Vodafone 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

47

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

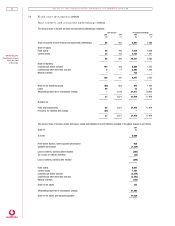

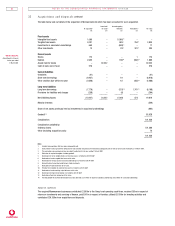

20 Reserves

Share Profit

premium Merger Other and loss

account reserve reserve account

£m £m £m £m

1 April 2000 39,577 96,914 1,120 (575)

Shares issued in respect of the acquisition of

Airtel Móvil S.A. 7,699–––

Shares issued in respect of the acquisition of an interest

in Swisscom Mobile SA 811 – – –

Other allotments of shares 202 – – –

Loss for the financial year – – – (10,650)

Goodwill transferred to the profit and loss

account in respect of business disposals – – – 1

Currency translation – – – 5,197

Transfer in respect of issue of shares

to employee trusts (note 19) 5 – – (5)

Transfer to profit and loss account – – (96) 96

Scrip dividends (2) – – 67

–––––––– –––––––– –––––––– ––––––––

31 March 2001 48,292 96,914 1,024 (5,869)

–––––––– –––––––– –––––––– ––––––––

The currency translation movement includes a loss of £518m (2000 – gain of £316m) in respect of foreign currency net borrowings.

For acquisitions prior to 1 April 1998, the cumulative goodwill written off to reserves, net of the goodwill attributed to business disposals,

was £1,193m at 31 March 2001 (2000 – £1,194m). See notes 8 and 10 for details of the movement.

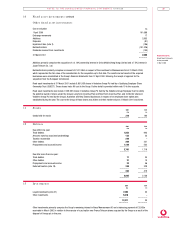

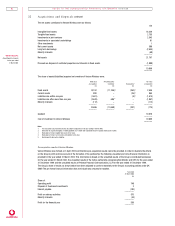

21 Non -equity m in ority in terests

Non-equity minority interests of £1,129m (2000 – £1,004m) comprise £1,125m (2000 – £1,000m) of Class D & E Preferred Shares

issued by Vodafone Americas Asia Inc. and £4m (2000 – £4m) non-cumulative redeemable preference shares issued by Vodafone

Pacific Limited.

The aggregate redemption value of the Class D & E Preferred Shares, on which annual dividends of $51.43 per share are payable

quarterly in arrears, is $1.65 billion. The holders of the Preferred Shares are not entitled to vote unless their dividends are in arrears

and unpaid for six quarterly dividend periods, in which case holders can vote for the election of two directors. The maturity date of the

825,000 Class D Preferred Shares is 6 April 2020, although they may be redeemed at the option of the company, in whole or in part,

after 7 April 2018. The 825,000 Class E Preferred Shares have a maturity date of 7 April 2018 with no early redemption. The Preferred

Shares have a redemption price of $1,000 per share plus all accrued and unpaid dividends.

The holders of the shares issued by Vodafone Pacific Limited have the right to vote and receive such dividend as the directors declare,

subject to a pre-defined limit on the amount of that dividend. These shares are redeemable by either the company or the holder of the

share under certain circumstances and are generally not entitled to any participation in the profits or assets of the company other than

as prescribed. These securities rank in priority to all other classes of share issued by the company as regards return of capital.

22 Acqu isitions an d disposals

The Group has undertaken a number of transactions during the year including completion of the acquisition of Mannesmann AG,

contribution of the Group’s US cellular operations to Verizon Wireless, the acquisition of a controlling interest in Airtel Móvil S.A. and

the acquisition of a 25% interest in Swisscom Mobile SA.

The total goodwill capitalised in respect of transactions completed during the year has been provisionally assessed to be £112,721m

of which £87,171m, £25,536m and £14m is in respect of subsidiary undertakings, associated undertakings and customer bases

respectively.

Further details of these transactions are given below.

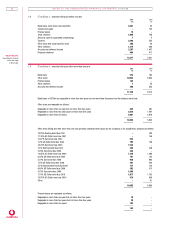

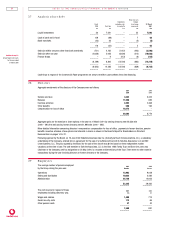

Acquisition of Man nesman n AG

On 12 April 2000, the Group received approval from the European Commission for the acquisition of Mannesman AG. Among the

interests held by Mannesmann AG were majority stakes in the German mobile operator, Mannesmann Mobilfunk GmbH (“D2 Vodafone”)

and the Italian mobile operator, Omnitel Pronto Italia S.p.A. (“Omnitel Vodafone”). Prior to the acquisition of Mannesmann AG, the Group

held interests in D2 Vodafone and Omnitel Vodafone of approximately 34.8% and 21.6%, respectively, and these were accounted for as

associated undertakings. In accordance with Financial Reporting Standard 2, “Accounting for Subsidiary Undertakings”, and in order

to give a true and fair view, purchased goodwill has been calculated as the sum of the goodwill arising on each stake increase in

D2 Vodafone and Omnitel Vodafone, being the difference at the date of each purchase between the fair value of the consideration given

and the fair value of the identifiable assets and liabilities attributable to the interest purchased. This represents a departure from the

statutory method, under which goodwill is calculated as the difference between cost and fair value on the date that D2 Vodafone and

Omnitel Vodafone became subsidiary undertakings. The statutory method would not give a true and fair view because it would result in

the Group’s share of D2 Vodafone’s and Omnitel Vodafone’s retained reserves, during the period that they were associated undertakings,

being recharacterised as goodwill. The effect of this departure is to increase retained profits, and purchased goodwill, by £49m.