Vodafone 2001 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

63

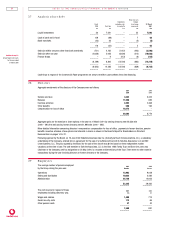

UNITED STATES ACCOUNTING PRINCIPLES continued

Min ority in terests

The adjustments in respect of minority interests relate to provisions for deferred tax which have been recognised for US GAAP purposes by a less

than 100% owned subsidiary undertaking.

Oth er adju stm en ts

Licence fee amortisation – Under UK GAAP, Vodafone has adopted a policy of amortising licence fees in proportion to the expected usage of the

network during the start up period and then on a straight line basis. Under US GAAP, licence fees are amortised on a straight line basis from the

date that operations commence to the date the licence expires.

Pension costs – Under both UK GAAP and US GAAP pension costs are provided so as to provide for future pension liabilities. However, there are

differences in the prescribed methods of valuation, which give rise to GAAP adjustments to the pension cost and the pension prepayment.

Defeasance of liabilities – Under UK GAAP, liabilities which have been unconditionally satisfied by monetary assets placed in trust and other set

off arrangements are considered to be extinguished. Under US GAAP, the offsetting of assets and liabilities is generally not allowed and, therefore,

the non-recognition of a liability is permissible only if the liability has been legally extinguished.

Capitalisation of computer software costs – Under UK GAAP, costs that are directly attributable to the development of computer software for

continuing use in the business, whether purchased from external sources or developed internally, are capitalised. Under US GAAP data conversion

costs and costs incurred during the research stage of software projects are not capitalised.

Gain on disposal of fixed assets and fixed asset investments – Under US GAAP, the net gain on disposal of fixed assets and fixed asset

investments of £6m and £6m, respectively (2000 – £Nil and £954m) would be included within operating income.

Investments in own shares – Investments in the Company’s own shares are included within other fixed asset investments under UK GAAP. US

GAAP requires investments in own shares to be shown as a deduction from equity.

Prop osed dividen ds

Under UK GAAP, final dividends are included in the financial statements when recommended by the Board of directors to the shareholders

in respect of the results for a financial year. Under US GAAP, dividends are included in the financial statements when declared by the Board

of directors.

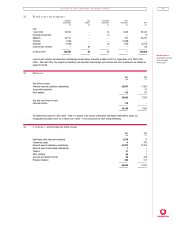

Equity accoun tin g

UK GAAP requires the investor’s share of operating profit or loss, exceptional items and interest income or expense of associated undertakings

and joint ventures to be shown separately from those of the Group on the face of the profit and loss account. The charges for interest and

taxation for associated undertakings and joint ventures may be aggregated within the Group interest and taxation amounts shown on the face of

the profit and loss account, but must be disclosed in the notes to the accounts. The Group’s share of the turnover of joint ventures and associated

undertakings is also permitted to be disclosed on the face of the profit and loss account. In addition, the Group’s share of gross assets and gross

liabilities of joint ventures are shown on the face of the consolidated balance sheet. Under US GAAP, the after-tax profits or losses (i.e. operating

results after exceptional items, interest and taxation) are included in the income statement as a single line item and the investments in associated

undertakings and joint ventures are included in the consolidated balance sheet as a single line item. US GAAP does not permit the Group’s share

of turnover of joint ventures and associated undertakings to be disclosed on the face of the income statement, nor does it permit the Group’s

share of gross assets and gross liabilities of joint ventures to be shown on the face of the consolidated balance sheet.

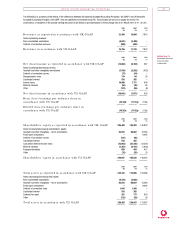

Earn in gs per ordin ary sh are

Earnings per ordinary share information is calculated based on:

2001 2001 2000

$m £m £m

Net (loss)/income in accordance with US GAAP (10,041) (7,071) 553

Weighted average number of ordinary shares in issue 61,439 61,439 27,100

Basic (loss)/earnings per ordinary share (16.34)¢ (11.51)p 2.04p

Diluted weighted average number of ordinary shares 61,398 61,398 27,360

Diluted (loss)/earnings per ordinary share (16.35)¢ (11.52)p 2.02p

The presentation of adjusted basic earnings per share is not permitted under US GAAP.