Vodafone 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

22 Acqu isitions an d disposals continued

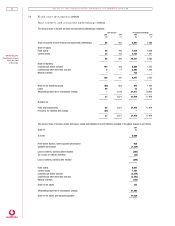

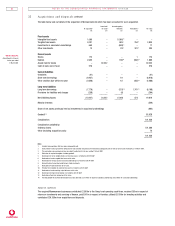

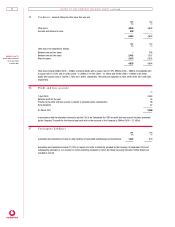

The table below sets out details of the acquisition of Mannesmann AG which has been accounted for as an acquisition.

Assets held Accounting policy

At acquisition(1) for resale(2) conformity Revaluations(3) Fair value

£m £m £m £m £m

Fixed assets

Intangible fixed assets 1,060 – (1,060)(4) ––

Tangible fixed assets 3,091 – 485(5) 254(6) 3,830

Investments in associated undertakings 665 – (648)(7) –17

Other investments 13 – 76(8) 301(9) 390

Current assets

Stocks 173 – – 1 174

Debtors 2,655 – 196(10) (962)(11) 1,889

Assets held for resale – 30,222 – – 30,222

Cash at bank and in hand 576 – – – 576

Current liabilities

Overdrafts (41) – – – (41)

Short term borrowings (6,937) – 19 – (6,918)

Other creditors due within one year (3,648) – 42 (482)(11) (4,088)

Long term liabilities

Long term borrowings (7,776) – (153)(12) 1,761(13) (6,168)

Provisions for liabilities and charges (258) – (6) – (264)

––––––– ––––––– ––––––– ––––––– –––––––

Net (liabilities)/assets (10,427) 30,222 (1,049) 873 19,619

––––––– ––––––– ––––––– –––––––

Minority interests (549)

Share of net assets previously held as investments in associated undertakings (662)

Goodwill (14) 83,028

–––––––

Consideration 101,436

–––––––

Consideration satisfied by:

Ordinary shares 101,366

Other (including acquisition costs) 70

–––––––

101,436

–––––––

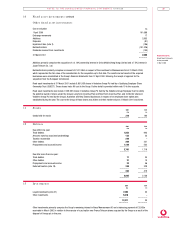

Notes

1. Excludes those operations that have been subsequently sold.

2. Assets held for resale represent the anticipated net sale proceeds of businesses that have been subsequently sold, or held as current asset investments at 31 March 2001.

3. The revaluations are provisional and may be subject to adjustment in the year ending 31 March 2002.

4. Elimination of acquired intangibles, including goodwill.

5. Restatement of certain tangible fixed asset carrying values in accordance with UK GAAP.

6. Revaluation of certain tangible fixed assets to fair value.

7. Restatement of carrying value of associated undertakings in accordance with UK GAAP.

8. Reclassification of associated undertaking to trade investments.

9. Revaluation of trade investments to fair value.

10. Primarily the recognition of a deferred tax asset in accordance with UK GAAP.

11. Revaluation of certain working capital balances to fair value.

12. Restatement of long term borrowings in accordance with UK GAAP.

13. Revaluation of long term borrowings to fair value.

14. The total goodwill of £83,028m derived above has been allocated as £79,426m in respect of subsidiary undertakings and £3,602m for associated undertakings.

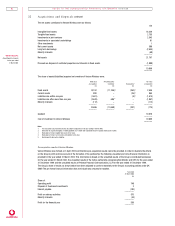

Impact on cash flows

The acquired Mannesmann businesses contributed £2,863m to the Group’s net operating cash flows, received £53m in respect of

returns on investments and servicing of finance, paid £841m in respect of taxation, utilised £8,188m for investing activities and

contributed £26,358m from acquisitions and disposals.