Vodafone 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

53

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

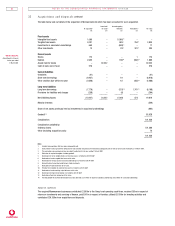

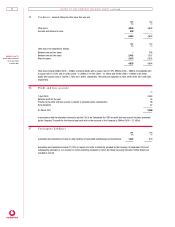

26 An alysis of cash flows

2001 2000

£m £m

Net cash in flow from op eratin g activities

Operating (loss)/profit (6,439) 981

Exceptional items 176 30

Depreciation 1,593 746

Amortisation of goodwill 9,585 674

Amortisation of other intangible fixed assets 24 12

–––––––– ––––––––

4,939 2,443

Decrease/(increase) in stocks 15 (65)

Increase in debtors (350) (271)

Increase in creditors 67 433

Payments in respect of exceptional items (84) (30)

–––––––– ––––––––

4,587 2,510

–––––––– ––––––––

Net cash outflow for return s on in vestm en ts an d

servicin g of fin an ce

Interest received 296 57

Termination of hedging instruments 901 –

Dividends from investments 102 –

Interest paid (1,254) (370)

Interest element of finance leases (11) –

Dividends paid to minority shareholders in subsidiary undertakings (81) (93)

–––––––– ––––––––

(47) (406)

–––––––– ––––––––

Net cash outflow for capital exp en diture an d

fin an cial in vestmen t

Purchase of intangible fixed assets (13,163) (185)

Purchase of tangible fixed assets (3,698) (1,848)

Purchase of investments (3,254) (17)

Disposal of interests in tangible fixed assets 275 294

Disposal of investments 513 991

Loans to joint ventures (85) –

Loans repaid by associated undertakings 59

Loans to acquired businesses held for sale (1,509) –

Loans repaid by acquired businesses held for sale 1,905 –

–––––––– ––––––––

(19,011) (756)

–––––––– ––––––––

Net cash in flow/(outflow) from acquisition s

an d disposals

Purchase of subsidiary undertakings (219) (4,062)

Net cash acquired with subsidiary undertakings 542 4

Proceeds on formation of joint venture 2,544 -

Purchase of interests in associated undertakings (79) (717)

Purchase of customer bases (15) (9)

Disposal of interests in joint ventures and associated undertakings 1,878 28

Disposal of acquired businesses held for sale 26,002 -

–––––––– ––––––––

30,653 (4,756)

–––––––– ––––––––

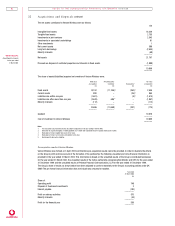

Net cash outflow for returns on investments and servicing of finance includes exceptional cash inflows of £261m in respect of the

termination of the Infostrada hedge transaction (note 3) and £640m realised from the closure of interest and currency swap

instruments.

Material non-cash transactions during the year comprise the issue of new ordinary shares in relation to increased ownership interests

in Mannesmann AG, the acquisition of a controlling shareholding in Airtel Móvil S.A. in December 2000 and the acquisition of a minority

interest in Swisscom Mobile SA in March 2001. In addition, the formation of Verizon Wireless in April 2000 involved the contribution of

the Group's US wireless assets to a US partnership. Further details of these transactions are included in notes 19 and 22.