Vodafone 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4FINANCIAL REVIEW

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

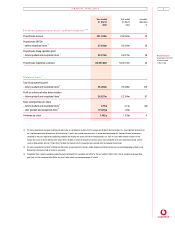

Profi t and loss account

The statutory consolidated profit and loss account presented on page

25, and the accompanying notes, have been prepared on the basis

required by accounting standards in the United Kingdom and include

the results of a number of significant transactions completed during

the year.

The results and net assets of Mannesmann have been consolidated in

the Group’s financial statements with effect from 12 April 2000, the

date the acquisition was completed. Non-core businesses sold following

the acquisition of Mannesmann AG, including Atecs Mannesmann AG,

Orange plc, Mannesmann’s watches and tubes businesses, Ipulsys,

Infostrada S.p.A. and tele.ring, have not been consolidated in the results

for the year.

The results and net assets of Airtel Móvil S.A. have been fully

consolidated with effect from 29 December 2000. Prior to the

acquisition of a controlling interest, the Group’s 21.7% interest in

Airtel Móvil S.A. was accounted for as an associated undertaking

within continuing operations under the equity accounting method.

The Group’s interest in Verizon Wireless, which was formed on 3 April

2000, has been accounted for using equity accounting in the current

year and the Group’s share of results is disclosed within continuing

operations. In the year ended 31 March 2000, turnover of £2,585m

and operating losses of £100m (after goodwill amortisation) in respect

of the Group’s US businesses were fully consolidated.

Group turnover and total Group

operating (loss)/profi t

Group turnover increased to £15,004m from £7,873m last year.

This reflects growth in continuing operations from £5,288m to

£6,637m, after adjusting for the results of US operations in prior year

turnover, and includes £8,367m in respect of acquired businesses.

Turnover from continuing operations, including the Group’s share of

joint ventures and associated undertakings, increased from £11,521m

to £15,155m, reflecting the strong growth of these businesses.

Total Group operating loss of £6,998m for the year (31 March 2000:

profit of £796m) is after charging exceptional operating costs of

£320m (31 March 2000: £30m) and goodwill amortisation of

£11,882m (31 March 2000: £1,712m). Total Group operating profit,

before exceptional operating costs and amortisation of goodwill,

increased to £5,204m, compared with £2,538m last year.

Acquisitions represented £2,087m of the increase with a further

increase of £579m to £3,117m from continuing operations.

Exceptional operating items of £320m primarily comprise impairment

charges of £91m in relation to the carrying value of certain assets

within the Group’s Globalstar service provider businesses, exceptional

reorganisation costs of £85m relating to the restructuring of the Group’s

operations in Germany and the US, and £141m in relation to the

Group’s share of the restructuring costs incurred by Verizon Wireless.

The increase in the goodwill amortisation charge from £1,712m to

£11,882m is primarily due to amortisation of the goodwill arising

from the acquisition of Mannesmann AG, provisionally calculated to be

£83 billion, goodwill on formation of the Verizon Wireless joint venture

partnership and a full year’s amortisation charge for goodwill relating

to the acquired AirTouch operations (excluding US businesses

contributed to Verizon Wireless). These charges for goodwill

amortisation do not affect the cash flows of the Group or the ability

of the Group to make dividend payments.

Exceptional non-operating items

2001 2000

£m £m

Profit on termination of hedging instrument 261 –

Impairment of fixed asset investments (193) –

Profit on disposal of fixed assets 6 –

Profit on disposal of fixed asset investments 6 954

–––––– ––––––

80 954

–––––– ––––––

The profit on termination of the hedging instrument arose in March

2001 upon the settlement of a hedging transaction entered into by the

Group in order to obtain protection against an adverse market-related

price adjustment included in the original terms of the agreement for

the sale of Infostrada S.p.A. This hedging transaction was terminated

with cash proceeds to the Group of approximately K410 million.

The impairments of fixed asset investments are in relation to the

Group’s interests in Globalstar and Shinsegi Telecom, Inc.

The profit of £954m in the prior year arose mainly on disposal of

the Group’s interest in E-Plus Mobilfunk GmbH as a condition of

the European Commission’s approval of the merger with AirTouch

Communications, Inc.

Interest

Total Group interest, including the Group’s share of the net interest

expense of joint ventures and associated undertakings, increased by

£776m to £1,177m.

Net interest costs in respect of the Group’s net borrowings increased

by £517m to £850m, compared with £333m (before exceptional

finance costs of £17m) in the year to 31 March 2000. The increase

includes interest on Mannesmann’s debt of £12,551m, which was

assumed at acquisition on 12 April 2000.

Taxation

The effective rate of taxation for the year, before goodwill and

exceptional non-operating items, increased to 33.9% from 32.5%

in the year ended 31 March 2000. The 1.4% increase in the

effective tax rate is primarily the result of the integration of the

Mannesmann businesses into the Group’s result.

Pro forma proportionate fi nancial

information

Due to the significance of the acquisition of Mannesmann AG and the

merger with AirTouch Communications, Inc. on the results for each of

the years ended 31 March 2001 and 31 March 2000, unaudited pro

forma proportionate financial information has been presented on the

basis that these transactions took place on 1 April in each financial

year. The following discussion of pro forma proportionate Group

turnover and EBITDA, before exceptional items, provides a more direct

comparison of year on year operating performance.

Pro forma proportionate turnover for the Group’s mobile businesses

increased by over 29% to £21,428m and pro forma proportionate

EBITDA, before exceptional items, increased by 28% from £5,504m to

£7,043m, reflecting the strong progress of the business following the

Mannesmann transaction and formation of Verizon Wireless.

After making adjustments for acquisitions completed in the year,

primarily the increased stakes in Airtel Móvil S.A. in Spain, the

J-Phone Group in Japan and the acquisition of shareholdings in

Swisscom Mobile SA and China Mobile (Hong Kong) Limited,

underlying organic growth in both mobile pro forma proportionate

turnover and EBITDA, at constant exchange rates, was 25%.

In Continental Europe pro forma proportionate turnover grew by

almost 21% to £9,743m. This increase reflects the rapid growth in

customer numbers in all major markets, the Group’s increased

shareholding in Airtel Móvil S.A. and the acquisition of an equity

interest in Swisscom Mobile SA.

Pro forma proportionate EBITDA for Continental Europe increased by

almost 22% to £3,534m. In Germany, the costs of connection and

marketing associated with the near doubling of the customer base

lowered the EBITDA margin of D2 Vodafone by six percentage points

to 35%. This represents an improvement on the 30% margin

reported in the first half of the financial year, partially due to the

implementation of changes to commercial policies. In Italy, which

has much lower equipment subsidies, customer growth of 40%