Vodafone 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

10 Fixed asset in vestm en ts continued

Join t ven tures an d associated un dertakin gs continued

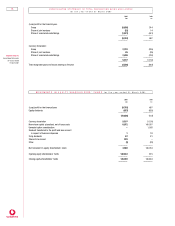

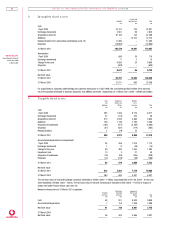

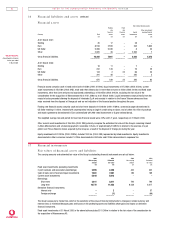

The Group’s share of its joint ventures and associated undertakings comprises:

Joint ventures Associated undertakings

2001 2000 2001 2000

£m £m £m £m

Share of turnover of joint ventures and associated undertakings 98 362 8,891 3,286

––––––– ––––––– ––––––– –––––––

Share of assets

Fixed assets 65 790 7,519 2,439

Current assets 23 103 3,232 1,341

––––––– ––––––– ––––––– –––––––

88 893 10,751 3,780

––––––– ––––––– ––––––– –––––––

Share of liabilities

Liabilities due within one year 144 164 5,889 1,737

Liabilities due after more than one year 277 3,865 1,020

Minority interests ––123 –

––––––– ––––––– ––––––– –––––––

146 241 9,877 2,757

––––––– ––––––– ––––––– –––––––

Share of net (liabilities)/assets (58) 652 874 1,023

Loans 85 –25 33

Attributed goodwill net of amortisation charges –2,019 31,011 16,923

––––––– ––––––– ––––––– –––––––

27 2,671 31,910 17,979

––––––– ––––––– ––––––– –––––––

Analysed as:

Fixed asset investments 85 2,671 31,910 17,979

Provisions for liabilities and charges (58) –––

––––––– ––––––– ––––––– –––––––

27 2,671 31,910 17,979

––––––– ––––––– ––––––– –––––––

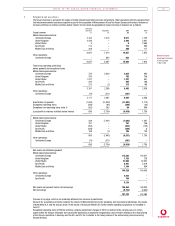

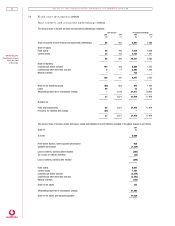

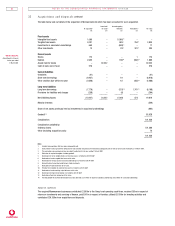

The Group’s share of turnover, profits and losses, assets and liabilities of Verizon Wireless included in the above analysis is as follows:

2001

Share of: £m

Turnover 5,000

–––––––

Profit before taxation, before goodwill amortisation 926

Goodwill amortisation (1,229)

–––––––

Loss on ordinary activities before taxation (303)

Tax on loss on ordinary activities (53)

–––––––

Loss on ordinary activities after taxation (356)

–––––––

Fixed assets 5,027

Current assets 1,342

Liabilities due within one year (3,529)

Liabilities due after more than one year (2,394)

Minority interests (123)

–––––––

Share of net assets 323

Attributed goodwill net of amortisation charges 21,205

–––––––

Share of net assets and attributed goodwill 21,528

–––––––