Vodafone 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

39

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

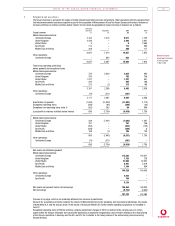

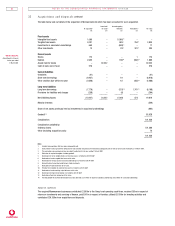

10 Fixed asset in vestm en ts continued

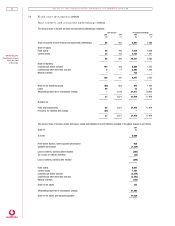

Oth er fixed asset investm en ts

Cost or valuation £m

1 April 2000 101,688

Exchange movements 17

Additions 2,953

Disposals (91)

Impairment loss (note 3) (186)

Reclassifications (101,326)

Dividends received from investments (100)

–––––––

31 March 2001 2,955

–––––––

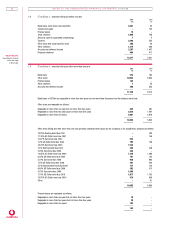

Additions primarily comprise the acquisition of a 2.18% ownership interest in China Mobile (Hong Kong) Limited and a 7.5% interest in

Japan Telecom Co., Ltd.

Reclassifications primarily comprise an amount of £101,246m in respect of the investment in Mannesmann AG at 31 March 2000,

which represented the fair value of the consideration for the acquisition up to that date. The results and net assets of the acquired

businesses were consolidated in the Group’s financial statements from 12 April 2000, following the receipt of approval for the

acquisition from the European Commission.

Fixed asset investments at 31 March 2001 include 5,861,959 shares in Vodafone Group Plc held by a Qualifying Employee Share

Ownership Trust (‘QUEST’). These shares had a Nil cost to the Group. Further detail is provided within note 19 to the accounts.

Fixed asset investments also include 7,039,587 shares in Vodafone Group Plc held by the Vodafone Group Employee Trust to satisfy

the potential award of shares under the Group’s Long Term Incentive Plan and Short Term Incentive Plan, and 3,288,042 shares in

Vodafone Group Plc held by the Group’s Australian and New Zealand businesses in respect of an employee share option plan

established during the year. The cost to the Group of these shares was £28m and their market value at 31 March 2001 was £20m.

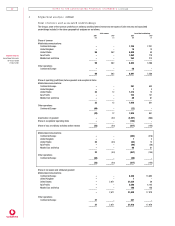

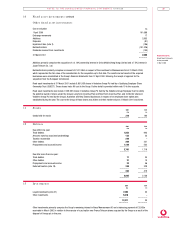

11 Stocks 2001 2000

£m £m

Goods held for resale 316 190

–––––––– ––––––––

12 Debtors 2001 2000

£m £m

Due within one year:

Trade debtors 1,852 943

Amounts owed by associated undertakings 132 23

Taxation recoverable 249 –

Other debtors 269 221

Prepayments and accrued income 1,199 532

–––––––– ––––––––

3,701 1,719

–––––––– ––––––––

Due after more than one year:

Trade debtors 11 34

Other debtors 21 10

Prepayments and accrued income 24 46

Deferred taxation (note 18) 338 329

–––––––– ––––––––

394 419

–––––––– ––––––––

4,095 2,138

–––––––– ––––––––

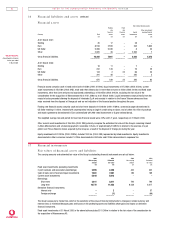

13 In vestm en ts 2001 2000

£m £m

Liquid investments (note 27) 7,593 30

Other investments 5,618 –

–––––––– ––––––––

13,211 30

–––––––– ––––––––

Other investments primarily comprise the Group’s remaining interest in Atecs Mannesmann AG and a balancing payment of £3,092m

receivable in March 2002 in relation to the exercise of a put option over France Telecom shares acquired by the Group as a result of the

disposal of Orange plc in the year.