Vodafone 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

43

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

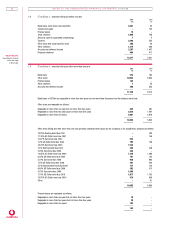

17 Fin an cial in stru m ents continued

The following methods and assumptions were used to estimate the fair values shown in the previous table.

Fixed asset investments (excluding investments in joint ventures and associated undertakings) – The net book value of fixed asset

investments at 31 March 2001 comprises investments recorded at an original cost of £3,141m (2000 – £442m). An impairment loss of

£186m has been set against the Group’s investments in Globalstar and Shinsegi Telecom Inc. Investments include traded and untraded

equity investments in companies involved in providing telecommunications services. Listed investments are stated at fair value based

on their quoted share price at 31 March 2001. Fixed asset investments do not include any valuation in respect of existing customer

bases or other intangible assets.

Cash at bank and in hand and liquid investments – The carrying values of cash and liquid investments approximate to their fair

values because of the short term maturity of these instruments.

Current asset investments – The carrying values of current asset investments are recorded in the accounts at the estimated fair value

of the expected proceeds from disposal.

Borrowings (excluding foreign exchange contracts) – The carrying values of short term borrowings approximate to fair value because

of their short term maturity. The fair value of quoted long term borrowings is based on year end mid-market quoted prices. The fair

value of other borrowings is estimated by discounting the future cash flows to net present values using appropriate market interest

and foreign currency rates prevailing at the year end.

Foreign exchange contracts and interest rate swaps and futures – The Group enters into foreign exchange contracts, interest rate

swaps and futures in order to manage its foreign currency and interest rate exposure. The fair value of these financial instruments was

estimated by discounting the future cash flows to net present values using appropriate market interest and foreign currency rates

prevailing at the year end.

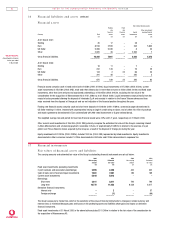

Hedges

The Group’s policy is to use derivative instruments to hedge against exposure to movements in interest rates and exchange rates.

Changes in the fair value of instruments used for hedging are not recognised in the financial statements until the hedged exposure is

itself recognised. Unrecognised gains and losses on instruments used for hedging are set out below:

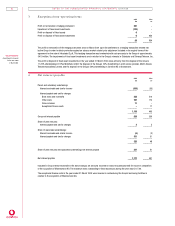

Total net

Gains Losses gains/(losses)

£m £m £m

Unrecognised gains and losses on hedges at 1 April 2000 88 (97) (9)

Less: gains and losses arising in previous years that

were recognised in the year (86) 97 11

–––––– –––––– ––––––

Gains and losses arising before 1 April 2000 that were

not recognised at 31 March 2001 2 – 2

Gains and losses arising in the year that were

not recognised at 31 March 2001 4 (5) (1)

–––––– –––––– ––––––

Unrecognised gains and losses on hedges at 31 March 2001 6 (5) 1

–––––– –––––– ––––––

Of which:

Gains and losses expected to be recognised in 2001 6 (5) 1

Curren cy exposu res

Taking into account the effect of forward contracts and other derivative instruments, the Group did not have a material financial

exposure to foreign exchange gains or losses on monetary assets and monetary liabilities denominated in foreign currencies at

31 March 2001.

Further details regarding the Group’s Treasury Management and Policies are included in the Financial Review on pages 6 and 7.

Short-term debtors and creditors have been omitted from the analyses in notes 16 and 17.