Vodafone 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

49

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

22 Acqu isitions an d disposals continued

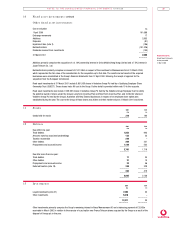

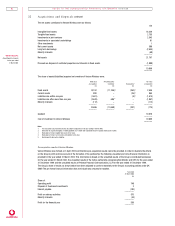

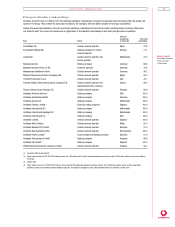

Pre-acquisition results of Mannesmann AG

The summarised profit and loss accounts of Mannesmann AG, prepared under German GAAP, for the years ended 31 December 1999

(translated at the average exchange rate for the year of £1 = a1.524) and 31 December 1998 (translated at the exchange rate on

31 December 1998 of £1 = a1.416) are given below. The accounts for the 12 months ended 31 December 1999 are the last

consolidated accounts prepared by the company prior to the acquisition on 12 April 2000.

Year ended Year ended

31 December 1999 31 December 1998

£m £m

Net sales 15,264 13,464

Cost of sales (10,369) (9,396)

–––––––––– ––––––––––

Gross profit 4,895 4,068

Research and development expenditure (460) (431)

Selling expenses (1,995) (1,537)

General administrative expenses (972) (821)

Other operating income 578 534

Other operating expenses (763) (768)

Net income from equity investments 77 99

Value adjustments to financial assets and short-term investments (3) (30)

Net interest (341) (136)

–––––––––– ––––––––––

Result from ordinary activities 1,016 978

Extraordinary result (138) 24

Taxes on profit (552) (557)

–––––––––– ––––––––––

Net profit for the year 326 445

Minority interests in profit (379) (194)

Minority interests in loss 117 88

Changes in revenue reserves 283 (171)

–––––––––– ––––––––––

Profit available for distribution 347 168

–––––––––– ––––––––––

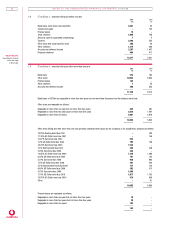

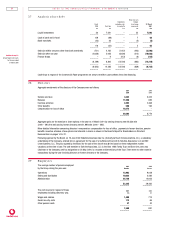

A consolidated profit and loss account for Mannesmann AG for the period from 1 January 2000 to 12 April 2000 was not prepared by

the company. In order to provide information which highlights the impact of the acquisition of Mannesmann AG on the continuing

activities of the Group, aggregated pro forma financial information is presented below for the acquired operations, excluding businesses

held for resale on acquisition.

Aggregated pro forma

results for the period from

1 January 2000 to 12 April 2000

£m

Turnover 2,079

––––––––––

Operating profit 641

––––––––––

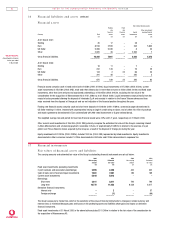

Disposals of businesses acquired with Mannesmann AG

Following the acquisition of Mannesmann AG, the Group has agreed the sale of certain acquired businesses including Orange plc,

Atecs Mannesmann AG, Mannesmann’s watches and tubes businesses, Infostrada S.p.A., tele.ring Telekom Service GmbH and Ipulsys.

In accordance with Financial Reporting Standard 7, “Fair Values in Acquisition Accounting”, the fair value of the Group’s investment in

these businesses at acquisition has been deemed to equal the value of the subsequent net sale proceeds. The results of these

businesses have been excluded from the Group’s consolidated profit and loss account for the year and no gain or loss on disposal has

been recorded. No ownership interests in these businesses have been retained by the Group, except in the case of Atecs Mannesmann

AG where the Group holds a remaining interest of 50% less two shares over which certain put and call options exist which may be

exercised before 31 December 2003. A balancing payment in respect of France Telecom shares received as part of the consideration

for the sale of Orange plc is receivable in March 2002 and is held as a current asset investment at 31 March 2001.

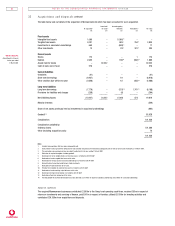

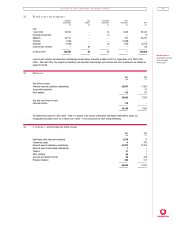

Acquisition of an in terest in Verizon Wireless

On 21 September 1999, the Group announced an agreement with Bell Atlantic and GTE to combine their US cellular operations to

create the largest mobile operator in the United States, Verizon Wireless. The first stage of the transaction, involving the contribution

of the US cellular operations of Vodafone and Bell Atlantic was completed on 3 April 2000, with the Group holding an initial stake of

65.1% of Verizon Wireless. Following the completion of the merger of Bell Atlantic and GTE to form Verizon Communications, the

second stage of the transaction completed with the contribution of the US cellular operations of GTE to Verizon Wireless on 10 July

2000, reducing the Group’s interest to 45%. The Group’s assets contributed to the joint venture partnership have been treated as

having been disposed, including the attributed goodwill of £19.5 billion, and the Group’s interest in the new venture has been

accounted for as an acquisition and is included within investments in associated undertakings. The Group also contributed its interest

in Primeco Personal Communications LLP to the venture and was required to dispose of certain conflicting properties. No gain or loss

has been recorded in the Group’s consolidated profit and loss account in respect of the disposal of the US cellular and paging

businesses or the disposal of the conflicting properties.