Vodafone 2001 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

57

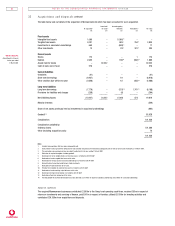

NOTES TO THE COMPANY BALANCE SHEET

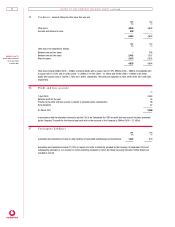

32 Fixed asset in vestm en ts

Subsidiary Joint Associated Other

undertakings ventures undertakings investments Total

£m £m £m £m £m

Cost

1 April 2000 53,552 – 16 1,848 55,416

Exchange movements – – (1) – (1)

Additions 50,010 – – 720 50,730

Transfers 1,848 – – (1,848) –

Disposals (1,848) – (4) (720) (2,572)

Loans to joint ventures – 85 – – 85

–––––––– –––––––– –––––––– –––––––– ––––––––

31 March 2001 103,562 85 11 – 103,658

–––––––– –––––––– –––––––– –––––––– ––––––––

Loans to joint ventures and associated undertakings included above amounted to £85m and £11m, respectively, at 31 March 2001

(2000 – £Nil and £16m). The Company’s subsidiary and associated undertakings, joint ventures and other investments are detailed on

pages 59 and 60.

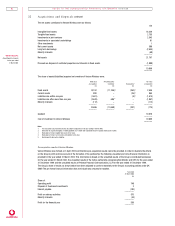

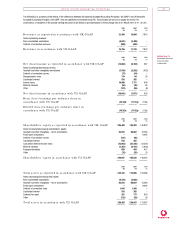

33 Debtors

2001 2000

£m £m

Due within one year:

Amounts owed by subsidiary undertakings 23,947 7,455

Group relief receivable –37

Other debtors 115 62

–––––––– ––––––––

24,062 7,554

Due after more than one year:

Deferred taxation 118 –

–––––––– ––––––––

24,180 7,554

–––––––– ––––––––

The deferred tax asset of £118m (2000 – £Nil) is in respect of the closure of derivative instruments. Deferred tax assets not

recognised amounted to £37m at 31 March 2001 (2000 – £1m) and arose from other timing differences.

34 Creditors: amounts falling due within one year

2001 2000

£m £m

Bank loans, other loans and overdrafts 3,376 12

Commercial paper 4703

Amounts owed to subsidiary undertakings 61,872 10,224

Amounts owed to associated undertakings 1–

Taxation 31 1

Other creditors 66 7

Accruals and deferred income 29 246

Proposed dividend 464 417

–––––––– ––––––––

65,843 11,610

–––––––– ––––––––