Vodafone 2001 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 BOARD’S REPORT TO SHAREHOLDERS ON DIRECTORS’ REMUNERATION continued

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

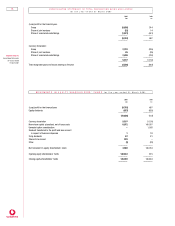

Sh are op tions

The following information summarises the directors’ options under the Vodafone Group Savings Related Share Option Scheme, the Vodafone Group

1998 Sharesave Scheme, the Vodafone Group Executive Share Option Scheme, all Inland Revenue approved schemes, the Vodafone Group Share

Option Scheme, which is not Inland Revenue approved, the AirTouch Communications, Inc. 1993 Long Term Stock Incentive Plan and the Vodafone

Group 1999 Long Term Stock Incentive Plan. No other directors have options under any of these schemes. Only under the Vodafone Group 1998

Sharesave Scheme may shares be offered at a discount in future grants of options.

Weighted

Options average

held at Options Options Options Options exercise

1 April 2000 granted exercised held at held at price at

or date of during during date of 31 March 31 March Date from Latest

appointment the year the year resignation 2001 2001 which expiry

Number Number Number Number Number Pence exercisable date

Paul Hazen (1) 473,050 – 473,050 – ––––

Chris Gent (2) 2,576,145 5,892,664 1,231,270 – 7,237,539 267.1 7/99 7/10

Peter Bamford 1,497,670 2,797,255 776,000 – 3,518,925 263.1 7/00 7/10

Thomas Geitner – 2,933,055 – – 2,933,055 290.4 7/03 7/10

Julian Horn-Smith 2,062,440 2,816,455 145,500 – 4,733,395 204.9 7/98 7/10

Ken Hydon 1,434,020 2,888,248 9,270 – 4,312,998 224.5 7/00 7/10

Arun Sarin (1) , (3) 11,250,000–––11,250,000 202.4 12/99 5/06

Don Fisher (1) , (4) 350,000 – – 350,000 –45.1 11/94 5/05

Sam Ginn (1) , (5) 18,875,000 – – 18,875,000 –95.0 1/99 11/07

Charles Schwab (1) , (4) 709,150 – – 709,150 –57.7 11/94 4/06

––––––––– ––––––––– ––––––––– ––––––––– ––––––––––

39,227,475 17,327,677 2,635,090 19,934,150 33,985,912

––––––––– ––––––––– ––––––––– ––––––––– ––––––––––

Notes

1. All options held by Paul Hazen, Arun Sarin, Don Fisher, Sam Ginn and Charles Schwab are in respect of American Depositary Shares, each representing ten Ordinary shares of the Company, which are

traded on the New York Stock Exchange.

2. In July 2000 Chris Gent undertook to acquire and maintain a shareholding of 2 million shares within twelve months. He expects to attain this figure from shares to be released to him in July from the

STIP and through shares acquired through the Vodafone Group Profit Sharing Scheme.

3. The terms of Arun Sarin’s stock options allow exercise until the earlier of the date on which Arun Sarin ceases to be a director of Vodafone and the seventh anniversary of the respective dates of grant.

4. Don Fisher and Charles Schwab exercised all outstanding options after their date of resignation. The pre-tax gains on exercise, translated at the average exchange rate for the year of $1.48 : £1, were

£679,000 and £1,320,000 respectively.

5. The latest expiry dates for the exercise of Sam Ginn’s outstanding share options are 15 April 2005 and 28 January 2007 in respect of options over 15,000,000 ordinary shares and 3,875,000 ordinary

shares, respectively.

Further details of options outstanding at 31 March 2001 are as follows:

Exerciseable Exerciseable Not yet exercisable

Market price greater than Option price greater than

option price market price

Weighted Weighted Weighted

average average average Earliest

Options exercise Latest Options exercise Latest Options exercise date from

held price expiry held price expiry held price which

Number Pence date Number Pence date Number Pence exercisable

Chris Gent 278,000 58.7 7/04 – – – 6,959,539 275.4 7/01

Peter Bamford 150,500 58.7 7/04 – – – 3,368,425 272.2 7/01

Thomas Geitner – – – – – – 2,933,055 290.4 7/03

Julian Horn-Smith 1,570,500 56.6 7/03 – – – 3,162,895 278.6 7/01

Ken Hydon 1,044,000 58.7 7/04 – – – 3,268,998 277.5 7/01

Arun Sarin 5,000,000 108.8 4/05 1,562,500 277.3 5/06 4,687,500 277.3 5/01

––––––––– ––––––––– –––––––––

8,043,000 1,562,500 24,380,412

––––––––– ––––––––– –––––––––

The Company’s register of directors’ interests (which is open to inspection) contains full details of directors’ shareholdings and options to subscribe.