Vodafone 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6FINANCIAL REVIEW

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

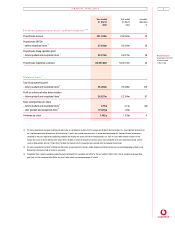

Equity shareholders’ funds

Total equity shareholders’ funds at 31 March 2001 had increased

from £140,833m at 31 March 2000 to £145,393m. The movement

primarily comprises new share capital and share premium of

£9,950m, including shares issued as consideration for acquisitions

completed during the year, net currency translation gains of £5,197m,

offset by a loss for the year of £9,763m (after goodwill amortisation of

£11,882m) and dividends paid and declared in respect of the year

totalling £887m.

On 29 December 2000, the Group completed the acquisition of

approximately 52.1% of the issued share capital of Airtel Móvil

S.A., increasing the Group’s stake to 73.8%. Vodafone issued

3,097,446,624 new listed ordinary shares to the transferring Airtel

shareholders, representing a transaction value of approximately £7.9

billion for the acquired shares. Additionally, a 25% equity interest in

Swisscom Mobile SA was acquired for CHF4.5 billion during the first

quarter of 2001, the first tranche of consideration being satisfied by

the issue of 422,869,008 new Vodafone shares and the payment of

CHF25 million in cash. The second tranche of £0.98 billion will be

satisfied in cash or Vodafone Group Plc shares, or a combination

of both, at Vodafone’s discretion and is payable by March 2002.

The deferred consideration is shown as shares to be issued.

Cash fl ows and funding

Cash generated from operating activities increased by £2,077m from

£2,510m to £4,587m for the year, due primarily to the growth in the

Group’s operations and the inclusion of the operating cash flows of

acquired businesses. The principal cash outflows in the period related

to the purchase of intangible assets (£13,163m), primarily 3G

licences, purchases of tangible fixed assets (£3,698m), acquisitions of

fixed asset investments (£3,254m), primarily China Mobile and Japan

Telecom and the payment of taxation (£1,585m) and equity dividends

(£773m).

Following the Mannesmann transaction, the Group agreed the sale of

a number of businesses for an aggregate value of approximately

£33.3 billion. Cash proceeds during the year totalled approximately

£27.9 billion, including loan repayments to the Group of approximately

£1.9 billion, as set out below:

£billion

Orange 18.7

Infostrada 5.2

Atecs Mannesmann 2.9

Mannesmann’s watches and clocks businesses 1.1

––––––

27.9

––––––

In addition, the formation of Verizon Wireless in April 2000 resulted

in net proceeds to the Group of approximately £2.5 billion from

a debt push-down arrangement agreed with the other parties.

Further proceeds of £1.8 billion have been realised following the

disposal of conflicted properties in the US, such disposals being a

condition of the regulatory approval of the transaction.

The resulting net cash inflow, before repayment of debt and

management of liquid resources, was £13,744m. This cash inflow

was offset by the consolidation of the net debt of Mannesmann AG

and Airtel Móvil S.A., totalling £13,184m at acquisition, and other

non-cash movements of £639m, primarily relating to exchange

movements. These movements resulted in a small increase in net

debt at 31 March 2001 to £6,722m, compared with £6,643m last

year.

Net debt at 31 March 2001 represented 5.4% of the Group’s market

capitalisation. This represented a reduction of £6.5 billion from net

debt of £13.2 billion at 30 September 2000, primarily due to proceeds

received in the second half of the year from the disposal of non-core

businesses, offset by payments for 3G licences and other

investments.

Future investment

In the year to 31 March 2001, the Group has acquired spectrum to

operate 3G services in most of its significant territories.

In 2001/2002, the Group expects to spend approximately £5 billion on

capital expenditure, excluding 3G licences but including expenditure

by Eircell, the Group’s recently acquired mobile operator in Ireland.

Of this expenditure, approximately 3% relates to investment in GPRS

capability and 20% relates to incremental expenditure on 3G network

infrastructure. The majority of this expenditure will be in the Group’s

businesses in Europe, with over £1.0 billion of capital expenditure

expected to be incurred in Germany, almost £0.9 billion in the UK

and over £0.7 billion in Italy. Capital expenditure in each of the

Group’s Asia Pacific and Middle East and Africa regions is expected to

be approximately £0.2 billion, and the Group’s non-mobile operations

are expected to spend over £0.3 billion on capital investment.

The Group presently expects the investment in capital expenditure

to be at a similar level for the following year, with spend on 3G

network infrastructure increasing to approximately 50% of the total.

3G network launches will be timed to coincide with handset

availability. Capital expenditure programmes are then projected

to fall in subsequent years once 3G network services are launched

and spend on 2G infrastructure is curtailed.

Treasury management and policy

The principal financial risks arising from the Group’s activities are

funding risk, interest rate risk, currency risk and counterparty risk.

The Group’s treasury function provides a centralised service for the

management and monitoring of these risks for all of the Group’s

operations.

Treasury operations are conducted within a framework of policies

and guidelines authorised and reviewed annually by the Board.

The Group accounting function provides regular update reports of

treasury activity to the Board. The Group uses a number of derivative

instruments which are transacted, for risk management purposes

only, by specialist treasury personnel.

There has been no significant change during the year, or since the

year end, to the types of financial risks faced by the Group or the

Group’s approach to the management of those risks.

Fu n din g an d liquidity

The Group’s policy is to borrow centrally, using a mixture of long term

and short term capital market issues and borrowing facilities, to meet

anticipated funding requirements. These borrowings, together with

cash generated from operations, are lent or contributed as equity to

subsidiaries.

The Board has approved ratios consistent with those used by

companies with high credit ratings for net interest cover, market

capitalisation to net debt and EBITDA to net debt, which establish

internal limits for the maximum level of debt that the Group may have

outstanding. Group interest, excluding the Group’s share of interest

payable by joint ventures and associated undertakings, is covered

6.2 times by Group EBITDA (before exceptional operating costs) plus

dividends received from joint ventures and associated undertakings.

The Group’s main interest exposures are Sterling, Euro and US dollar

interest rates.

The Group remains committed to maintaining a strong financial

position as demonstrated by its credit ratings of P-1/F1/A-1 short term

and A2/A/A long term from Moody’s, Fitch Ratings and Standard and

Poor’s, respectively. The credit ratings reflect the financial strength of

the Group and were reconfirmed by each of the rating agencies on

2 May 2001, following the announcement of the acquisition of further

equity interests in Japan and Spain, which is being financed in part by

the offering of 1.825 billion new Vodafone ordinary shares on 2 May

2001 which raised approximately £3.5 billion.