not anticipated that these changes

will have a material effect on the Group’s results or balance sheet.

FRS 19 replaces SSAP 15 “Accounting for Deferred Tax” and

prescribes significant changes to the existing accounting and

disclosure for deferred tax. The requirements of FRS 19 must be

adopted for the first time in the Group accounts for the year ending

31 March 2002. The main change is that deferred tax must be

recognised on a full provision basis in the Group’s accounts, as

opposed to the partial provision method presently adopted by the

Group. On implementation of FRS 19, a prior year adjustment will be

required to reflect the change in basis of accounting.

Going concern

After reviewing the Group’s and Company’s budget for the next

financial year, and other longer term plans, the directors are satisfied

that, at the time of approving the financial statements, it is

appropriate to adopt the going concern basis in preparing the

financial statements.