Vodafone 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 BOARD’S REPORT TO SHAREHOLDERS ON DIRECTORS’ REMUNERATION continued

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

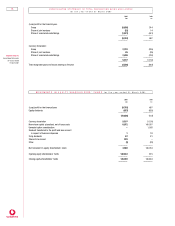

Pen sion benefits earn ed by th e directors in th e year to 31 March 2001

Increase in Transfer value Accumulated total

accrued pension of increase in accrued pension

during the year accrued pension at year end

£000 £000 £000

Chris Gent 90 1,161 411

Peter Bamford 3 29 12

Thomas Geitner (2) 10 105 10

Julian Horn-Smith 47 578 226

Ken Hydon 57 842 283

Arun Sarin (3) 179 3,507 269

The accrued pension for Klaus Esser at the date of his resignation was £307,000 per annum (translated at the average exchange rate for the year

of DM3.19 : £1). There was no increase in accrued pension during his period of service as a director. Contributions paid to a funded unapproved

retirement benefit scheme for the benefit of Peter Bamford amounted to £99,550 in the year.

Notes

1. The pension benefits earned by the directors are those which would be paid annually on retirement, on service to the end of the year, at the normal retirement age. Salaries have been averaged over

3 years in accordance with Inland Revenue regulations. The increase in accrued pension during the year excludes any increase for inflation. The transfer value has been calculated on the basis of

actuarial advice in accordance with the Faculty and Institute of Actuaries’ Guidance Note GN11. No director elected to pay Additional Voluntary Contributions.

2. In respect of Thomas Geitner the amounts have been translated at the average exchange rate for the year of DM3.19 : £1.

3. In respect of Arun Sarin the amounts have been translated at the average exchange rate for the year of $1.48 : £1.

Directors’ in terests in th e shares of Vodafon e Group P lc

Sh ort Term In cen tives

Conditional awards of ordinary shares made to executive directors under the Vodafone Group Short Term Incentive Plan (STIP), and dividends on

those shares paid under the terms of the Company’s scrip dividend scheme, are shown below. No STIP shares vested during the year for any

director.

Number Number Value at Value at In In Number Number

of shares of date of date of respect respect of of shares of Total

as base enhancement award (1)(2) award (2) of base enhancement as base enhancement value(3)

award shares Number £000 Number £000 awards shares award shares £000

Chris Gent 62,789 31,397 52,048 162 26,024 81 451 226 115,288 57,647 334

Julian Horn-Smith 35,055 17,530 29,060 90 14,530 45 252 125 64,367 32,185 186

Ken Hydon 33,382 16,688 27,671 86 13,835 43 239 119 61,292 30,642 177

Notes

1. Included within directors’ emoluments for the year ended 31 March 2000.

2. Value at date of award is based on the purchase price of the Company’s ordinary shares on 6 July 2000 of 311.25p.

3. The value at 31 March 2001 is calculated using the closing middle market price of the Company’s ordinary shares of 193p.

Total interest in STIP as at

31 March 2001

Total interest in STIP at

1 April 2000

Number of shares added

during the year through

scrip dividend scheme

Shares conditionally

awarded during the

year as enhancement

shares in respect of

1999/2000 STIP awards

Shares conditionally

awarded during the

year as base award

in respect of

1999/2000 STIP awards