Vodafone 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

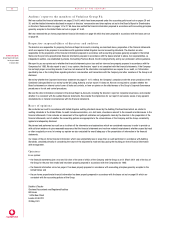

BOARD’S REPORT TO SHAREHOLDERS ON DIRECTORS’ REMUNERATION continued

Vodafone Group Plc

Annual Report & Accounts

for the year ended

31 March 2001

17

Service con tracts

The Remuneration Committee has determined that in the cases of UK based executive directors their appointments to the Board will be on

the terms of a contract which can be terminated by the Company at the end of an initial term of two years or at any time thereafter on one

year’s notice.

Contracts on this basis were granted to Julian Horn-Smith on 4 June 1996, to Chris Gent and Ken Hydon on 1 January 1997 and to Peter

Bamford on 1 April 1998, each of which is now, therefore, terminable by the Company on one year’s notice. The service contracts of these

executive directors contained a provision increasing the period of notice required from the Company to two years in the event that the contract

was terminated by the Company within one year of a change of control of the Company. To be compliant with best standards of corporate

governance, each of these executive directors has now waived this provision without separate recompense. The executive directors are required

to give the Company one year’s notice if they wish to terminate their contracts.

Thomas Geitner entered into a fixed term five year contract with Mannesmann AG on 15 May 2000. This is the normal contract arrangement for

Mannesmann AG board members. Mr Geitner has agreed to replace this contract, without separate recompense, with one that contains different

provisions in relation to duration and termination. The new contract is for an initial three year term and will then be indefinite until terminated by

either party. The period of notice for termination is one year and notice will not be possible until the end of the initial three years.

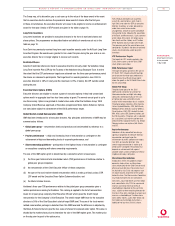

Rem u n eration for th e year to 31 March 2001

Compensation for

Salary/Fees Bonuses Incentive schemes(1) Benefits loss of office Total

2001 2000 2001 2000 2001 2000 2001 2000 2001 2000 2001 2000

£000 £000 £000 £000 £000 £000 £000 £000 £000 £000 £000 £000

Ch a irm a n

Ian MacLaurin (2) 397 204 ––––17 12 ––414 216

Deputy Ch airman

Paul Hazen (3) 89 39 ––––––––89 39

Ch ief Executive

Chris Gent 1,069 837 5,000 325 783 162 31 34 ––6,883 1,358

Execu tive directors

Peter Bamford 582 451 1,000 –426 83 31 29 ––2,039 563

Thomas Geitner (4) 414 –––341 –12 –––767 –

Julian Horn-Smith 582 458 2,000 150 426 90 23 24 ––3,031 722

Ken Hydon 582 454 2,000 195 426 86 28 27 ––3,036 762

Non -executive directors

Josef Ackermann (5) 57 –––––––––57 –

Michael Boskin 62 39 ––––––––62 39

Alec Broers 62 35 ––––––––62 35

Penny Hughes 62 52 ––––––––62 52

Arun Sarin (6) 81 391 1,000 ––463 14 17 1,119 –2,214 871

David Scholey 62 52 ––––––––62 52

Jürgen Schrempp (5) 57 –––––––––57 –

Henning Schulte-Noelle (5) 57 –––––––––57 –

Klaus Esser (7) 31 –––––4–9,153 –9,188 –

Don Fisher (8) 35 39 ––––––––35 39

Sam Ginn (9) 42 176 ––––225 ––44 201

Charles Schwab (10) 939 ––––––––939

Form er directors (11) –156 –25 –1,584 396 26 ––396 1,791

–––––– –––––– –––––– –––––– –––––– –––––– –––––– –––––– –––––– –––––– –––––– ––––––

Total 4,332 3,422 11,000 695 2,402 2,468 558 194 10,272 –28,564 6,779

–––––– –––––– –––––– –––––– –––––– –––––– –––––– –––––– –––––– –––––– –––––– ––––––

Notes

1. These figures are the value of the awards under the Vodafone Group Short Term Incentive Plan applicable to the year ended 31 March 2001 or, in the case of Thomas Geitner, under the Vodafone-

Mannesmann Short Term Incentive Plan.

2. Ian MacLaurin was appointed Chairman on 23 May 2000, prior to which he was Deputy Chairman.

3. Following Ian MacLaurin’s appointment as Chairman, Paul Hazen was appointed Deputy Chairman on 23 May 2000.

4. Thomas Geitner joined the Board on 15 May 2000. Salary and benefits for Thomas Geitner have been translated at the average exchange rate for the year of DM3.19 : £1.

5. Appointed to the Board on 1 May 2000.

6. Information for Arun Sarin covers both the period 1 April 2000 to 15 April 2000, when he was an executive director, and the period 16 April 2000 to 31 March 2001 as a non-executive director.

Payments made for Arun Sarin’s services as a non-executive director comprised fees of £60,000 and benefits of £13,000. Compensation for loss of office payments to Arun Sarin were based on final

salary at the date of his resignation as an executive director and were made in accordance with the terms of his service contract. Salary and benefits for Arun Sarin have been translated at the

average exchange rate for the year of $1.48 : £1.

7. Klaus Esser, Chairman of the Management Board of Mannesmann AG at the time of the Company’s acquisition of Mannesmann, joined the Board of the Company on 5 June 2000 as Deputy Chairman.

He resigned on 30 September 2000 to pursue other interests. Fees and benefits in the table relate to his services as a director of the Company. Compensation for loss of office comprises a payment of

DM25,500,000 by Mannesmann, to which Dr Esser was entitled under his agreement with Mannesmann AG, and a payment of 12,000,000 in final settlement of lifetime benefits awarded to him by the

Supervisory Board of Mannesmann in February 2000.

8. Fees for Don Fisher are for the period to 19 October 2000, when he resigned from the Board.

9. Salary and benefits for Sam Ginn are for the period to 23 May 2000, when he resigned from the Board.

10. Fees for Charles Schwab are for the period to 23 May 2000, when he resigned from the Board.

11. Under the terms of an agreement Sam Ginn provides consultancy services to the Group and is entitled to certain benefits. The estimated value of benefits received by him from the date of his

resignation to 31 March 2001 was £65,000, translated at the average exchange rate for the year of $1.48 : £1. Payments totalling £311,000 were made to a former director during the year pending

recovery of the sum under the terms of an insured long-term disability plan. Under the terms of the Life President arrangements of Sir Ernest Harrison the estimated value of benefits received by him

in the year ended 31 March 2001 was £20,000 (2000: £20,000).