Vodafone 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

29

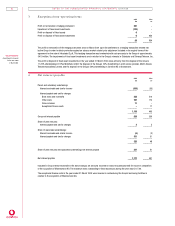

STATEMENT OF ACCOUNTING POLICIES

Basis of accou n tin g

The financial statements have been prepared in accordance with applicable accounting standards. During the financial year, the Group has

adopted Financial Reporting Standard 18, “Accounting Policies”, issued by the Accounting Standards Board. Adoption of this Financial Reporting

Standard has not had any effect on the results for the year or required any restatement of prior year comparatives.

The particular accounting policies adopted are stated below.

Accoun tin g con ven tion

The financial statements are prepared under the historical cost convention.

Basis of con solidation

The Group financial statements consolidate the financial statements of the Company and its subsidiary undertakings and include the Group’s

share of the results of its joint ventures and associated undertakings for financial statements made up to 31 March 2001. A listing of the Group’s

principal subsidiary undertakings, joint ventures and associated undertakings is given on pages 59 and 60.

The acquisitions of Mannesmann AG and Airtel Móvil S.A., and the acquisitions of interests in Verizon Wireless and Swisscom Mobile SA, have

been accounted for as acquisitions in accordance with Financial Reporting Standard 6, “Acquisitions and Mergers”.

Prior to the formation of Verizon Wireless, the turnover and operating results of the Group’s US wireless and paging operations were consolidated

within Group operating profit from continuing operations. From 3 April 2000, the Group has equity accounted for its interest in the operating

results of Verizon Wireless, which is included in the Group’s share of the operating profit of joint ventures and associated undertakings from

continuing operations. The turnover and operating loss (after goodwill amortisation) of the Group’s US businesses for the year ended 31 March

2000 were £2,585m and £100m, respectively. The net assets of the US businesses contributed to the Verizon Wireless joint venture have been

treated as having been disposed, and the Group’s interest in the new venture is included within fixed asset investments as an interest in an

associated undertaking.

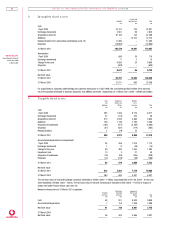

Foreign cu rrencies

Transactions in foreign currencies are recorded at the exchange rates ruling on the dates of those transactions, adjusted for the effects of any

hedging arrangements. Foreign currency monetary assets and liabilities are translated into sterling at year end rates.

The results of international subsidiary undertakings, joint ventures and associated undertakings are translated into sterling at average rates of

exchange. The adjustment to year end rates is taken to reserves. Exchange differences which arise on the retranslation of international subsidiary

undertakings’, joint ventures’ and associated undertakings’ balance sheets at the beginning of the year, and equity additions and withdrawals

during the financial year, are dealt with as a movement in reserves.

Other translation differences are dealt with in the profit and loss account.

Tu rn over

Turnover primarily consists of charges to mobile customers for monthly access charges and airtime usage and to fixed line customers for access

charges and line usage. Turnover is recognised as services are provided. Unbilled turnover resulting from mobile services provided from the

billing cycle date to the end of each period is accrued and unearned monthly access charges relating to periods after each accounting period

end are deferred.

Turnover also includes equipment sales, which are recognised upon delivery of equipment to customers, and connection charges, which are

recognised upon activation of customers.

Derivative finan cial in strum en ts

Transactions in derivative financial instruments are undertaken for risk management purposes only.

The Group uses derivative financial instruments to hedge its exposure to interest rate and foreign currency risk. To the extent that such

instruments are matched against an underlying asset or liability, they are accounted for using hedge accounting.

Gains or losses on interest rate instruments are matched against the corresponding interest charge or interest receivable in the profit and loss

account over the life of the instrument. For foreign exchange instruments, gains or losses and premiums or discounts are matched to the

underlying transactions being hedged.

Termination payments made or received in respect of derivative financial instruments held for hedging purposes are spread over the life of the

underlying exposure where the underlying exposure continues to exist. Where the underlying exposure ceases to exist, any termination payments

are taken to the profit and loss account.

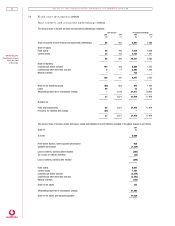

Pen sion s

Costs relating to defined benefit plans, which are periodically calculated by professionally qualified actuaries, are charged against profits so that

the expected costs of providing pensions are recognised during the period in which benefit is derived from the employees’ services.

The costs of the various pension schemes may vary from the funding, dependent upon actuarial advice, with any difference between pension cost

and funding being treated as a provision or prepayment.

Defined contribution pension costs charged to the profit and loss account represent contributions payable in respect of the period.

Research an d develop m ent

Expenditure on research and development is written off in the year in which it is incurred.

Scrip dividen ds

Dividends satisfied by the issue of ordinary shares are credited to reserves. The nominal value of the shares issued is offset against the share

premium account.