Vodafone 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

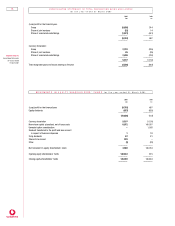

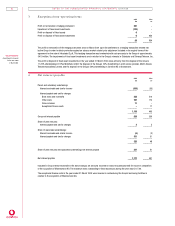

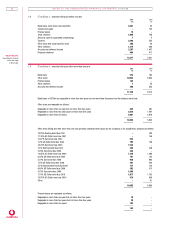

3 Exceptional n on -operatin g items

2001 2000

£m £m

Profit on termination of hedging instrument 261 –

Impairment of fixed asset investments (193) –

Profit on disposal of fixed assets 6–

Profit on disposal of fixed asset investments 6954

–––––––– ––––––––

80 954

–––––––– ––––––––

The profit on termination of the hedging instrument arose in March 2001 upon the settlement of a hedging transaction entered into

by the Group in order to obtain protection against an adverse market-related price adjustment included in the original terms of the

agreement for the sale of Infostrada S.p.A. This hedging transaction was terminated with cash proceeds to the Group of approximately

I410 million. The impairments of fixed asset investments are in relation to the Group’s interests in Globalstar and Shinsegi Telecom, Inc.

The profit on disposal of fixed asset investments in the year ended 31 March 2000 arose primarily from the disposal of the Group’s

17.24% shareholding in E-Plus Mobilfunk GmbH, the disposal of the Group’s 20% shareholding in a UK service provider, Martin Dawes

Telecommunications Limited, and the disposal of the Group’s 50% shareholding in Comfone AG in Switzerland.

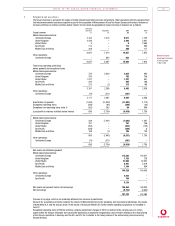

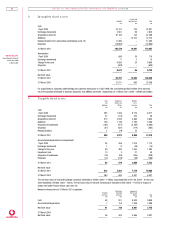

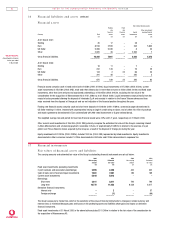

4 Net in terest p ayable

2001 2000

£m £m

Parent and subsidiary undertakings

Interest receivable and similar income (306) (55)

–––––––– ––––––––

Interest payable and similar charges

Bank loans and overdrafts 438 214

Other loans 707 174

Finance leases 11 –

Exceptional finance costs –17

–––––––– ––––––––

1,156 405

–––––––– ––––––––

Group net interest payable 850 350

–––––––– ––––––––

Share of joint ventures:

Interest payable and similar charges 23

–––––––– ––––––––

Share of associated undertakings:

Interest receivable and similar income (6) (3)

Interest payable and similar charges 331 51

–––––––– ––––––––

325 48

–––––––– ––––––––

Share of joint ventures and associated undertakings net interest payable 327 51

–––––––– ––––––––

Net interest payable 1,177 401

–––––––– ––––––––

Included in Group interest receivable in the above analysis are amounts received on loans to businesses held for resale on completion

of the acquisition of Mannesmann AG. The maximum loans outstanding to these businesses during the year was £2,173m.

The exceptional finance costs in the year ended 31 March 2000 were incurred in restructuring the Group’s borrowing facilities in

relation to the acquisition of Mannesmann AG.