Vodafone 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

22 Acqu isitions an d disposals continued

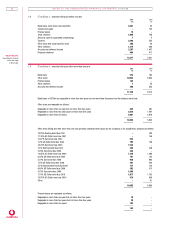

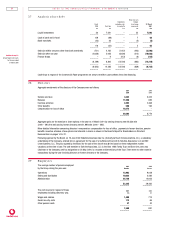

The net assets contributed to Verizon Wireless were as follows:

£m

Intangible fixed assets 18,329

Tangible fixed assets 2,755

Investments in joint ventures 2,543

Investments in associated undertakings 61

Other investments 1

Net current assets 586

Long term borrowings (2,500)

Minority interests (68)

–––––––

Net assets 21,707

Proceeds on disposal of conflicted properties and interests in fixed assets (1,898)

–––––––

19,809

–––––––

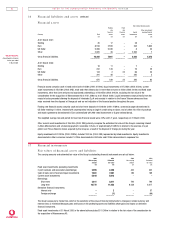

The share of assets/(liabilities) acquired on formation of Verizon Wireless were:

Book value Accounting policy Fair value

at acquisition conformity Revaluations(1) at acquisition

£m £m £m £m

Fixed assets 14,152 (11,245)(2) (262)(3) 2,645

Current assets 890 – (26)(4) 864

Liabilities due within one year (1,601) – (9)(4) (1,610)

Liabilities due after more than one year (2,643) 686(5) – (1,957)

Minority interests (112) – – (112)

––––––– ––––––– ––––––– –––––––

10,686 (10,559) (297) (170)

––––––– ––––––– –––––––

Goodwill 19,979

–––––––

Cost of investment in Verizon Wireless 19,809

–––––––

Notes

1. The revaluations are provisional and may be subject to adjustment in the year ending 31 March 2002.

2. Elimination of acquired intangibles, including goodwill, of £11,209m and capitalised interest in tangible fixed assets of £36m.

3. Revaluation of certain tangible fixed assets to fair value.

4. Revaluation of certain current assets and liabilities to fair value.

5. Restatement of deferred tax liabilities.

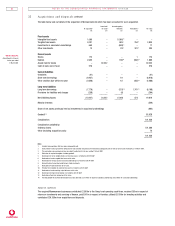

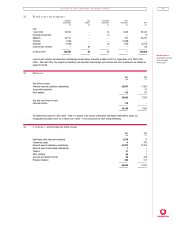

Pre-acquisition results of Verizon Wireless

Verizon Wireless was formed on 3 April 2000 and therefore pre-acquisition results cannot be provided. In order to illustrate the effects

on the Group’s profit and loss account of the formation of the partnership, the following unaudited pro forma financial information is

provided for the year ended 31 March 2000. This information is based on the unaudited results of the Group’s contributed businesses

for the year ended 31 March 2000, the unaudited results of the Cellco partnership (comprising Bell Atlantic and GTE) for the year ended

31 December 1999 and the unaudited results of Primeco Personal Communications, LLP, for the year ended 31 December 1999.

The Group’s share of results as shown below have been adjusted to conform materially to the Group’s accounting policies under UK

GAAP. The pro forma financial information does not include any amounts for taxation.

Year ended

31 March 2000

£m

Share of:

Operating profit 748

Disposal of fixed asset investments 2

Interest payable (180)

––––––––

Profit on ordinary activities 570

Minority interests (34)

––––––––

Profit for the financial year 536

––––––––