Vodafone 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

31

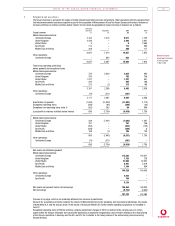

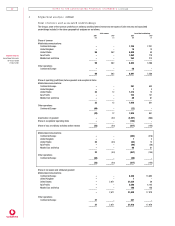

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

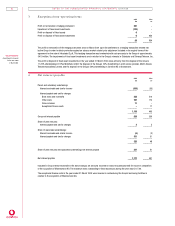

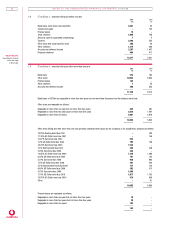

1 Segm ental an alysis

The Group’s business is principally the supply of mobile telecommunications services and products. Other operations primarily comprise fixed

line telecommunications businesses acquired as part of the acquisition of Mannesmann AG and the Vizzavi Europe joint venture. Analyses of

turnover, profit/loss on ordinary activities before interest and net assets by geographical region and class of business are as follows:

Continuing

operations Acquisitions 2001 2000

Group turnover £m £m £m £m

Mobile telecommunications:

Continental Europe 2,163 7,414 9,577 1,705

United Kingdom 3,444 – 3,444 2,901

United States 9 – 92,585

Asia Pacific 713 – 713 565

Middle East and Africa 308 – 308 117

–––––––– –––––––– –––––––– ––––––––

6,637 7,414 14,051 7,873

Other operations:

Continental Europe – 953 953 –

–––––––– –––––––– –––––––– ––––––––

6,637 8,367 15,004 7,873

–––––––– –––––––– –––––––– ––––––––

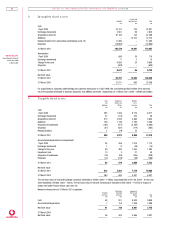

Total Group operating profit/(loss)

before goodwill and exceptional items

Mobile telecommunications:

Continental Europe 735 2,300 3,035 955

United Kingdom 795 – 795 706

United States 1,237 – 1,237 541

Asia Pacific 205 – 205 188

Middle East and Africa 215 (2) 213 148

–––––––– –––––––– –––––––– ––––––––

3,187 2,298 5,485 2,538

Other operations:

Continental Europe (70) (211) (281) –

–––––––– –––––––– –––––––– ––––––––

3,117 2,087 5,204 2,538

Amortisation of goodwill (1,843) (10,039) (11,882) (1,712)

Exceptional operating items (256) (64) (320) (30)

Exceptional non-operating items (note 3) (182) 262 80 954

–––––––– –––––––– –––––––– ––––––––

(Loss)/profit on ordinary activities before interest 836 (7,754) (6,918) 1,750

–––––––– –––––––– –––––––– ––––––––

Mobile telecommunications:

Continental Europe 439 (7,441) (7,002) 1,007

United Kingdom 757 – 757 706

United States (252) – (252) (100)

Asia Pacific (226) – (226) 8

Middle East and Africa 188 (2) 186 129

–––––––– –––––––– –––––––– ––––––––

906 (7,443) (6,537) 1,750

Other operations:

Continental Europe (70) (311) (381) –

–––––––– –––––––– –––––––– ––––––––

836 (7,754) (6,918) 1,750

–––––––– –––––––– –––––––– ––––––––

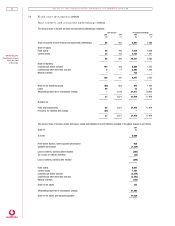

Net assets and attributed goodwill

Mobile telecommunications:

Continental Europe 113,584 118,577

United Kingdom 7,155 729

United States 21,084 23,547

Asia Pacific 6,401 5,216

Middle East and Africa 1,104 934

–––––––– ––––––––

149,328 149,003

Other operations:

Continental Europe 4,432 –

Asia Pacific 704 –

–––––––– ––––––––

5,136 –

Net assets and goodwill, before net borrowings 154,464 149,003

Net borrowings (6,722) (6,643)

–––––––– ––––––––

147,742 142,360

–––––––– ––––––––

Turnover is by origin, which is not materially different from turnover by destination.

Amounts for acquisitions primarily comprise the results of Mannesmann AG and its subsidiary and associated undertakings, the results

of Airtel Móvil S.A. and the Group’s share of the results of Swisscom Mobile SA. Further details regarding acquisitions are included in

note 22.

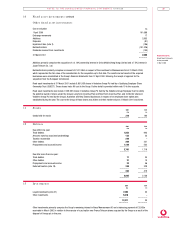

Exceptional operating items of £320m primarily comprise impairment charges of £91m in relation to the carrying value of certain

assets within the Group’s Globalstar service provider businesses, exceptional reorganisation costs of £85m relating to the restructuring

of the Group’s operations in Germany and the US, and £141m in relation to the Group’s share of the restructuring costs incurred by

Verizon Wireless.