Vodafone 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

37

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

10 Fixed asset in vestm en ts

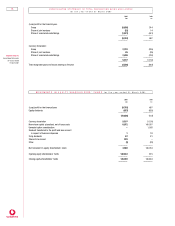

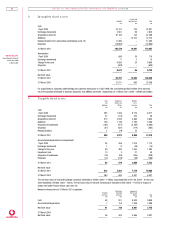

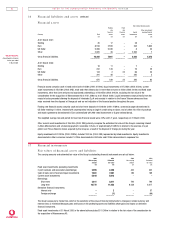

Join t ven tures an d associated un dertakin gs

Joint Associated

ventures undertakings

£m £m

Share of net assets/(liabilities), excluding capitalised goodwill

1 April 2000 652 1,023

Exchange movements 46 44

Acquisitions – (311)

Disposals (418) (11)

Impairment in carrying value of investments (note 3) – (7)

Share of retained results (49) 888

Share of goodwill amortisation in associated undertaking – (5)

Reclassifications (289) (747)

––––––– –––––––

31 March 2001 (58) 874

––––––– –––––––

Capitalised goodwill

1 April 2000 2,019 16,923

Exchange movements – 2,366

Acquisitions (note 22) – 25,536

Disposals (2,019) (32)

Goodwill amortisation – (2,292)

Reclassifications to intangible assets (note 8) – (11,490)

––––––– –––––––

31 March 2001 – 31,011

––––––– –––––––

Loan advances

1 April 2000 – 33

Exchange movements – (2)

Loan advances 85 –

Loan repayments – (6)

––––––– –––––––

31 March 2001 85 25

––––––– –––––––

Net book value

31 March 2001 27 31,910

––––––– –––––––

31 March 2000 2,671 17,979

––––––– –––––––

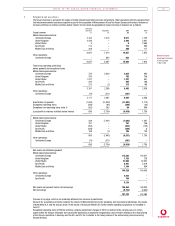

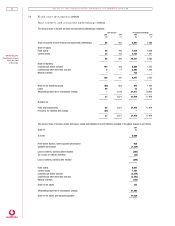

The goodwill capitalised in the year in respect of associated undertakings of £25,536m relates primarily to the Group’s acquisition of

interests in Verizon Wireless, Swisscom Mobile SA, and in respect of associated undertakings acquired as part of the Mannesmann AG

transaction.

Reclassifications of associated undertakings primarily comprise amounts in respect of the Group’s interests in certain of Mannesmann

AG’s subsidiary undertakings and Airtel Móvil S.A., which were accounted for as associated undertakings prior to the acquisition by the

Group of controlling stakes during the year.

The Group’s share of its joint ventures’ and associated undertakings’ post acquisition accumulated (losses)/profits at 31 March 2001

amounted to £(58)m (2000 – £(44)m) and £941m (2000 – £402m) respectively.

The maximum aggregate loans to joint ventures and associated undertakings (including former joint ventures and associated

undertakings) during the year which are not included within the period end balance were £Nil and £8m (2000 – £Nil and £13m).

For acquisitions of associated undertakings prior to 1 April 1998, the cumulative goodwill written off to reserves, net of the goodwill

attributed to business disposals, was £467m at 31 March 2001 (2000 – £468m). The movement during the year relates to the disposal

of the Group’s interest in Celtel Limited.

The Group’s principal joint ventures, associated undertakings and fixed asset investments are detailed on page 60.