Vodafone 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

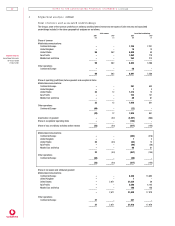

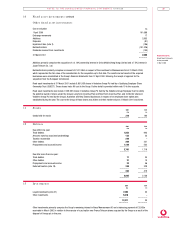

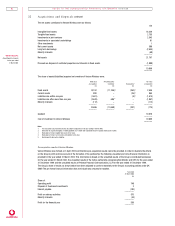

16 Fin an cial liabilities an d assets continued

Fin an cial assets

Non-interest bearing assets

Floating Fixed

rate rate Other non-interest

financial financial Equity bearing financial

Currency Total assets assets investments assets

£m £m £m £m £m

At 31 March 2001:

Sterling 45 17 – 28 –

Euro 8,518 2,559 – 334 5,643

US Dollar 5,098 5,049 – 8 23

Other 2,605 36 – 2,562 7

–––––––– –––––––– –––––––– –––––––– ––––––––

Gross financial liabilities 16,266 7,661 – 2,932 5,673

–––––––– –––––––– –––––––– –––––––– ––––––––

At 31 March 2000:

Sterling 18 11 – 7 –

Euro 232 128 – 79 25

US Dollar 134 2 32 66 34

Other 291 48 – 240 3

–––––––– –––––––– –––––––– –––––––– ––––––––

Gross financial liabilities 675 189 32 392 62

–––––––– –––––––– –––––––– –––––––– ––––––––

Financial assets comprise cash in hand and at bank of £68m (2000: £159m), liquid investments of £7,593m (2000: £30m), current

asset investments of £5,618m (2000: £Nil), trade and other debtors due in more than one year of £32m (2000: £44m) and fixed asset

investments, other than joint ventures and associated undertakings, of £2,955m (2000: £442m, excluding the fair value of the

consideration for the acquisition of Mannesmann AG of £101,246m as at 31 March 2000). Liquid investments arose primarily from the

receipt of sales proceeds following the disposal of Infostrada S.p.A and receipts in relation to the France Telecom shares and loan

notes received from the disposal of Orange plc and are not indicative of the financial position throughout the year.

Floating rate financial assets comprise cash and short term deposits of £4,484m (2000: £189m), commercial paper denominated in

US Dollar totalling £1,162m, invested with counterparties having a single-A credit rating or above, and a further £2,015m of purchase

and resale agreements denominated in Euro collateralised with AAA-rated Government or Supra-national bonds.

The weighted average rate and period for fixed rate financial assets were 4.9% and 3.7 years, respectively, at 31 March 2000.

Other current asset investments of £5,618m (2000: £Nil) primarily comprise the estimated fair value of the Group’s remaining interest

in Atecs Mannesmann and a balancing payment, receivable in Euros, of approximately £3,092m in relation to the exercise of a put

option over France Telecom shares acquired by the Group as a result of the disposal of Orange plc during the year.

Equity investments of £2,932m (2000: £392m) include £2,510m (2000: £Nil) represented by listed investments. Equity investments

denominated in other currencies include £1,759m denominated in HK Dollar and £704m denominated in Japanese Yen.

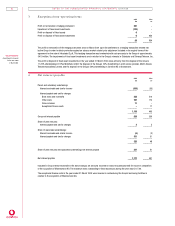

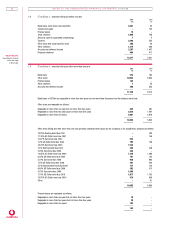

17 Fin an cial in stru m ents

Fair values of fin ancial assets an d liabilities

The carrying amounts and estimated fair value of the Group’s outstanding financial instruments are set out below:

2001 2001 2000 2000

Net carrying Estimated Net carrying Estimated

amount fair value amount fair value

£m £m £m £m

Fixed asset investments (excluding investments

in joint ventures and associated undertakings) 2,955 2,350 442 442

Cash at bank and in hand and liquid investments 7,661 7,661 189 189

Current asset investments 5,618 5,618 ––

Borrowings:

Short term 3,611 3,611 794 794

Long term 10,772 11,058 6,038 6,017

Derivative financial instruments:

Interest rate –2 –57

Foreign exchange – (1) – (66)

––––––– ––––––– ––––––– –––––––

The Group’s exposure to market risk, which is the sensitivity of the value of financial instruments to changes in related currency and

interest rates, is minimised because gains and losses on the underlying assets and liabilities offset gains and losses on derivative

financial instruments.

Fixed asset investments at 31 March 2000 in the above table excludes £101,246m in relation to the fair value of the consideration for

the acquisition of Mannesmann AG.