US Cellular 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to the Consolidated Financial Statements (Continued)

NOTE 12 DEBT (Continued)

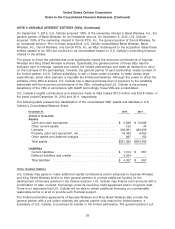

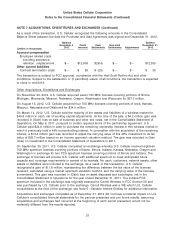

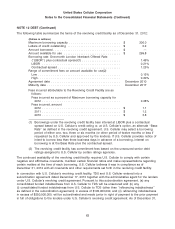

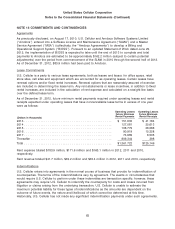

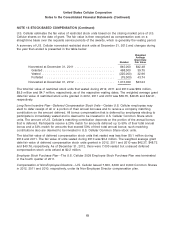

The following table summarizes the terms of the revolving credit facility as of December 31, 2012:

(Dollars in millions)

Maximum borrowing capacity ............................ $ 300.0

Letters of credit outstanding ............................. $ 0.2

Amount borrowed ..................................... $ —

Amount available for use ............................... $ 299.8

Borrowing rate: One-month London Interbank Offered Rate

(‘‘LIBOR’’) plus contractual spread(1) ..................... 1.46%

LIBOR ........................................... 0.21%

Contractual spread .................................. 1.25%

Range of commitment fees on amount available for use(2)

Low ............................................. 0.13%

High ............................................. 0.30%

Agreement date ...................................... December 2010

Maturity date ........................................ December 2017

Fees incurred attributable to the Revolving Credit Facility are as

follows:

Fees incurred as a percent of Maximum borrowing capacity for

2012 ........................................... 0.38%

Fees incurred, amount

2012 ........................................... $ 1.1

2011 ........................................... $ 1.2

2010 ........................................... $ 3.8

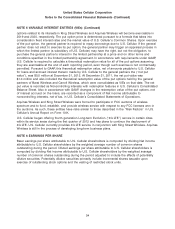

(1) Borrowings under the revolving credit facility bear interest at LIBOR plus a contractual

spread based on U.S. Cellular’s credit rating or, at U.S. Cellular’s option, an alternate ‘‘Base

Rate’’ as defined in the revolving credit agreement. U.S. Cellular may select a borrowing

period of either one, two, three or six months (or other period of twelve months or less if

requested by U.S. Cellular and approved by the lenders). If U.S. Cellular provides notice of

intent to borrow less than three business days in advance of a borrowing, interest on

borrowing is at the Base Rate plus the contractual spread.

(2) The revolving credit facility has commitment fees based on the unsecured senior debt

ratings assigned to U.S. Cellular by certain ratings agencies.

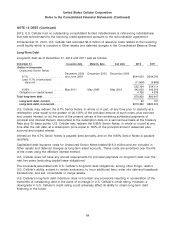

The continued availability of the revolving credit facility requires U.S. Cellular to comply with certain

negative and affirmative covenants, maintain certain financial ratios and make representations regarding

certain matters at the time of each borrowing. U.S. Cellular believes it was in compliance as of

December 31, 2012 with all covenants and other requirements set forth in the revolving credit facility.

In connection with U.S. Cellular’s revolving credit facility, TDS and U.S. Cellular entered into a

subordination agreement dated December 17, 2010 together with the administrative agent for the lenders

under U.S. Cellular’s revolving credit agreement. Pursuant to this subordination agreement, (a) any

consolidated funded indebtedness from U.S. Cellular to TDS will be unsecured and (b) any

(i) consolidated funded indebtedness from U.S. Cellular to TDS (other than ‘‘refinancing indebtedness’’

as defined in the subordination agreement) in excess of $105,000,000, and (ii) refinancing indebtedness

in excess of $250,000,000, will be subordinated and made junior in right of payment to the prior payment

in full of obligations to the lenders under U.S. Cellular’s revolving credit agreement. As of December 31,

63