Vodafone 2001 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL REVIEW

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

5

during the year contributed to an EBITDA margin of 45%, an increase

of three percentage points over last year. In the rest of Continental

Europe, the 69% increase in pro forma proportionate EBITDA reflects

strong trading throughout the region with particularly strong margin

improvements in the Group’s subsidiaries in Greece, the Netherlands

and Spain, and the increase in the Group’s ownership interests in Airtel

Móvil S.A. and the acquisition of an interest in Swisscom Mobile SA

during the year.

Proportionate turnover in the UK increased by 17% to £3,458m and

proportionate EBITDA increased by 14% to £1,068m, reflecting further

strong prepaid customer growth and the increased usage of data

services, offset by the impact of tariff reductions.

In the United States, proportionate turnover and EBITDA were

£5,008m and £1,627m, respectively, resulting in an EBITDA margin of

32%. This reflects the profitable trading of Verizon Wireless during the

year, as the business has focused on gaining high value customers

through new customer additions and the migration of existing

analogue customers to digital price plans.

The Asia Pacific region saw an increase in pro forma proportionate

turnover of over 80% to £2,771m and an increase in pro forma

proportionate EBITDA of almost 56% to £587m. This comprised

underlying organic growth of 50% and 28%, respectively, with the

balance being primarily due to the acquisition of increased stakes in

the J-Phone Group and the acquisition of a 2.18% stake in China

Mobile (Hong Kong) Limited during the year.

The Middle East and Africa region reported an increase in pro forma

proportionate EBITDA of almost 60% to £227m. Strong growth

occurred in both the Group’s subsidiary in Egypt and associated

undertaking in South Africa.

The Group’s other non-mobile operations mainly comprise interests

in Mannesmann Arcor, a German fixed line business, Telecommerce,

a German IT and data services business, Cegetel, the second largest

fixed line operator in France and Vizzavi Europe, the Group’s 50%

owned multi-access consumer portal joint venture with Vivendi

Universal. These other operations recorded pro forma proportionate

turnover of £802m, pro forma proportionate EBITDA losses of £27m

and proportionate operating losses of £237m including the Group’s

share of the start-up losses incurred by Vizzavi.

Exch an ge rates

The net impact of movements in exchange rates was not significant

to the year on year increases in pro forma proportionate turnover and

EBITDA, with the effect of adverse exchange rate movements against

the Euro being offset by favourable movements against the US dollar

and Japanese yen.

Employees

The Company and its subsidiary undertakings employed

approximately 56,800 people at 31 March 2001, including 29,800

employees in businesses acquired during the year. This compares

with 25,600 employees at 31 March 2000, after excluding 15,100

people employed in the US wireless businesses transferred to Verizon

Wireless. Of the total employees at 31 March 2001, 81% worked

outside the United Kingdom.

Future results

There are many factors that will influence the Group’s future

performance, including the successful introduction of new services for

both data and voice using existing GPRS and 3G technology, further

development of the Group’s multi-access internet portal and the

completion of the integration process of our recent transactions.

Factors affecting future turnover and profit performance are the

potential for growth of mobile telecommunications markets,

particularly in territories where penetration rates are comparatively

low, the Group’s market share, our ability to retain high value

customers and stimulate more usage of voice and data services using

new GPRS and 3G technologies, the costs of providing and selling

these new products and existing services, the impact of regulatory

changes, and start-up costs of new products and services dependent

on GPRS and 3G technology.

The global market for mobile telecommunications continues to

provide the potential for significant growth. In the immediate future,

the emphasis on cost control and margin management should result

in cash flow growth as the market transitions to the full impact of

the new data services, technologies and spectrum capacity of 3G.

Mobile telephony is expected to continue to substitute for fixed line

networks in both voice and data services and Vodafone, with its

unrivalled global positioning, and its high quality and substantial

customer base, is well placed to sustain its leadership.

Balance sheet

Total fixed assets have increased in the year from £150,851m last

year to £154,375m at 31 March 2001.

At 31 March 2000, the Group’s interest in Mannesmann AG was

included in fixed asset investments at a cost of £101,246m.

Following completion on 12 April 2000, and the consolidation of

the acquired net assets, goodwill has been provisionally calculated

to be £83,028m.

The assets of the US businesses contributed to Verizon Wireless have

been treated as having been disposed, including attributed goodwill of

£19.5 billion arising from the AirTouch transaction that was previously

included in intangible fixed assets. The Group’s interest in the new

venture has been equity accounted within investments in associated

undertakings at an initial value of £19,809m.

The remaining increase in intangible assets primarily comprises

£13,347m in respect of 3G licences acquired in the year and goodwill

on the acquisition of a controlling interest in Airtel Móvil S.A. of

approximately £7,740m. The increase in tangible fixed assets from

£6,307m to £10,586m includes fixed assets from acquisitions of

£4,840m.

Other fixed asset investments at 31 March 2001 include the Group’s

equity interests in China Mobile and Japan Telecom. In an offering

that closed on 3 November 2000, Vodafone acquired newly issued

shares representing approximately 2.18% of China Mobile’s

share capital for a cash consideration of US$2.5 billion and, on

31 January 2001, the Group acquired a 7.5% shareholding in

Japan Telecom for a cash consideration of approximately

£0.7 billion.

Current asset investments with an aggregate value of £13,211m

primarily comprise the Group’s remaining interest in Atecs

Mannesmann AG, a balancing payment of approximately £3,092m

receivable from the exercise of a put option over France Telecom

shares and liquid investments with a value of £7,593m. The liquid

investments arose primarily from the receipt of sales proceeds

following the disposal of Infostrada S.p.A. and receipts in relation to

the France Telecom shares and loan notes received from the disposal

of Orange plc.

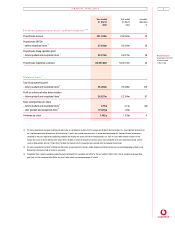

Average exchange rates

Year to Year to Percentage

31 March 31 March change

Currency 2001 2000 %

Euro 1.63 1.57 3.8

Greek Drachma 552 514 7.4

Japanese Yen 163.8 178.2 (8.1)

Swedish Krona 14.0 13.6 2.9

US Dollar 1.48 1.61 (8.1)