Vodafone 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

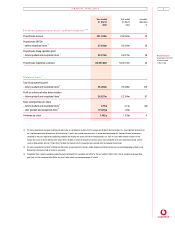

FINANCIAL HIGHLIGHTS

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

3

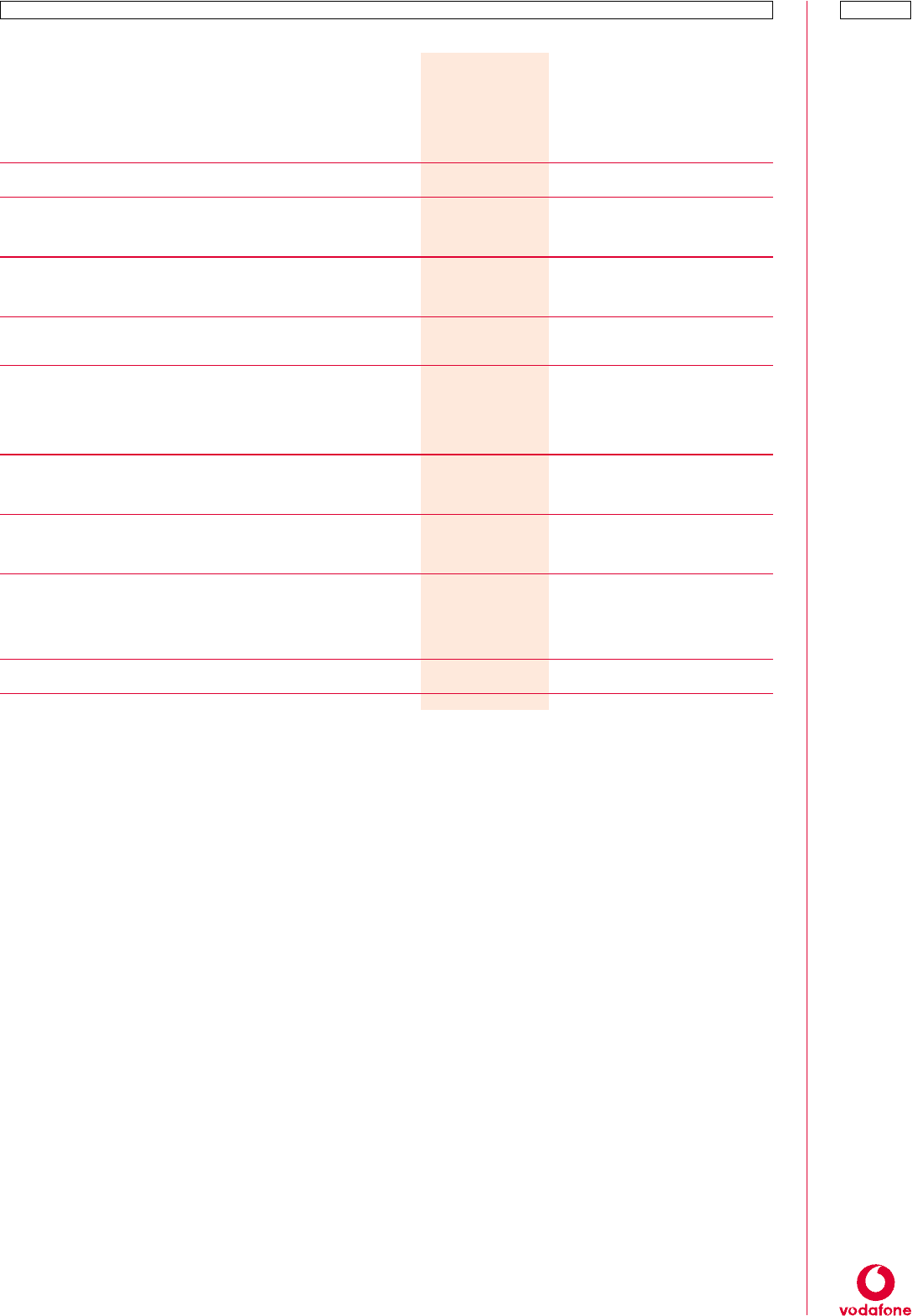

Statutory basis(1)

Total Group operating profit

– before goodwill and exceptional items(3) £5,204m £2,538m 105

Profit on ordinary activities before taxation

– before goodwill and exceptional items(3) £4,027m £2,154m 87

Basic earnings/(loss) per share

– before goodwill and exceptional items(3) 3.75p 4.71p (20)

– after goodwill and exceptional items (3) (15.89)p 1.80p

Dividends per share 1.402p 1.335p 5

Year ended Year ended Increase/

31 March 31 March (decrease)

2001 2000 %

Pro forma proportion ate basis – m obile busin esses(1) (2)

Proportionate turnover £21,428m £16,590m 29

Proportionate EBITDA

– before exceptional items (3) £7,043m £5,504m 28

Proportionate Group operating profit

– before goodwill and exceptional items (3) £5,019m £3,977m 26

Proportionate registered customers 82,997,000 53,327,000 56

(1) Pro forma proportionate customer and financial information is calculated on the basis that the merger with AirTouch Communications, Inc. (now Vodafone Americas Asia

Inc.) and the acquisition of Mannesmann AG took place on 1 April in each period presented, which is further described on page 64. Statutory financial information is

calculated on the basis required by accounting standards and includes the results of AirTouch Communications, Inc. from 30 June 1999, the date of closure of the

merger, the results of Verizon Wireless from 3 April 2000, the date on which the Group’s US wireless assets were contributed to the joint venture partnership, and the

results of Mannesmann AG from 12 April 2000, the date that clearance for the acquisition was received from the European Commission.

(2) Pro forma proportionate customer and financial information is presented for the Group’s mobile telecommunications businesses only, excluding paging customers and

Mannesmann businesses held for resale on acquisition.

(3) Exceptional items comprise exceptional operating costs totalling £320m, compared with £30m for the year ended 31 March 2000, and an exceptional non-operating

profit (net) of £80m, compared with £954m last year. Further details are included on pages 31 and 34.