Vodafone 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

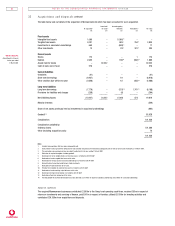

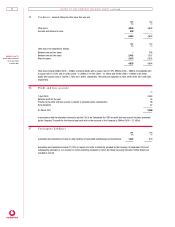

27 An alysis of net debt

Other non-cash

Acquisitions changes

1 April (excluding cash & exchange 31 March

2000 Cash flow & overdrafts) movements 2001

£m £m £m £m £m

Liquid investments 30 7,541 – 22 7,593

––––––– ––––––– –––––––– –––––––– ––––––––

Cash at bank and in hand 159 (98) – 7 68

Bank overdrafts (43) 43 – (5) (5)

––––––– ––––––– –––––––– –––––––– ––––––––

116 (55) – 2 63

––––––– ––––––– –––––––– –––––––– ––––––––

Debt due within one year (other than bank overdrafts) (751) 4,765 (7,167) (443) (3,596)

Debt due after one year (6,038) 2,026 (6,406) (212) (10,630)

Finance leases – 9 (153) (8) (152)

––––––– ––––––– –––––––– –––––––– ––––––––

(6,789) 6,800 (13,726) (663) (14,378)

––––––– ––––––– –––––––– –––––––– ––––––––

(6,643) 14,286 (13,726) (639) (6,722)

––––––– ––––––– –––––––– –––––––– ––––––––

Cash flows in respect of the Commercial Paper programme are shown net within cash outflows from debt financing.

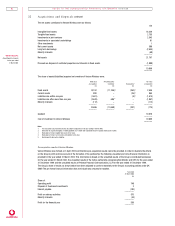

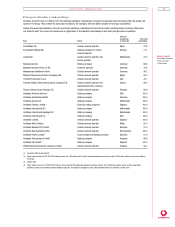

28 Directors

Aggregate emoluments of the directors of the Company were as follows:

2001 2000

£000 £000

Salaries and fees 4,332 3,422

Bonuses 11,000 695

Incentive schemes 2,402 2,468

Other benefits 558 194

Compensation for loss of office 10,272 –

–––––––– ––––––––

28,564 6,779

–––––––– ––––––––

Aggregate gains on the exercise of share options in the year to 31 March 2001 by serving directors were £6,330,000

(2000 – £93,910,000) and by former directors were £1,999,000 (2000 – £Nil).

More detailed information concerning directors’ remuneration, compensation for loss of office, payments to former directors, pension

benefits, incentive schemes, share options and interests in shares is shown in the Board’s Report to Shareholders on Directors’

Remuneration on pages 14 to 22.

Following approval by the Board, on 19 June 2000 Vodafone Americas Asia Inc. (formerly AirTouch Communications, Inc.), a subsidiary

undertaking of the Company, entered into an agreement for the sale of a Gulfstream III aircraft to Salt Aire Associates, LLC and Mill

Creek Systems, LLC. The price agreed by the Board for the sale of the aircraft was $10m based on three independent market

valuations at the time of sale. The sole member of Salt Aire Associates, LLC is the Ginn 1985 Family Trust and Sam Ginn, who was

Chairman of the Company until his resignation on 23 May 2000, is a trustee and beneficiary of the Trust. There were no other material

transactions during the year involving directors or former directors of the Company.

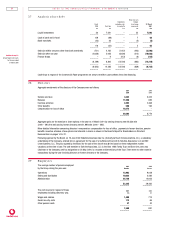

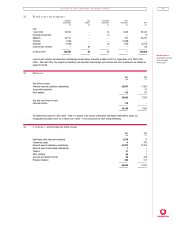

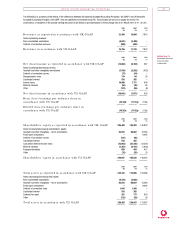

29 Employees

The average number of persons employed 2001 2000

by the Group during the year was: Number Number

Operations 13,963 9,058

Selling and distribution 10,642 5,484

Administration 28,720 14,923

–––––––– ––––––––

53,325 29,465

–––––––– ––––––––

The cost incurred in respect of these 2001 2000

employees (including directors) was: £m £m

Wages and salaries 1,408 774

Social security costs 113 65

Other pension costs 47 42

–––––––– ––––––––

1,568 881

–––––––– ––––––––