Vodafone 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

55

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

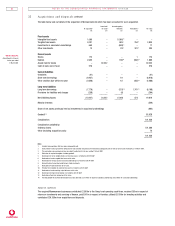

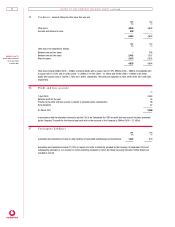

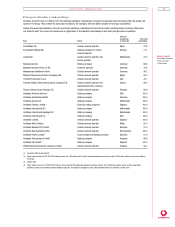

30 Pe n sion s

The Group operates a number of pension plans for the benefit of its employees throughout the world, which vary with conditions and

practices in the countries concerned. The pension plans are provided through defined benefit or defined contribution arrangements.

Defined benefit schemes provide pensions based on the employees’ length of pensionable service and their final pensionable salary.

Defined contribution schemes offer employees individual funds that are converted into pension benefits at the time of retirement.

For non-UK employees the Group provides, in most cases, defined contribution schemes. For employees in the UK and certain

businesses acquired as part of the Mannesmann acquisition, the Group generally provides defined benefit schemes.

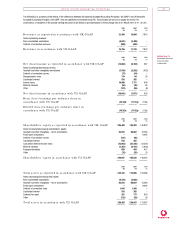

Defin ed ben efit sch emes

United Kingdom

The UK scheme is a funded scheme subject to a triennial valuation by independent actuaries. The assets of the scheme are held in

separate trustee administered funds. The last formal valuation was carried out as at 1 April 1998. The valuation used the projected

unit funding method of valuation in which allowance is made for projected earnings growth. The triennial formal valuations are

supplemented by annual reviews by independent actuaries.

At 1 April 1998, the market value of the three principal schemes was £98m and their actuarial value was sufficient to cover 87.6% of

the benefits accrued to members calculated on an ongoing basis, and 99.4% of accrued benefits based on the Minimum Funding

Requirement basis. The deficiency is dealt with by payment of contributions at the rate advised by the actuary.

The main assumptions used in the last valuations were that the average long term rate of return earned by the scheme assets would

be 8.5% and that this will exceed the general rate of salary growth by between 0.5% and 1.5% per annum, and that equity dividend

growth would be 4.5% per annum.

The three UK defined benefit pension schemes were merged on 1 April 1999 to form the Vodafone Group Pension Scheme.

The Vodafone Group Pension Scheme will be subject to a full valuation at 1 April 2001, the results of which will be available to the

Trustee later in the year. These results will be made available in next year’s report.

The pension cost for this year amounted to £23m (2000 – £17m). A net prepayment of £24m (2000 – £17m) is included in debtors

due after more than one year and represents the excess of the amounts funded over accumulated pension costs.

Germany

The Group’s pension obligations in relation to employees in Germany are not generally funded with any shortfall in external funding

being accrued within provisions. At 31 March 2001, the scheme provided benefits for approximately 16,000 participants.

The last formal valuation of the German scheme was prepared at 1 April 2001 by independent actuaries using the projected unit

funding method of valuation. The total pension liability was £140m and the market value of the scheme’s assets amounted to £7m

representing a percentage cover of accrued benefits for members of 5.3%.

The main assumptions used in the valuation were that salaries would increase at an average of 4% per annum, wages would increase

at 2.5% per annum and pension payments would increase by 2% per annum. The discount rate used was 6.5%.

The pension cost for the year amounted to £14m. A provision of £136m is included in provisions for liabilities and charges.

Defin ed con tribution sch em es

The pension cost for the year was £10m (2000 – £25m). The decrease this year is primarily in respect of contributions charged in the year

ended 31 March 2000 in relation to the AirTouch defined contribution plan which was transferred to Verizon Wireless during the year.

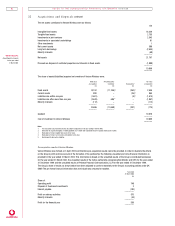

31 Subsequent even ts

On 4 April 2001, the Group completed its acquisition of a 34.5% stake in Grupo Iusacell, S.A. de C.V., for a cash consideration of

$973 million.

On 12 April 2001, following the second payment of Yen 125.1 billion (£0.7 billion), the acquisition of a 15% stake in Japan Telecom

from West Japan Railway Company and Central Japan Railway Company was completed. The initial payment of Yen 124.6 billion

(£0.7 billion) for 7.5% of the 15% interest being acquired was made on 31 January 2001. On 26 April 2001, the Group completed the

acquisition of a further 10% stake in Japan Telecom from AT&T for a cash consideration of $1.35 billion (£0.9 billion).

On 2 May 2001, the Group announced that it had agreed to acquire BT’s ownership interests in Japan Telecom and the J-Phone

Group for a cash consideration of £3.7 billion, assuming the exercise by BT of its option over shares in the operating subsidiaries

of the J-Phone Group, and the acquisition of BT’s 17.8% shareholding in Airtel Móvil S.A. for a cash consideration of £1.1 billion.

The acquisition of BT’s interests in Japan Telecom and the J-Phone Group is conditional upon regulatory approvals and procedural

requirements under agreements to which BT is a party and the exercise of certain options by BT. The Airtel transaction is conditional

upon EU regulatory approval. Neither transaction is conditional upon the other.

In an offering on 2 May 2001, the Company raised approximately £3.5 billion through the issue of 1.825 billion new Vodafone ordinary

shares at 194p per share (equivalent to $27.83 per ADS, representing ten Vodafone ordinary shares). The new Vodafone shares issued

represented approximately 2.8% of Vodafone’s issued ordinary share capital prior to the offering.

On 8 May 2001, the Group announced that agreement had been reached to sell its 100% equity stake in the Austrian

telecommunications company, tele.ring Telekom Service GmbH. The transaction is subject to regulatory approval.

On 21 December 2000, eircom plc announced the proposed demerger of eircom plc’s mobile communications business, Eircell, to a

new company, called Eircell 2000, and Vodafone announced a separate offer for the entire share capital of Eircell 2000. Eircell is the

leading provider of mobile communications in Ireland, with over 1.5 million customers at 31 March 2001. At the date it was launched,

the offer valued Eircell at approximately 13.6 billion, including the assumption of 1250 million of net debt. The offer was declared

unconditional on 14 May 2001 following the receipt of valid acceptances representing approximately 79.6% of the total shareholding

in Eircell. The offer remained open for acceptance until 27 May 2001 and, in accordance with the Articles of Association of Eircell, all

shareholders were deemed to have accepted the offer at that date.