Vodafone 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

51

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

22 Acqu isitions an d disposals continued

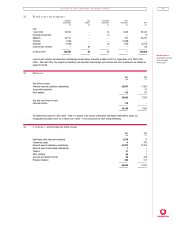

Acquisition of Airtel Móvil S.A.

On 29 December 2000, approval was received from the European Commission for the acquisition of 52.1% of Airtel Móvil S.A.

The acquisition increased the Group’s stake in Airtel Móvil S.A. to 73.8%. Prior to the acquisition of this additional stake, the Group‘s

interest of 21.7% was accounted for as an associated undertaking. As described on page 47, the piecemeal approach to calculating

goodwill has been adopted in accordance with Financial Reporting Standard 2. Adopting the statutory method would not give a true

and fair view because it would result in the Group’s share of retained reserves, during the period that Airtel Móvil S.A. was an associated

undertaking, being recharacterised as goodwill. The effect of this departure is to increase retained profits, and purchased goodwill,

by £57m. The table below sets out the details of the acquisition which has been accounted for as an acquisition.

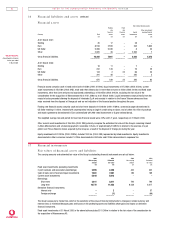

Accounting

At acquisition policy conformity Revaluations (1) Fair value

£m £m £m £m

Intangible fixed assets 374 (270) (2) – 104

Tangible fixed assets 1,010 – – 1,010

Cash at bank and in hand 7 – – 7

Other net current liabilities (130) – 1(3) (129)

Short term borrowings (268) – – (268)

Long term borrowings (372) – – (372)

–––––––– –––––––– –––––––– ––––––––

Net assets 621 (270) 1 352

–––––––– –––––––– ––––––––

Minority interests (92)

Share of net assets previously held as investments in associated undertakings (85)

Goodwill 7,740

––––––––

Consideration – Vodafone Group ordinary shares 7,915

––––––––

Notes

1. The revaluations are provisional and may be subject to adjustment in the year ending 31 March 2002.

2. Elimination of certain acquired intangibles, including goodwill.

3. Net fair value adjustment in respect of working capital balances.

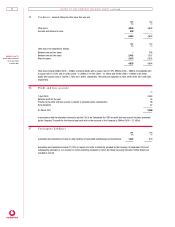

Impact on cash flows

Airtel contributed £135m to the Group’s net operating cash flows, paid £9m in respect of returns on investments and servicing of

finance, paid £5m in respect of taxation and utilised £70m for investing activities, following the Group’s acquisition.

Pre-acquisition results of Airtel Móvil S.A.

The profit after tax of Airtel Móvil S.A. for the years ended 31 December 2000 and 31 December 1999 was £167m and £97m,

respectively, prepared under Spanish GAAP and translated at the average exchange rates for the years of £1 = ESP273.66 and

£1 = ESP252.66, respectively.

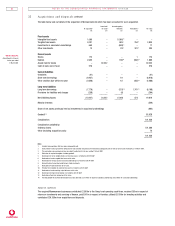

Oth er acqu isitions

The Group undertook a number of other acquisitions during the year as summarised below:

Fair value of net Goodwill

Consideration assets acquired capitalised

£m £m £m

Swisscom Mobile SA 1,828 57 1,771

Other 84 (119) 203

–––––––– –––––––– ––––––––

1,912 (62) 1,974

–––––––– –––––––– ––––––––

The goodwill has been allocated as follows:

Subsidiary undertakings 5

Customer bases 14

Associated undertakings 1,955

––––––––

1,974

––––––––

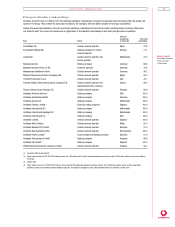

The Group completed the acquisition of a 25% interest in Swisscom Mobile SA for a total consideration of £1,828m. The consideration

will be settled in two tranches. The first tranche was settled with the issue of new ordinary shares with a value of £840m and £10m in

cash. The second tranche of approximately £978m will be satisfied in ordinary shares or cash, or a combination of both, at the Group’s

discretion and is payable by March 2002. The share of net assets acquired is provisionally calculated as £57m, resulting in goodwill of

£1,771m, and no significant fair value adjustments have been made.

Other acquisitions include the purchase of a further stake in the UK service provider, Uniqueair, the acquisition of an interest in

Mobitel, a Greek service provider, and further fair value adjustments made in the year in respect of the AirTouch Communications, Inc.

transaction in the prior year which have revised the provisional value of goodwill from £40,968m to £41,102m.