Vodafone 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 BOARD’S REPORT TO SHAREHOLDERS ON DIRECTORS’ REMUNERATION continued

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

No director had, since 1 April 2000, any interest in the shares of any subsidiary company except Julian Horn-Smith who, at the end of the financial

year, owned 18,000 ordinary shares of Panafon SA, the Group’s Greek subsidiary company.

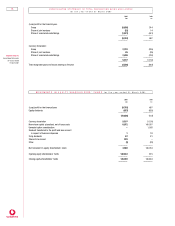

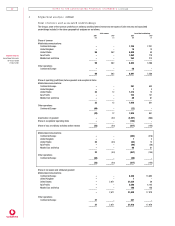

31 March 2001 1 April 2000

or date of

appointment

Ian MacLaurin 65,100 65,100

Chris Gent 1,904,759 641,369

Peter Bamford 67,576 11,612

Thomas Geitner 12,350 12,350

Julian Horn-Smith 781,337 622,928

Ken Hydon 1,217,314 1,093,295

31 March 2001 1 April 2000

or date of

appointment

Paul Hazen 422,450 161,550

Josef Ackermann Nil Nil

Michael Boskin 212,500 212,500

Alec Broers 5,000 Nil

Penny Hughes 22,500 Nil

Arun Sarin 5,408,416 3,407,350

David Scholey 50,000 50,000

Jürgen Schrempp Nil Nil

Henning Schulte-Noelle Nil Nil

Interests in

Ordinary Shares

Chris Gent 1,136

Peter Bamford 1,260

Interests in

Ordinary Shares

Julian Horn-Smith 1,260

Ken Hydon 1,260

There have been no changes in the interests of the directors of Vodafone Group Plc in the ordinary shares of the Company during the period

1 April to 29 May 2001, except that Julian Horn-Smith and Ken Hydon acquired one share each through Vodafone Group Personal Equity Plans

and the following directors acquired interests in shares of the Company under the Vodafone Group Profit Sharing Scheme, as follows:

Beneficial in terests

The directors have the following interests, all of which are beneficial, in the ordinary shares of Vodafone Group Plc:

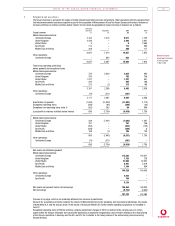

Details of the options exercised by directors of the Company in the year to 31 March 2001 are as follows:

Options exercised Market price Gross

during the Option at date of pre-tax

year price exercise gain

Number Pence Pence £000

Chris Gent 500,000 58.7 289.75 1,155

80,000 58.7 217.00 127

110,000 58.7 205.00 161

532,000 48.3 321.00 1,451

9,270 37.2 300.00 24

––––––––– –––––––––

1,231,270 2,918

––––––––– –––––––––

Peter Bamford 725,000 58.7 316.50 1,869

51,000 58.7 309.00 128

––––––––– –––––––––

776,000 1,997

––––––––– –––––––––

Julian Horn-Smith 35,000 39.7 295.30 89

110,500 46.7 295.30 275

––––––––– –––––––––

145,500 364

––––––––– –––––––––

Ken Hydon 9,270 37.2 271.50 22

––––––––– –––––––––

Paul Hazen (1) 250,000 37.8 256.83 548

123,050 23.2 256.83 287

25,000 45.5 256.83 53

25,000 45.9 256.83 53

25,000 56.7 256.83 50

25,000 104.3 256.83 38

––––––––– –––––––––

473,050 1,029

––––––––– –––––––––

Note

1. The stock options exercised by Paul Hazen were in respect of American Depositary Shares, each representing ten ordinary shares of the Company, which are traded on the New York Stock Exchange.The

number, option price and market price have been converted into the equivalent amounts for the Company’s ordinary shares, and have been translated at the average exchange rate for the year of $1.48 : £1.

The aggregate gross pre-tax gain made on the exercise of share options in the year by the above Company’s directors was £6,330,000

(2000 – £93,910,000). The closing middle market price of Vodafone Group Plc’s shares at the year end was 193p, its highest closing price

in the year having been 355.5p and its lowest closing price having been 182p.