Vodafone 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

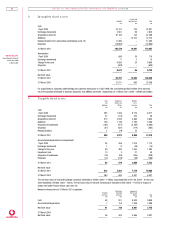

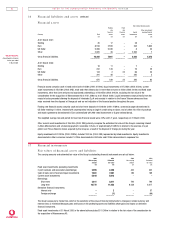

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

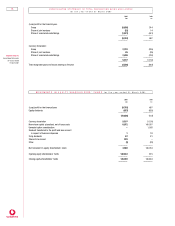

8 Intan gible fixed assets

Licence and

Goodwill spectrum fees Total

£m £m £m

Cost

1 April 2000 22,197 724 22,921

Exchange movements 2,561 59 2,620

Acquisitions (note 22) 87,185 104 87,289

Additions – 13,210 13,210

Reclassifications from associated undertakings (note 10) 11,490 – 11,490

Disposals (18,963) – (18,963)

–––––––– –––––––– ––––––––

31 March 2001 104,470 14,097 118,567

–––––––– –––––––– ––––––––

Amortisation

1 April 2000 686 29 715

Exchange movements 11 2 13

Charge for the year 9,585 24 9,609

Disposals (609) – (609)

–––––––– –––––––– ––––––––

31 March 2001 9,673 55 9,728

–––––––– –––––––– ––––––––

Net book value

31 March 2001 94,797 14,042 108,839

–––––––– –––––––– ––––––––

31 March 2000 21,511 695 22,206

–––––––– –––––––– ––––––––

For acquisitions of subsidiary undertakings and customer bases prior to 1 April 1998, the cumulative goodwill written off to reserves,

net of the goodwill attributed to business disposals, was £698m and £28m, respectively, at 31 March 2001 (2000 – £698m and £28m).

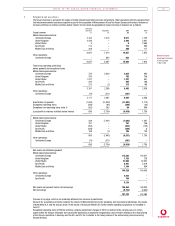

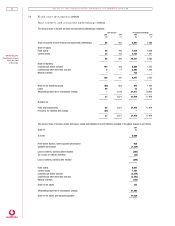

9 Tangible fixed assets

Land Equipment, Network

and fixtures and infra-

buildings fittings structure Total

£m £m £m £m

Cost

1 April 2000 295 1,006 6,716 8,017

Exchange movements 37 (212) 223 48

Acquisitions (note 22) 315 2,059 2,466 4,840

Additions 156 1,146 2,756 4,058

Disposals of businesses (182) (617) (2,264) (3,063)

Disposals (37) (431) (114) (582)

Reclassifications 4 (79) 75 –

–––––––– –––––––– –––––––– ––––––––

31 March 2001 588 2,872 9,858 13,318

–––––––– –––––––– –––––––– ––––––––

Accumulated depreciation and impairment

1 April 2000 35 356 1,319 1,710

Exchange movements 1 12 (28) (15)

Charge for the year 49 490 1,054 1,593

Impairment loss 10 3 27 40

Disposals of businesses (18) (64) (226) (308)

Disposals (12) (218) (58) (288)

–––––––– –––––––– –––––––– ––––––––

31 March 2001 65 579 2,088 2,732

–––––––– –––––––– –––––––– ––––––––

Net book value

31 March 2001 523 2,293 7,770 10,586

–––––––– –––––––– –––––––– ––––––––

31 March 2000 260 650 5,397 6,307

–––––––– –––––––– –––––––– ––––––––

The net book value of land and buildings comprises freeholds of £323m (2000 – £195m), long leaseholds of £114m (2000 – £10m) and

short leaseholds of £86m (2000 – £55m). The net book value of network infrastructure includes £225m (2000 – £147m) in respect of

assets held under finance leases (see note 23).

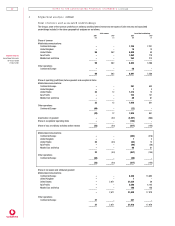

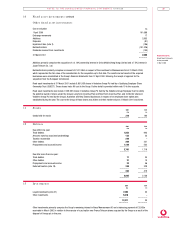

Network infrastructure at 31 March 2001 comprises: Short term Equipment,

Freehold leasehold fixtures and

premises premises fittings Total

£m £m £m £m

Cost 48 901 8,909 9,858

Accumulated depreciation 7 153 1,928 2,088

–––––––– –––––––– –––––––– ––––––––

Net book value 41 748 6,981 7,770

–––––––– –––––––– –––––––– ––––––––

31 March 2000

Net book value 36 405 4,956 5,397

–––––––– –––––––– –––––––– ––––––––